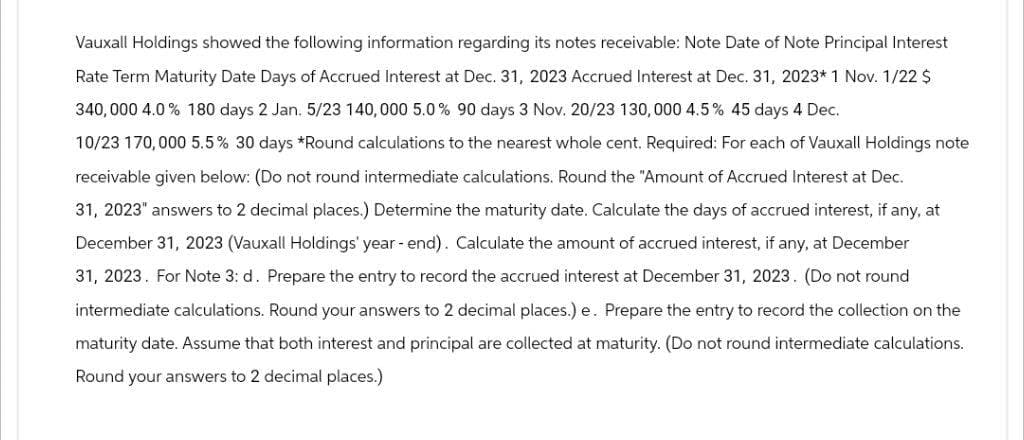

Vauxall Holdings showed the following information regarding its notes receivable: Note Date of Note Principal Interest Rate Term Maturity Date Days of Accrued Interest at Dec. 31, 2023 Accrued Interest at Dec. 31, 2023* 1 Nov. 1/22 $ 340,000 4.0 % 180 days 2 Jan. 5/23 140,000 5.0% 90 days 3 Nov. 20/23 130,000 4.5% 45 days 4 Dec. 10/23 170,000 5.5% 30 days *Round calculations to the nearest whole cent. Required: For each of Vauxall Holdings note receivable given below: (Do not round intermediate calculations. Round the "Amount of Accrued Interest at Dec. 31, 2023" answers to 2 decimal places.) Determine the maturity date. Calculate the days of accrued interest, if any, at December 31, 2023 (Vauxall Holdings' year-end). Calculate the amount of accrued interest, if any, at December 31, 2023. For Note 3: d. Prepare the entry to record the accrued interest at December 31, 2023. (Do not round intermediate calculations. Round your answers to 2 decimal places.) e. Prepare the entry to record the collection on the maturity date. Assume that both interest and principal are collected at maturity. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Vauxall Holdings showed the following information regarding its notes receivable: Note Date of Note Principal Interest Rate Term Maturity Date Days of Accrued Interest at Dec. 31, 2023 Accrued Interest at Dec. 31, 2023* 1 Nov. 1/22 $ 340,000 4.0 % 180 days 2 Jan. 5/23 140,000 5.0% 90 days 3 Nov. 20/23 130,000 4.5% 45 days 4 Dec. 10/23 170,000 5.5% 30 days *Round calculations to the nearest whole cent. Required: For each of Vauxall Holdings note receivable given below: (Do not round intermediate calculations. Round the "Amount of Accrued Interest at Dec. 31, 2023" answers to 2 decimal places.) Determine the maturity date. Calculate the days of accrued interest, if any, at December 31, 2023 (Vauxall Holdings' year-end). Calculate the amount of accrued interest, if any, at December 31, 2023. For Note 3: d. Prepare the entry to record the accrued interest at December 31, 2023. (Do not round intermediate calculations. Round your answers to 2 decimal places.) e. Prepare the entry to record the collection on the maturity date. Assume that both interest and principal are collected at maturity. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

Transcribed Image Text:Vauxall Holdings showed the following information regarding its notes receivable: Note Date of Note Principal Interest

Rate Term Maturity Date Days of Accrued Interest at Dec. 31, 2023 Accrued Interest at Dec. 31, 2023* 1 Nov. 1/22 $

340,000 4.0 % 180 days 2 Jan. 5/23 140,000 5.0% 90 days 3 Nov. 20/23 130,000 4.5% 45 days 4 Dec.

10/23 170,000 5.5% 30 days *Round calculations to the nearest whole cent. Required: For each of Vauxall Holdings note

receivable given below: (Do not round intermediate calculations. Round the "Amount of Accrued Interest at Dec.

31, 2023" answers to 2 decimal places.) Determine the maturity date. Calculate the days of accrued interest, if any, at

December 31, 2023 (Vauxall Holdings' year-end). Calculate the amount of accrued interest, if any, at December

31, 2023. For Note 3: d. Prepare the entry to record the accrued interest at December 31, 2023. (Do not round

intermediate calculations. Round your answers to 2 decimal places.) e. Prepare the entry to record the collection on the

maturity date. Assume that both interest and principal are collected at maturity. (Do not round intermediate calculations.

Round your answers to 2 decimal places.)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub