V PROBLEM COST OF SALES / COST OF GOODS MANUFACTURED Long-ganisa Corporation, a manufacturer of Hot Dogs, gave you the following partial financial information from the trial balance of the company, for its first year of operation, ending December 31, 2020: Factory insurance Salaries and wages - Office Store light and water expense Office light and water expense Depreciation Expense - Factory machineries Accrued salaries and wages - office Indirect labor Sales returns and allowances Freight in Material inventory, Jan. 1 Work in Process, Jan. 1 Finished goods inventory, Jan. 1 15,000 15,000 3,000 2,000 20,000 150,000 FOH/CGM AE SE AE 18,000 13,000 CL 10,000 100,000 200,000 200,000 FOH/CGM FOH/CGM NS CGM DM CGM / DM CGM COS 7

V PROBLEM COST OF SALES / COST OF GOODS MANUFACTURED Long-ganisa Corporation, a manufacturer of Hot Dogs, gave you the following partial financial information from the trial balance of the company, for its first year of operation, ending December 31, 2020: Factory insurance Salaries and wages - Office Store light and water expense Office light and water expense Depreciation Expense - Factory machineries Accrued salaries and wages - office Indirect labor Sales returns and allowances Freight in Material inventory, Jan. 1 Work in Process, Jan. 1 Finished goods inventory, Jan. 1 15,000 15,000 3,000 2,000 20,000 150,000 FOH/CGM AE SE AE 18,000 13,000 CL 10,000 100,000 200,000 200,000 FOH/CGM FOH/CGM NS CGM DM CGM / DM CGM COS 7

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.2P: Costs and Expenses The following costs are incurred by a retailer: Display fixtures in a retail...

Related questions

Question

Please answer all will surely given an upvote. THANK YOU

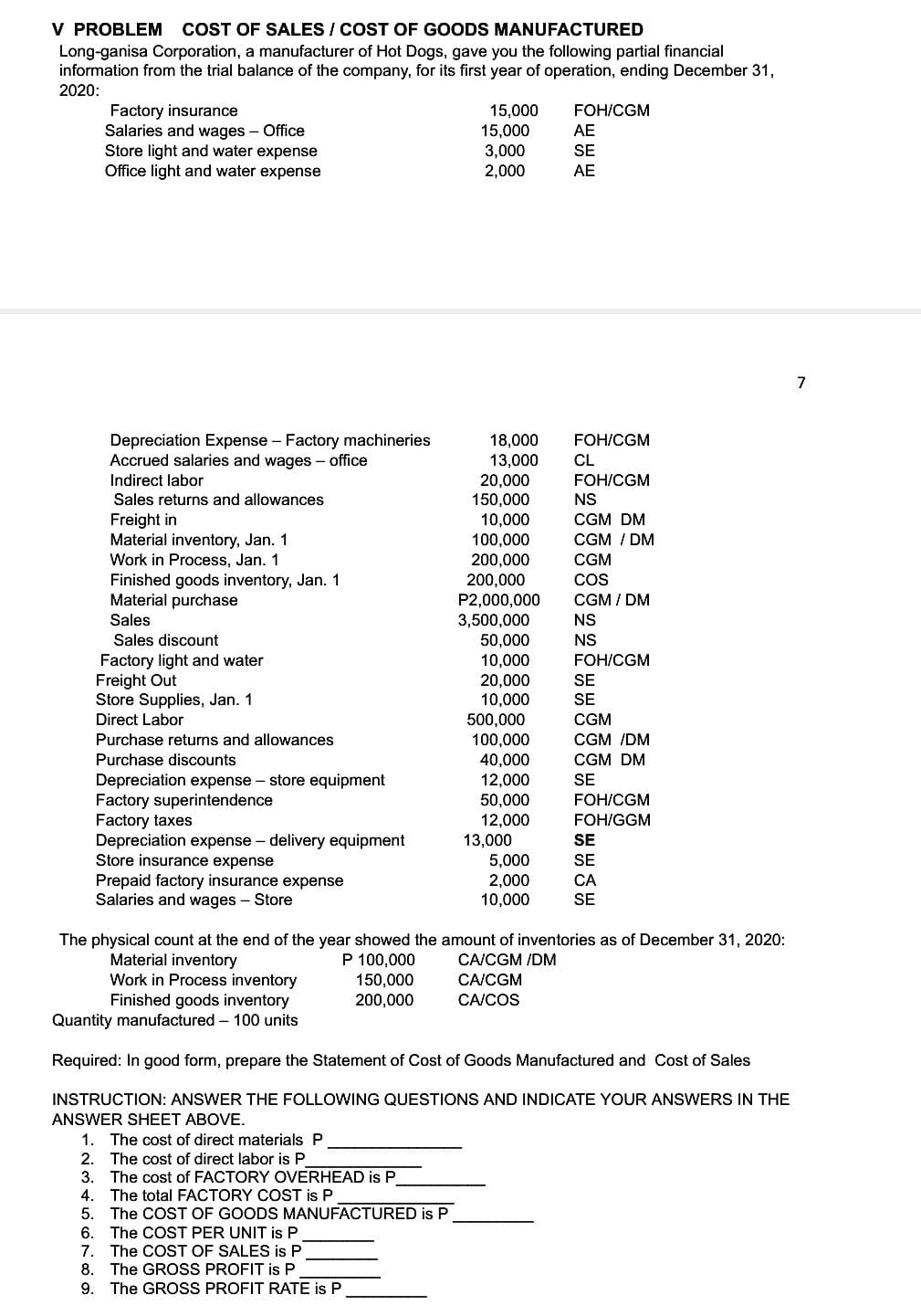

Transcribed Image Text:V PROBLEM COST OF SALES / COST OF GOODS MANUFACTURED

Long-ganisa Corporation, a manufacturer of Hot Dogs, gave you the following partial financial

information from the trial balance of the company, for its first year of operation, ending December 31,

2020:

Factory insurance

Salaries and wages - Office

Store light and water expense

Office light and water expense

Depreciation Expense - Factory machineries

Accrued salaries and wages - office

Indirect labor

Sales returns and allowances

Freight in

Material inventory, Jan. 1

Work in Process, Jan. 1

Finished goods inventory, Jan. 1

Material purchase

Sales

Sales discount

Factory light and water

Freight Out

Store Supplies, Jan. 1

Direct Labor

Purchase returns and allowances

Purchase discounts

Depreciation expense - store equipment

Factory superintendence

Factory taxes

Depreciation expense - delivery equipment

Store insurance expense

Prepaid factory insurance expense

Salaries and wages - Store

15,000

15,000

3,000

2,000

18,000

13,000

20,000

150,000

10,000

100,000

200,000

200,000

P2,000,000

3,500,000

50,000

10,000

20,000

10,000

500,000

100,000

40,000

12,000

50,000

12,000

13,000

5,000

2,000

10,000

FOH/CGM

AE

SE

AE

CA/CGM /DM

CA/CGM

CA/COS

FOH/CGM

CL

FOH/CGM

NS

CGM DM

CGM / DM

CGM

COS

CGM / DM

NS

NS

FOH/CGM

SE

SE

CGM

CGM /DM

CGM DM

SE

FOH/CGM

FOH/GGM

SE

SE

CA

SE

The physical count at the end of the year showed the amount of inventories as of December 31, 2020:

Material inventory

P 100,000

Work in Process inventory

150,000

Finished goods inventory

200,000

Quantity manufactured - 100 units

Required: In good form, prepare the Statement of Cost of Goods Manufactured and Cost of Sales

INSTRUCTION: ANSWER THE FOLLOWING QUESTIONS AND INDICATE YOUR ANSWERS IN THE

ANSWER SHEET ABOVE.

1. The cost of direct materials P

2. The cost of direct labor is P

3. The cost of FACTORY OVERHEAD is P

4. The total FACTORY COST is P

5. The COST OF GOODS MANUFACTURED is P

6. The COST PER UNIT is P

7. The COST OF SALES is P

8. The GROSS PROFIT is P

9. The GROSS PROFIT RATE is P

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub