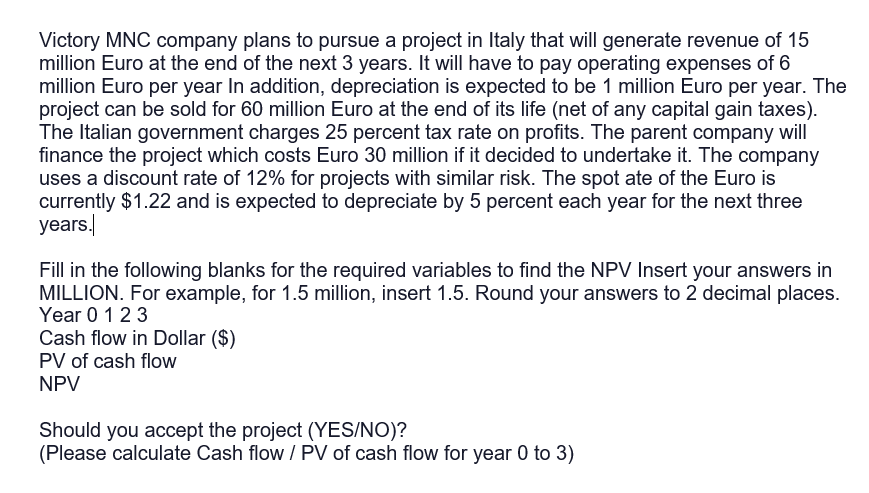

Victory MNC company plans to pursue a project in Italy that will generate revenue of 15 million Euro at the end of the next 3 years. It will have to pay operating expenses of 6 million Euro per year In addition, depreciation is expected to be 1 million Euro per year. The project can be sold for 60 million Euro at the end of its life (net of any capital gain taxes). The Italian government charges 25 percent tax rate on profits. The parent company will finance the project which costs Euro 30 million if it decided to undertake it. The company uses a discount rate of 12% for projects with similar risk. The spot ate of the Euro is currently $1.22 and is expected to depreciate by 5 percent each year for the next three years. Fill in the following blanks for the required variables to find the NPV Insert your answers in MILLION. For example, for 1.5 million, insert 1.5. Round your answers to 2 decimal places. Year 0 1 23 Cash flow in Dollar ($) PV of cash flow NPV

Victory MNC company plans to pursue a project in Italy that will generate revenue of 15 million Euro at the end of the next 3 years. It will have to pay operating expenses of 6 million Euro per year In addition, depreciation is expected to be 1 million Euro per year. The project can be sold for 60 million Euro at the end of its life (net of any capital gain taxes). The Italian government charges 25 percent tax rate on profits. The parent company will finance the project which costs Euro 30 million if it decided to undertake it. The company uses a discount rate of 12% for projects with similar risk. The spot ate of the Euro is currently $1.22 and is expected to depreciate by 5 percent each year for the next three years. Fill in the following blanks for the required variables to find the NPV Insert your answers in MILLION. For example, for 1.5 million, insert 1.5. Round your answers to 2 decimal places. Year 0 1 23 Cash flow in Dollar ($) PV of cash flow NPV

Chapter17: Multinational Capital Structure And Cost Of Capital

Section: Chapter Questions

Problem 24QA

Related questions

Question

Transcribed Image Text:Victory MNC company plans to pursue a project in Italy that will generate revenue of 15

million Euro at the end of the next 3 years. It will have to pay operating expenses of 6

million Euro per year In addition, depreciation is expected to be 1 million Euro per year. The

project can be sold for 60 million Euro at the end of its life (net of any capital gain taxes).

The Italian government charges 25 percent tax rate on profits. The parent company will

finance the project which costs Euro 30 million if it decided to undertake it. The company

uses a discount rate of 12% for projects with similar risk. The spot ate of the Euro is

currently $1.22 and is expected to depreciate by 5 percent each year for the next three

years.

Fill in the following blanks for the required variables to find the NPV Insert your answers in

MILLION. For example, for 1.5 million, insert 1.5. Round your answers to 2 decimal places.

Year 0 1 23

Cash flow in Dollar ($)

PV of cash flow

NPV

Should you accept the project (YES/NO)?

(Please calculate Cash flow / PV of cash flow for year 0 to 3)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning