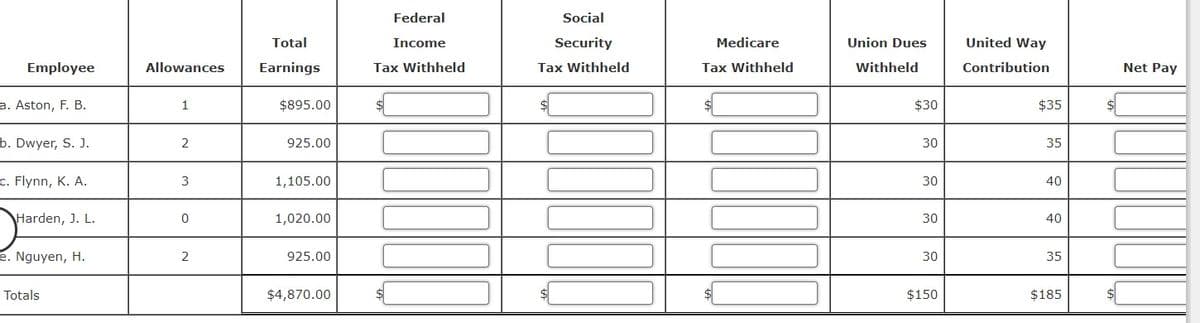

Using the income tax withholding table in Figure 3, for each employee of Miller Company, determine the net pay for the week ended January 21. Assume a Social Security tax of 6.2 percent and a Medicare tax of 1.45 percent. All employees have cumulative earnings, including this pay period, of less than $118,500. Assume that all employees are married. If required, round your answers to the nearest cent and use the rounded answers in subsequent computations. Questions:(in attached image)

Using the income tax withholding table in Figure 3, for each employee of Miller Company, determine the net pay for the week ended January 21. Assume a Social Security tax of 6.2 percent and a Medicare tax of 1.45 percent. All employees have cumulative earnings, including this pay period, of less than $118,500. Assume that all employees are married. If required, round your answers to the nearest cent and use the rounded answers in subsequent computations. Questions:(in attached image)

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 35P

Related questions

Question

Using the income tax withholding table in Figure 3, for each employee of Miller Company, determine the net pay for the week ended January 21. Assume a Social Security tax of 6.2 percent and a Medicare tax of 1.45 percent. All employees have cumulative earnings, including this pay period, of less than $118,500. Assume that all employees are married. If required, round your answers to the nearest cent and use the rounded answers in subsequent computations.

Questions:(in attached image)

Transcribed Image Text:Federal

Social

Total

Income

Security

Medicare

Union Dues

United Way

Employee

Allowances

Earnings

Tax Withheld

Tax Withheld

Tax Withheld

Withheld

Contribution

Net Pay

a. Aston, F. B.

1

$895.00

$

$30

$35

b. Dwyer, S. J.

2

925.00

30

35

c. Flynn, K. A.

3

1,105.00

30

40

Harden, J. L.

1,020.00

30

40

e. Nguyen, H.

2

925.00

30

35

Totals

$4,870.00

$150

$185

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you