Protax income Allocated costs() Labor expens Research and development (uncontrollable) Depreciation expense Net Income) Cost of goods sold Marketing costs (not) „Administrative expense Income tax expense (21% of pretax income) Sales ✔ Cost of Goods Sold Gross Prof✔ Deprec ✓ Administrative Expense✔ Other Expenses ✓ Allocated Costs (Uncontrollable) ✓ Research and Development (Uncontrollable) Marketing Costs (Uncontrollable) ✔ 7 Net Income - ✓ $2,030 41,580 190,000 310 18,000 7 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended Dec. 31, 20xx 119,700 1,250 7 800 690 330 ✓ Total Expens Pretax Income ✔ V Income Tax Expense (21% of Pretax Income)✔ 190,000 119,700 41,580 18,000✔ 5,300 ✓ 300 ✓ 1,113 4.387 ✓

Protax income Allocated costs() Labor expens Research and development (uncontrollable) Depreciation expense Net Income) Cost of goods sold Marketing costs (not) „Administrative expense Income tax expense (21% of pretax income) Sales ✔ Cost of Goods Sold Gross Prof✔ Deprec ✓ Administrative Expense✔ Other Expenses ✓ Allocated Costs (Uncontrollable) ✓ Research and Development (Uncontrollable) Marketing Costs (Uncontrollable) ✔ 7 Net Income - ✓ $2,030 41,580 190,000 310 18,000 7 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended Dec. 31, 20xx 119,700 1,250 7 800 690 330 ✓ Total Expens Pretax Income ✔ V Income Tax Expense (21% of Pretax Income)✔ 190,000 119,700 41,580 18,000✔ 5,300 ✓ 300 ✓ 1,113 4.387 ✓

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 3PA: The income statement comparison for Forklift Material Handling shows the income statement for the...

Related questions

Question

Transcribed Image Text:Financial information for bus Enterp

Pretax income

Gross profit

Allocated costs (uncontrollable)

Labor expense

Sales

Research and development (uncontrollable)

Depreciation expense

Net Income (los)

Cost of goods sold

Selling expense

Total expenses

Marketing costs (uncontrollable)

Administrative experim

Income tax expense (21% of pretax income)

Other expenses

Sales -✓

Cost of Goods Sold

Gross Profit ✓

Labor Expense

Depreciation Expanse ✔

Selling Expense

Administrative Expense

✓

✓

✓

Net Income

the year-ended December 31, 2uxx, was gathered from accounting intern, who

7

7

Marketing Coats (Uncontrollable)

✓

A. Prepare the income statement using the above information. Round your answers to the nearest dollar.

BDS Enterprises

Income Statement

For the Year Ended Dec. 31, 20xx

$2,030

41,550

190,000

310

✔

18,000

7

119,700

1,250

7

500

Other Expenses.

Allocated Costs (Uncontrollable)✔

Research and Development (Uncontrollable) ✓

690

7

330

Total Expenses

Pretax Income ✓

Income Tax Expense (21% of Pretax Income) ✔

190.000✔

119,700

70,300

41,580

15,000

1,260

500

2,000

✓

310 ✓

800 ✓

65,000✔

5,300

1,113

4,167 ✔

guidance on how to prepare an

in the incon

but you will need to calculate the value.

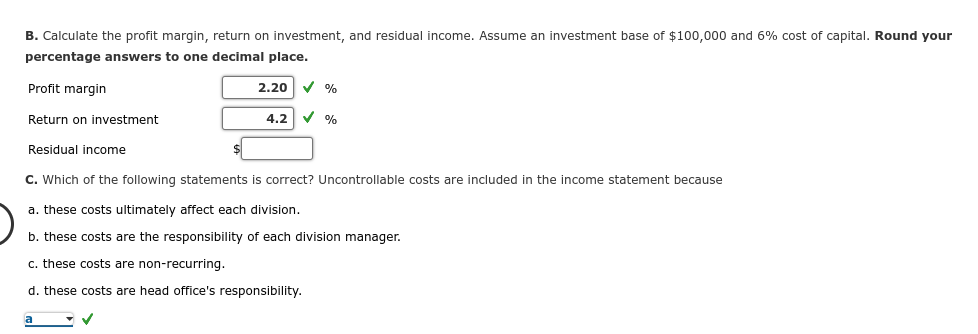

Transcribed Image Text:B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. Round your

percentage answers to one decimal place.

Profit margin

Return on investment

Residual income

2.20

a

✓ %

4.2 ✓ %

C. Which of the following statements is correct? Uncontrollable costs are included in the income statement because

a. these costs ultimately affect each division.

b. these costs are the responsibility of each division manager.

c. these costs are non-recurring.

d. these costs are head office's responsibility.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning