Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.99 million per year. Your upfront setup costs to be ready to produce the part would be $8.06 million. Your discount rate for this contract is 8.1%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? e HEER a. What does the NPV rule say you should do? f, The NPV of the project is $ million. (Round to two decimal places.) tf What should you do? (Select the best choice below.) SC OA. The NPV rule says that you should not accept the contract because the NPV<0. OB. The NPV rule says that you should not accept the contract because the NPV> 0. OC. The NPV rule says that you should accept the contract because the NPV <0. -TH on OD. The NPV rule says that you should accept the contract because the NPV> 0. b. If you take the contract, what will be the change in the value of your firm? en If you take the contract, the value added to the firm will be $ million. (Round to two decimal places.) ndo

Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.99 million per year. Your upfront setup costs to be ready to produce the part would be $8.06 million. Your discount rate for this contract is 8.1%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? e HEER a. What does the NPV rule say you should do? f, The NPV of the project is $ million. (Round to two decimal places.) tf What should you do? (Select the best choice below.) SC OA. The NPV rule says that you should not accept the contract because the NPV<0. OB. The NPV rule says that you should not accept the contract because the NPV> 0. OC. The NPV rule says that you should accept the contract because the NPV <0. -TH on OD. The NPV rule says that you should accept the contract because the NPV> 0. b. If you take the contract, what will be the change in the value of your firm? en If you take the contract, the value added to the firm will be $ million. (Round to two decimal places.) ndo

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 8P

Related questions

Question

100%

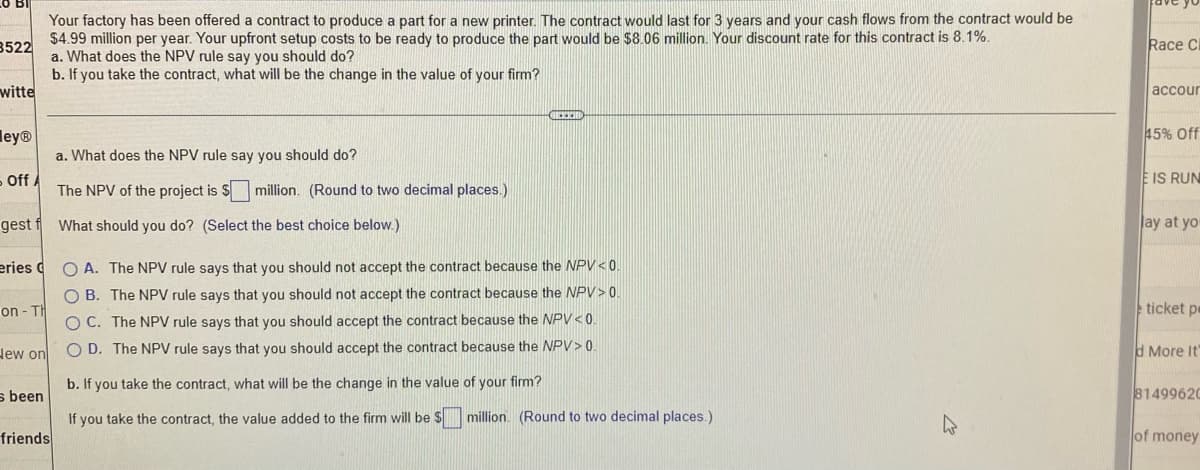

Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.99 million per year. Your upfront setup costs to be ready to produce the part would be $8.06 million. Your discount rate for this contract is 8.1%.

a. What does the NPV rule say you should do?

b. If you take the contract, what will be the change in the value of your firm?

*round to two decimal places*

Transcribed Image Text:Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be

$4.99 million per year. Your upfront setup costs to be ready to produce the part would be $8.06 million. Your discount rate for this contract is 8.1%.

a. What does the NPV rule say you should do?

3522

b. If you take the contract, what will be the change in the value of your firm?

witte

GEEEH

eyⓇ

a. What does the NPV rule say you should do?

- Off A

The NPV of the project is $ million. (Round to two decimal places.)

gest f What should you do? (Select the best choice below.)

eries C

on-Th

OA. The NPV rule says that you should not accept the contract because the NPV <0.

OB. The NPV rule says that you should not accept the contract because the NPV> 0.

OC. The NPV rule says that you should accept the contract because the NPV < 0.

OD. The NPV rule says that you should accept the contract because the NPV> 0.

New on

b. If you take the contract, what will be the change in the value of your firm?

s been

If you take the contract, the value added to the firm will be $ million. (Round to two decimal places.)

friends

W

Race Cl

accour

45% Off

E IS RUN

lay at you

ticket pe

d More It'

81499620

of money

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning