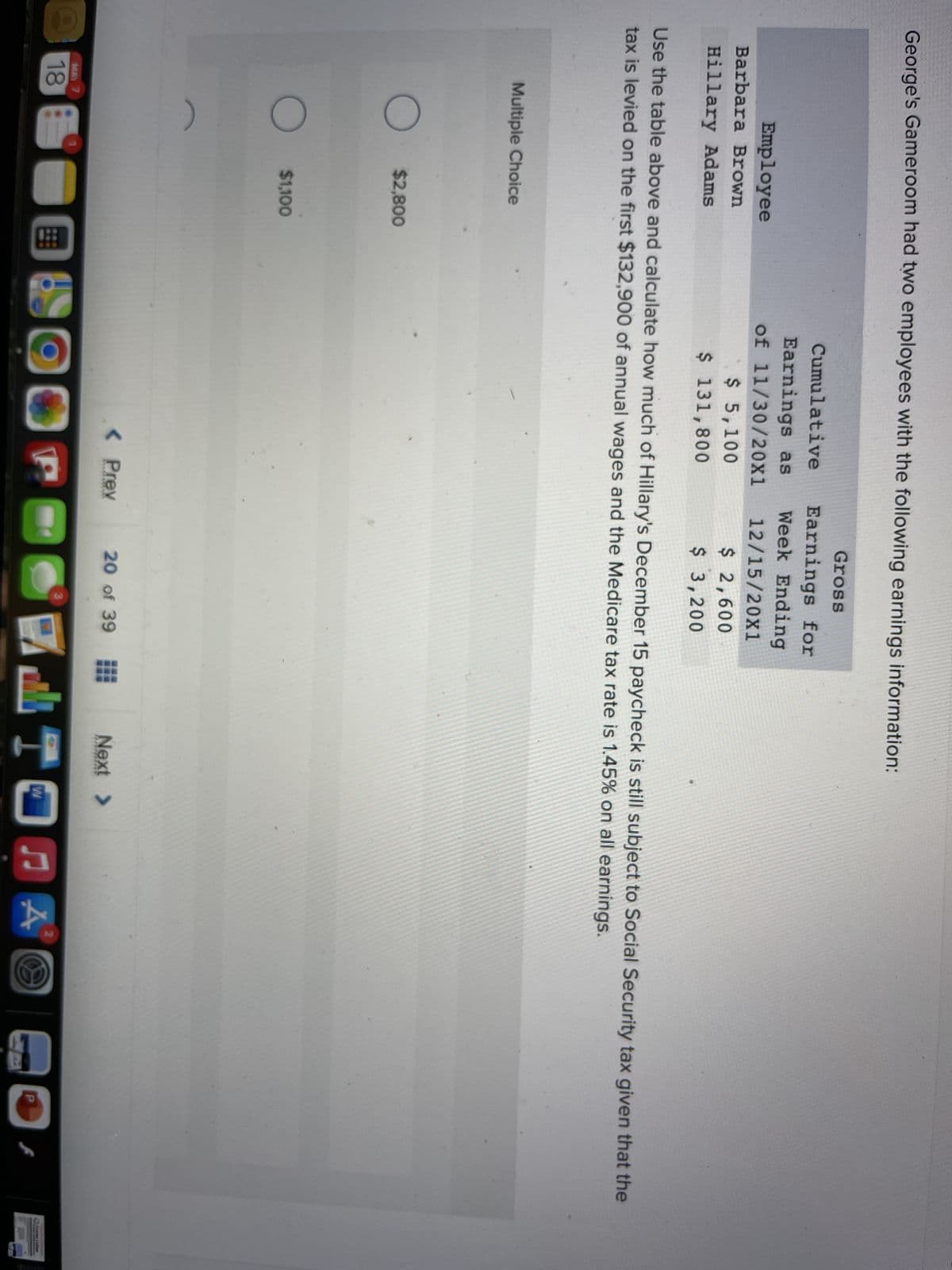

George's Gameroom had two employees with the following earnings information: Gross Earnings for Week Ending Cumulative Earnings as of 11/30/20X1 $ 5,100 $ 131,800 Employee 12/15/20X1 Barbara Brown $ 2,600 $ 3,200 Hillary Adams Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $132,900 of annual wages and the Medicare tax rate is 1.45% on all earnings. Multiple Choice $2,800 $1,100

George's Gameroom had two employees with the following earnings information: Gross Earnings for Week Ending Cumulative Earnings as of 11/30/20X1 $ 5,100 $ 131,800 Employee 12/15/20X1 Barbara Brown $ 2,600 $ 3,200 Hillary Adams Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $132,900 of annual wages and the Medicare tax rate is 1.45% on all earnings. Multiple Choice $2,800 $1,100

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 7E

Related questions

Question

Transcribed Image Text:George's Gameroom had two employees with the following earnings information:

Gross

Cumulative

Earnings for

Week Ending

Earnings as

of 11/30/20X1

$ 5,100

$ 131,800

Employee

12/15/20X1

Barbara Brown

$2,600

Hillary Adams

$ 3,200

Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the

tax is levied on the first $132,900 of annual wages and the Medicare tax rate is 1.45% on all earnings.

Multiple Choice

$2,800

$1,100

< Prev

20 of 39

Next >

MAY 7

21

18

Corin Calie

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage