Wäits tố đếtc ancial manager of Sarap Corporation cash outlays to be spent for the next period. He asked the help and the latter provided a cash budget for the next year. computations, the company would be incurring cash expenses nonth. The financial manager has estimated a cost of P40 per on-cash asset is converted to cash. The firm's opportunity cost

Wäits tố đếtc ancial manager of Sarap Corporation cash outlays to be spent for the next period. He asked the help and the latter provided a cash budget for the next year. computations, the company would be incurring cash expenses nonth. The financial manager has estimated a cost of P40 per on-cash asset is converted to cash. The firm's opportunity cost

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 8PROB

Related questions

Question

What is the optimum cash balance?

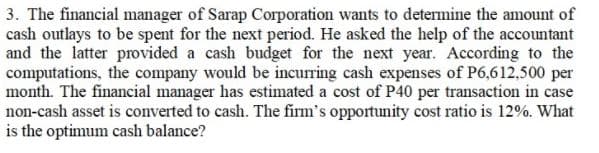

Transcribed Image Text:3. The financial manager of Sarap Corporation wants to determine the amount of

cash outlays to be spent for the next period. He asked the help of the accountant

and the latter provided a cash budget for the next year. According to the

computations, the company would be incurring cash expenses of P6,612,500 per

month. The financial manager has estimated a cost of P40 per transaction in case

non-cash asset is converted to cash. The firm's opportunity cost ratio is 12%. What

is the optimum cash balance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning