(vi) Rent paid, as recorded in the ledger, relates to only 9-month period. One quarter of rent payment remains owed as at 31st March 2016. Required a) Prepare a corrected Statement of Comprehensive Income for Basil Brush's business for the year ended 31st March 2016 using the Common European Format b) Prepare a corrected Statement of Financial Position for Basil Brush's business as at 31st March 2016 using the Common European Format

(vi) Rent paid, as recorded in the ledger, relates to only 9-month period. One quarter of rent payment remains owed as at 31st March 2016. Required a) Prepare a corrected Statement of Comprehensive Income for Basil Brush's business for the year ended 31st March 2016 using the Common European Format b) Prepare a corrected Statement of Financial Position for Basil Brush's business as at 31st March 2016 using the Common European Format

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.6BPR

Related questions

Question

Transcribed Image Text:EL Question 3

Basil Brush

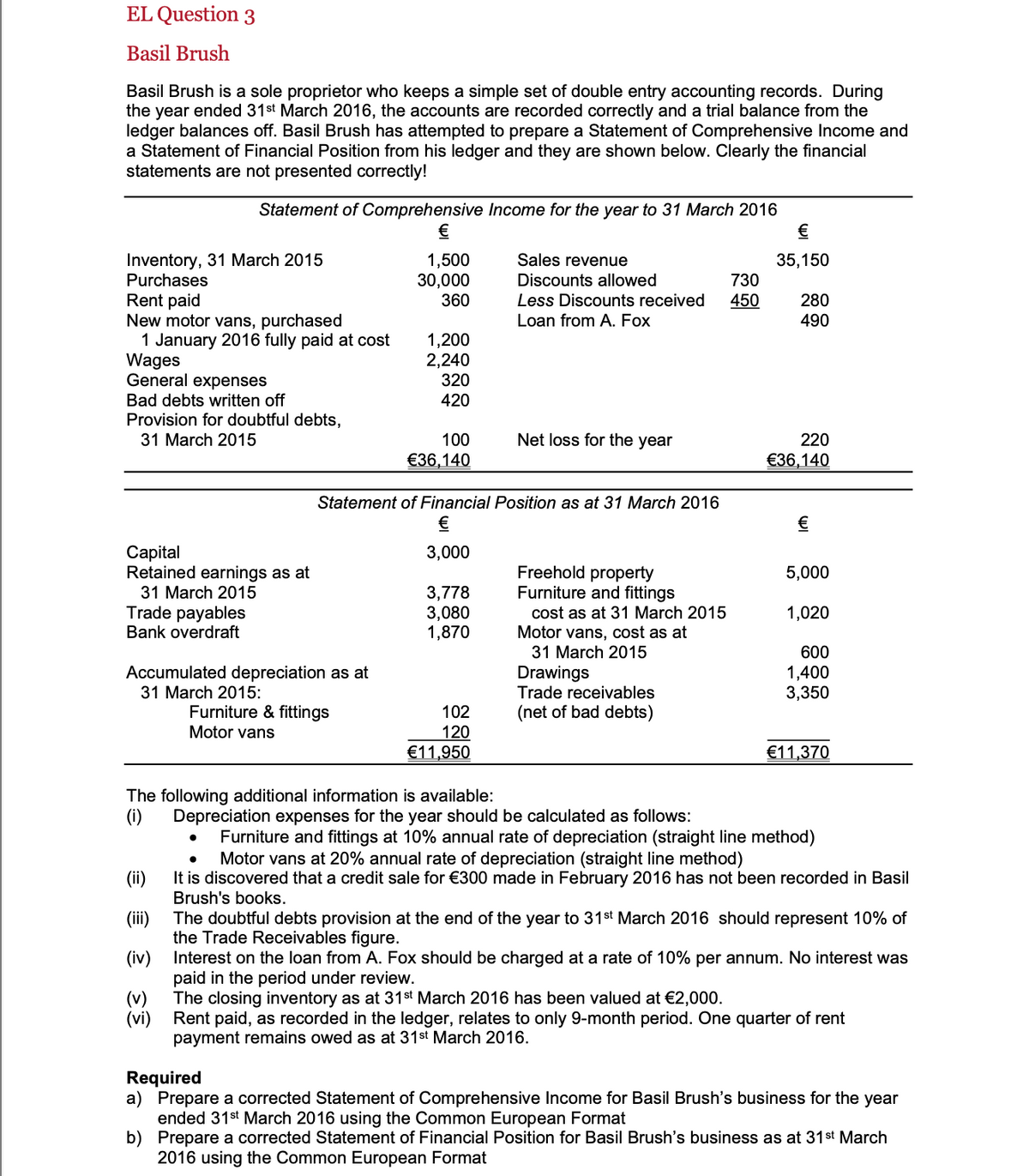

Basil Brush is a sole proprietor who keeps a simple set of double entry accounting records. During

the year ended 31st March 2016, the accounts are recorded correctly and a trial balance from the

ledger balances off. Basil Brush has attempted to prepare a Statement of Comprehensive Income and

a Statement of Financial Position from his ledger and they are shown below. Clearly the financial

statements are not presented correctly!

Statement of Comprehensive Income for the year to 31 March 2016

€

Inventory, 31 March 2015

Purchases

Rent paid

New motor vans, purchased

1 January 2016 fully paid at cost

Wages

General expenses

Bad debts written off

Provision for doubtful debts,

31 March 2015

Capital

Retained earnings as at

31 March 2015

Trade payables

Bank overdraft

Accumulated depreciation as at

31 March 2015:

1,500

30,000

360

Furniture & fittings

Motor vans

1,200

2,240

320

420

100

€36,140

Statement of Financial Position as at 31 March 2016

€

3,000

3,778

3,080

1,870

Sales revenue

Discounts allowed

102

120

€11,950

730

Less Discounts received 450

Loan from A. Fox

Net loss for the year

Freehold property

Furniture and fittings

cost as at 31 March 2015

Motor vans, cost as at

31 March 2015

Drawings

Trade receivables

(net of bad debts)

The following additional information is available:

(i) Depreciation expenses for the year should be calculated as follows:

€

35,150

280

490

220

€36,140

€

5,000

1,020

600

1,400

3,350

€11,370

Furniture and fittings at 10% annual rate of depreciation (straight line method)

Motor vans at 20% annual rate of depreciation (straight line method)

(ii)

It is discovered that a credit sale for €300 made in February 2016 has not been recorded in Basil

Brush's books.

(iii)

(iv)

(v)

(vi)

The doubtful debts provision at the end of the year to 31st March 2016 should represent 10% of

the Trade Receivables figure.

Interest on the loan from A. Fox should be charged at a rate of 10% per annum. No interest was

paid in the period under review.

The closing inventory as at 31st March 2016 has been valued at €2,000.

Rent paid, as recorded in the ledger, relates to only 9-month period. One quarter of rent

payment remains owed as at 31st March 2016.

Required

a) Prepare a corrected Statement of Comprehensive Income for Basil Brush's business for the year

ended 31st March 2016 using the Common European Format

b) Prepare a corrected Statement of Financial Position for Basil Brush's business as at 31st March

2016 using the Common European Format

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning