VCIcies lather than buy them. A new un be leased for a down payment of $5,000 and 36 end-of-the -month payments of $699. Alternately, the car can be purchased for cash for $52,000 and a Q7 with about 40.000 miles is estimated to have resale value of $26,000 in three years from now. Should one lease or buy if opportunity cost is 5.16%APR? Show all your work. Prepare an amortization schedule for the 51st, 52nd and 53rd payments on a 15-year, 3.60% APR, $1 million mortgage loan. Payments are monthly. Show all your work. (Similar concept to problem 4). 3. .003 ( ,00) mytuow -int.Ending Month BB x i BB- Beginning Balance Monthly Payment princ. Interest Principal Balance 51 773,970.39 7,200.48 2321.914,878.57 769,091.82 3. 52 769,091.82 7,200.482,307.28 |4,893.2764,198.62 53 764,198.62/ 7,200.48 2,292.604,907.88759290.74 4,907.88 759290.74 Maxmillan Corp is planning to buy a new computer system for $800,000 with 8, useful life of six years. At the end of six years, the system will have no value Over the six years the system will save them $240,000 each year for the first three years and $120,000 each year for the last three years. a. What is the NPV of the project if Maxmillan requires a return of 16%? b. What is the IRR for this project?

VCIcies lather than buy them. A new un be leased for a down payment of $5,000 and 36 end-of-the -month payments of $699. Alternately, the car can be purchased for cash for $52,000 and a Q7 with about 40.000 miles is estimated to have resale value of $26,000 in three years from now. Should one lease or buy if opportunity cost is 5.16%APR? Show all your work. Prepare an amortization schedule for the 51st, 52nd and 53rd payments on a 15-year, 3.60% APR, $1 million mortgage loan. Payments are monthly. Show all your work. (Similar concept to problem 4). 3. .003 ( ,00) mytuow -int.Ending Month BB x i BB- Beginning Balance Monthly Payment princ. Interest Principal Balance 51 773,970.39 7,200.48 2321.914,878.57 769,091.82 3. 52 769,091.82 7,200.482,307.28 |4,893.2764,198.62 53 764,198.62/ 7,200.48 2,292.604,907.88759290.74 4,907.88 759290.74 Maxmillan Corp is planning to buy a new computer system for $800,000 with 8, useful life of six years. At the end of six years, the system will have no value Over the six years the system will save them $240,000 each year for the first three years and $120,000 each year for the last three years. a. What is the NPV of the project if Maxmillan requires a return of 16%? b. What is the IRR for this project?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 9P

Related questions

Topic Video

Question

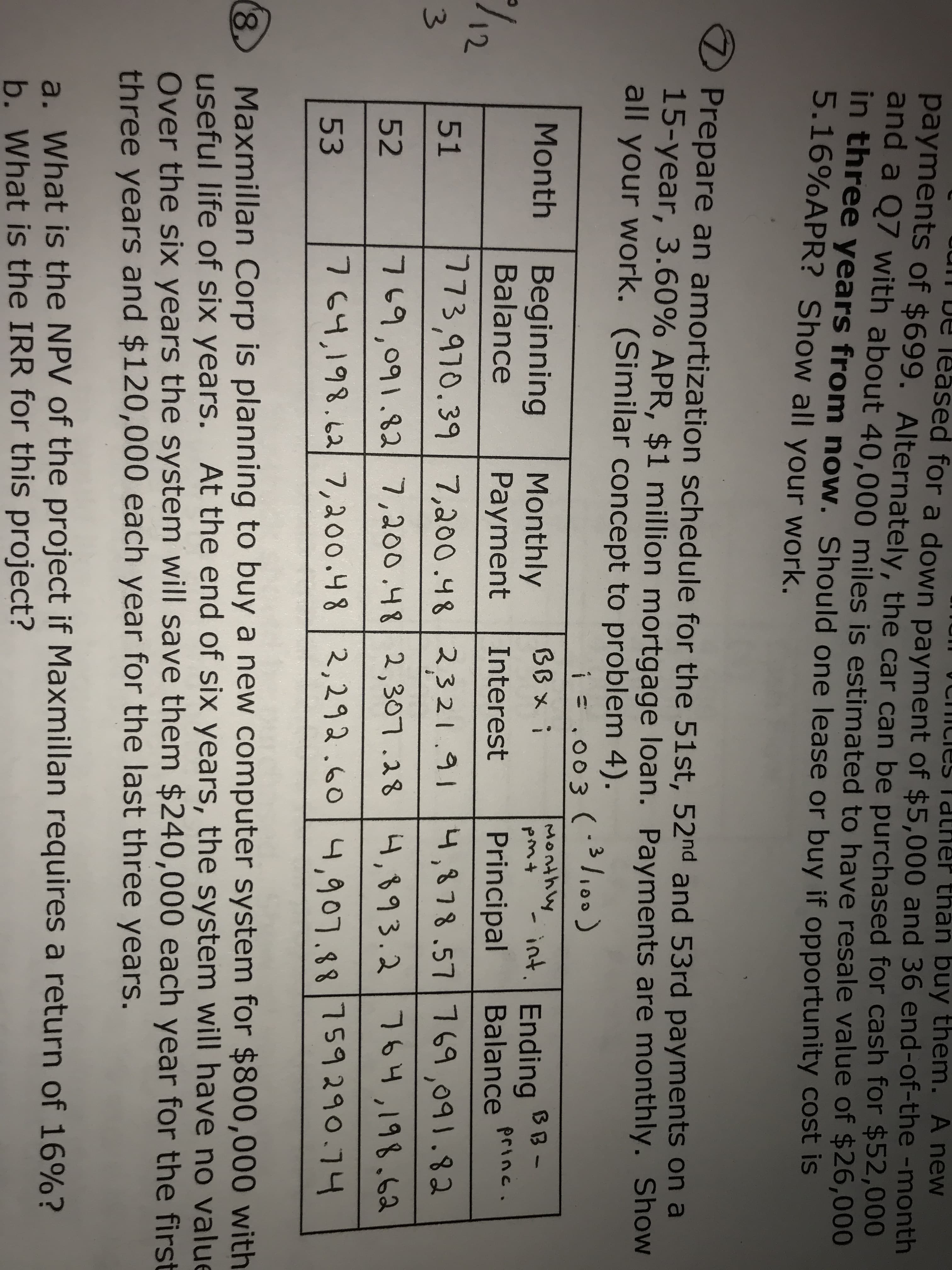

Question number 7. Complete the amortization schedule.

Transcribed Image Text:VCIcies lather than buy them. A new

un be leased for a down payment of $5,000 and 36 end-of-the -month

payments of $699. Alternately, the car can be purchased for cash for $52,000

and a Q7 with about 40.000 miles is estimated to have resale value of $26,000

in three years from now. Should one lease or buy if opportunity cost is

5.16%APR? Show all your work.

Prepare an amortization schedule for the 51st, 52nd and 53rd payments on a

15-year, 3.60% APR, $1 million mortgage loan. Payments are monthly. Show

all your work. (Similar concept to problem 4).

3.

.003 ( ,00)

mytuow

-int.Ending

Month

BB x i

BB-

Beginning

Balance

Monthly

Payment

princ.

Interest

Principal

Balance

51

773,970.39

7,200.48 2321.914,878.57 769,091.82

3.

52

769,091.82 7,200.482,307.28

|4,893.2764,198.62

53

764,198.62/ 7,200.48 2,292.604,907.88759290.74

4,907.88 759290.74

Maxmillan Corp is planning to buy a new computer system for $800,000 with

8,

useful life of six years. At the end of six years, the system will have no value

Over the six years the system will save them $240,000 each year for the first

three years and $120,000 each year for the last three years.

a. What is the NPV of the project if Maxmillan requires a return of 16%?

b. What is the IRR for this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT