Using the information in the following table, calculate this company's: $49 300 Net Income Beginning Total Assets Beginning Stockholders' Equity Payout Ratio $399,700 $249.800 0% a. Internal growth rate. b. Sustainable growth rate. c. Sustainable growth rate if it pays out 45% of its net income as a dividend. The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

Using the information in the following table, calculate this company's: $49 300 Net Income Beginning Total Assets Beginning Stockholders' Equity Payout Ratio $399,700 $249.800 0% a. Internal growth rate. b. Sustainable growth rate. c. Sustainable growth rate if it pays out 45% of its net income as a dividend. The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

Chapter9: Projecting Financial Statements

Section: Chapter Questions

Problem 5EP

Related questions

Question

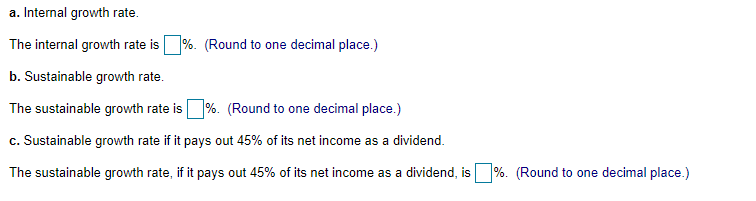

Transcribed Image Text:a. Internal growth rate.

The internal growth rate is%. (Round to one decimal place.)

b. Sustainable growth rate.

The sustainable growth rate is %. (Round to one decimal place.)

c. Sustainable growth rate if it pays out 45% of its net income as a dividend.

The sustainable growth rate, if it pays out 45% of its net income as a dividend, is

%. (Round to one decimal place.)

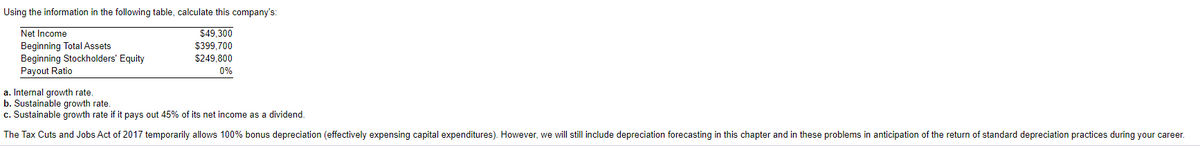

Transcribed Image Text:Using the information in the following table, calculate this company's:

Net Income

$49,300

Beginning Total Assets

Beginning Stockholders' Equity

Payout Ratio

$399,700

$249,800

0%

a. Internal growth rate.

b. Sustainable growth rate.

c. Sustainable growth rate if it pays out 45% of its net income as a dividend.

The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning