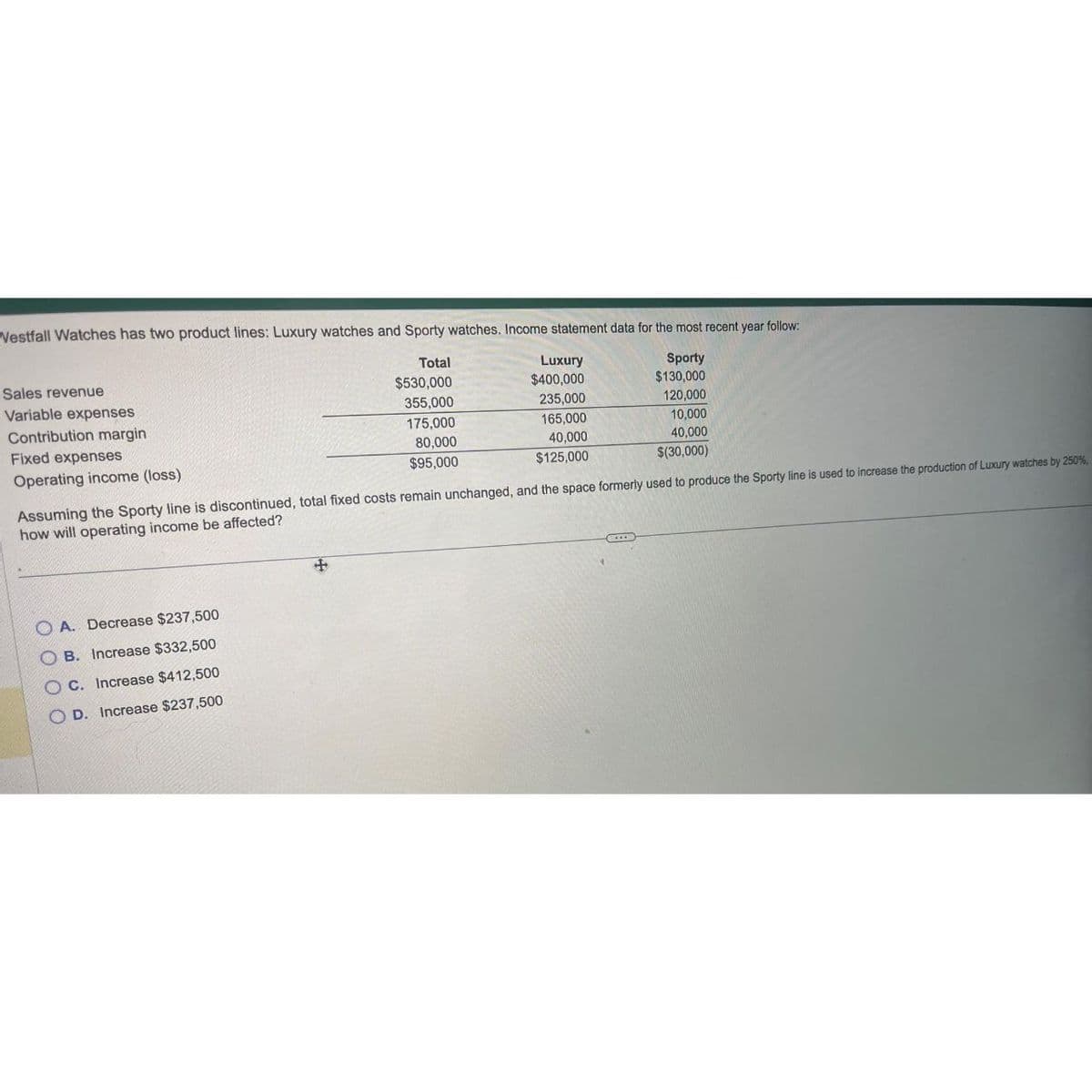

Vestfall Watches has two product lines: Luxury watches and Sporty watches. Income statement data for the most recent year follow: Sporty $130,000 120,000 10,000 40,000 $(30,000) Sales revenue Variable expenses Contribution margin Fixed expenses Operating income (loss) 0 0 0 A. Decrease $237,500 Assuming the Sporty line is discontinued, total fixed costs remain unchanged, and the space formerly used to produce the Sporty line is used to increase the production of Luxury watches by 250%. how will operating income be affected? OB. Increase $332,500 OC. Increase $412,500 OD. Increase $237,500 Total $530,000 355,000 + 175,000 80,000 $95,000 Luxury $400,000 235,000 165,000 40,000 $125,000 CES

Vestfall Watches has two product lines: Luxury watches and Sporty watches. Income statement data for the most recent year follow: Sporty $130,000 120,000 10,000 40,000 $(30,000) Sales revenue Variable expenses Contribution margin Fixed expenses Operating income (loss) 0 0 0 A. Decrease $237,500 Assuming the Sporty line is discontinued, total fixed costs remain unchanged, and the space formerly used to produce the Sporty line is used to increase the production of Luxury watches by 250%. how will operating income be affected? OB. Increase $332,500 OC. Increase $412,500 OD. Increase $237,500 Total $530,000 355,000 + 175,000 80,000 $95,000 Luxury $400,000 235,000 165,000 40,000 $125,000 CES

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

please answer do not image format

Transcribed Image Text:Westfall Watches has two product lines: Luxury watches and Sporty watches. Income statement data for the most recent year follow:

Total

Sporty

$530,000

$130,000

355,000

120,000

10,000

175,000

80,000

40,000

$95,000

$(30,000)

Sales revenue

Variable expenses

Contribution margin

Fixed expenses

Operating income (loss)

A. Decrease $237,500

B. Increase $332,500

OC. Increase $412,500

OD. Increase $237,500

Luxury

$400,000

Assuming the Sporty line is discontinued, total fixed costs remain unchanged, and the space formerly used to produce the Sporty line is used to increase the production of Luxury watches by 250%.

how will operating income be affected?

0000

235,000

165,000

40,000

$125,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning