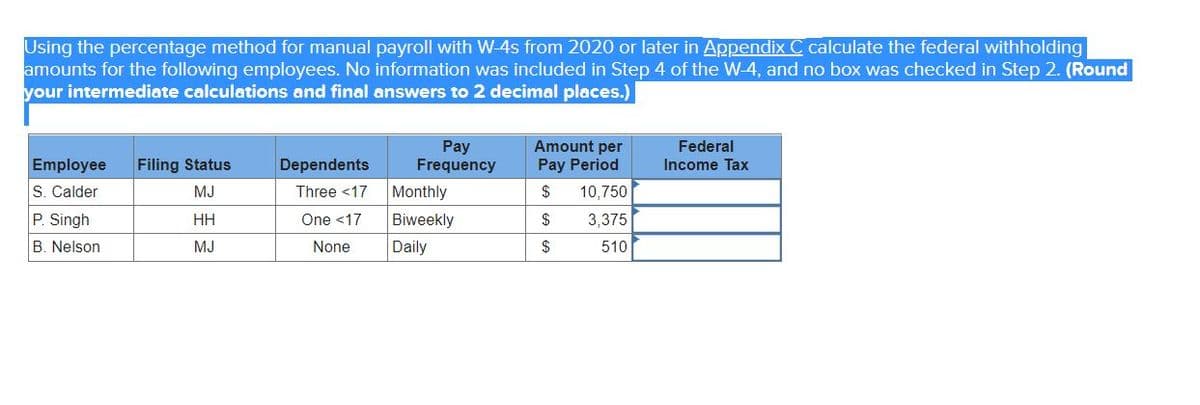

Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding amounts for the following employees. No information was included in Step 4 of the W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Filing Status S. Calder MJ P. Singh B. Nelson HH MJ Dependents Three <17 One <17 None Pay Frequency Monthly Biweekly Daily Amount per Pay Period $ 10,750 $ 3,375 $ 510 Federal Income Tax

Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding amounts for the following employees. No information was included in Step 4 of the W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Filing Status S. Calder MJ P. Singh B. Nelson HH MJ Dependents Three <17 One <17 None Pay Frequency Monthly Biweekly Daily Amount per Pay Period $ 10,750 $ 3,375 $ 510 Federal Income Tax

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding amounts for the following employees. No information was included in Step 4 of the W-4, and no box was checked in Step 2. (Round your intermediate calculations and final answers to 2 decimal places.)

Transcribed Image Text:Using the percentage method for manual payroll with W-4s from 2020 or later in Appendix C calculate the federal withholding

amounts for the following employees. No information was included in Step 4 of the W-4, and no box was checked in Step 2. (Round

your intermediate calculations and final answers to 2 decimal places.)

Employee Filing Status

S. Calder

MJ

P. Singh

B. Nelson

HH

MJ

Dependents

Three <17

One <17

None

Pay

Frequency

Monthly

Biweekly

Daily

Amount per

Pay Period

$

10,750

$

3,375

$

510

Federal

Income Tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College