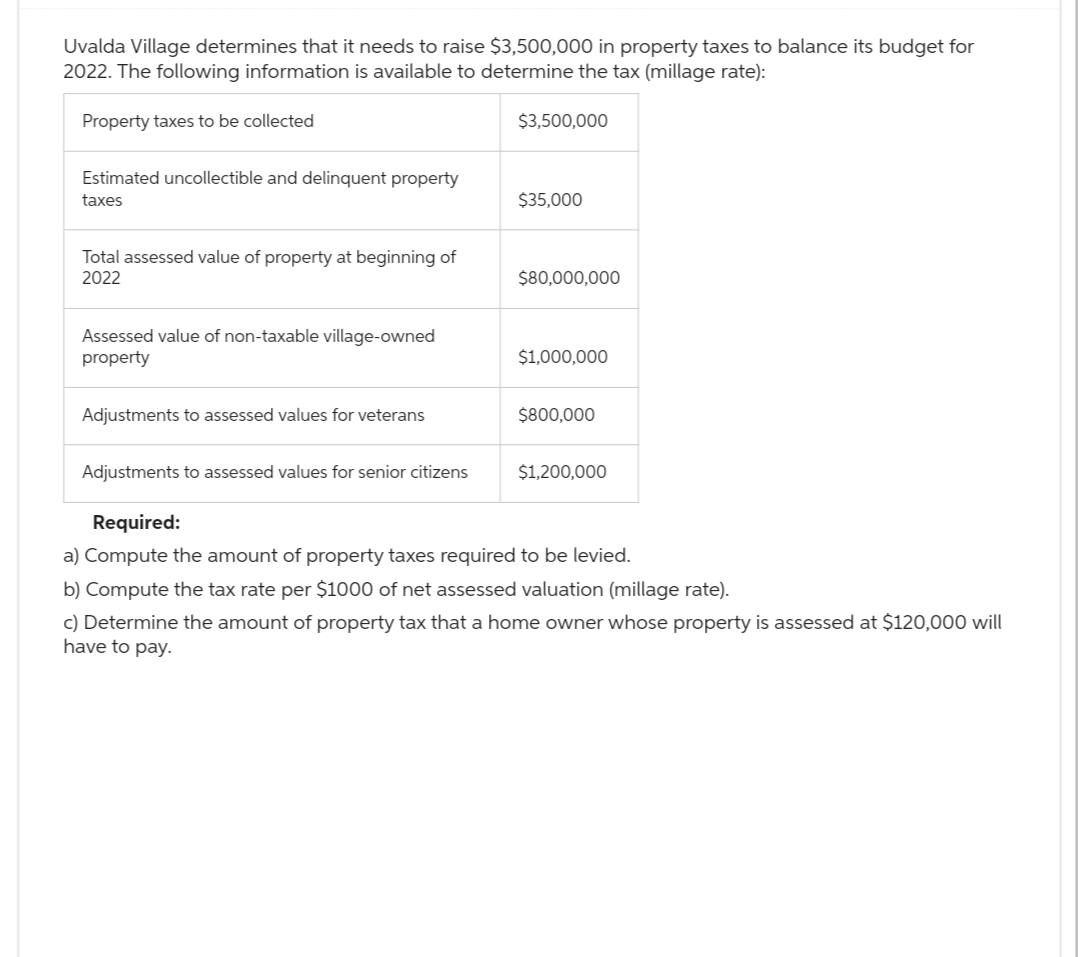

Uvalda Village determines that it needs to raise $3,500,000 in property taxes to balance its budget for 2022. The following information is available to determine the tax (millage rate): Property taxes to be collected Estimated uncollectible and delinquent property taxes Total assessed value of property at beginning of 2022 Assessed value of non-taxable village-owned property Adjustments to assessed values for veterans $3,500,000 $35,000 $80,000,000 $1,000,000 $800,000 Adjustments to assessed values for senior citizens Required: a) Compute the amount of property taxes required to be levied. b) Compute the tax rate per $1000 of net assessed valuation (millage rate). c) Determine the amount of property tax that a home owner whose property is assessed at $120,000 will have to pay. $1,200,000

Uvalda Village determines that it needs to raise $3,500,000 in property taxes to balance its budget for 2022. The following information is available to determine the tax (millage rate): Property taxes to be collected Estimated uncollectible and delinquent property taxes Total assessed value of property at beginning of 2022 Assessed value of non-taxable village-owned property Adjustments to assessed values for veterans $3,500,000 $35,000 $80,000,000 $1,000,000 $800,000 Adjustments to assessed values for senior citizens Required: a) Compute the amount of property taxes required to be levied. b) Compute the tax rate per $1000 of net assessed valuation (millage rate). c) Determine the amount of property tax that a home owner whose property is assessed at $120,000 will have to pay. $1,200,000

Chapter6: Business Expenses

Section: Chapter Questions

Problem 53P

Related questions

Question

Please Fast answer

do not Give solution in image format

Transcribed Image Text:Uvalda Village determines that it needs to raise $3,500,000 in property taxes to balance its budget for

2022. The following information is available to determine the tax (millage rate):

Property taxes to be collected

Estimated uncollectible and delinquent property

taxes

Total assessed value of property at beginning of

2022

Assessed value of non-taxable village-owned

property

Adjustments to assessed values for veterans

Adjustments to assessed values for senior citizens

$3,500,000

$35,000

$80,000,000

$1,000,000

$800,000

$1,200,000

Required:

a) Compute the amount of property taxes required to be levied.

b) Compute the tax rate per $1000 of net assessed valuation (millage rate).

c) Determine the amount of property tax that a home owner whose property is assessed at $120,000 will

have to pay.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you