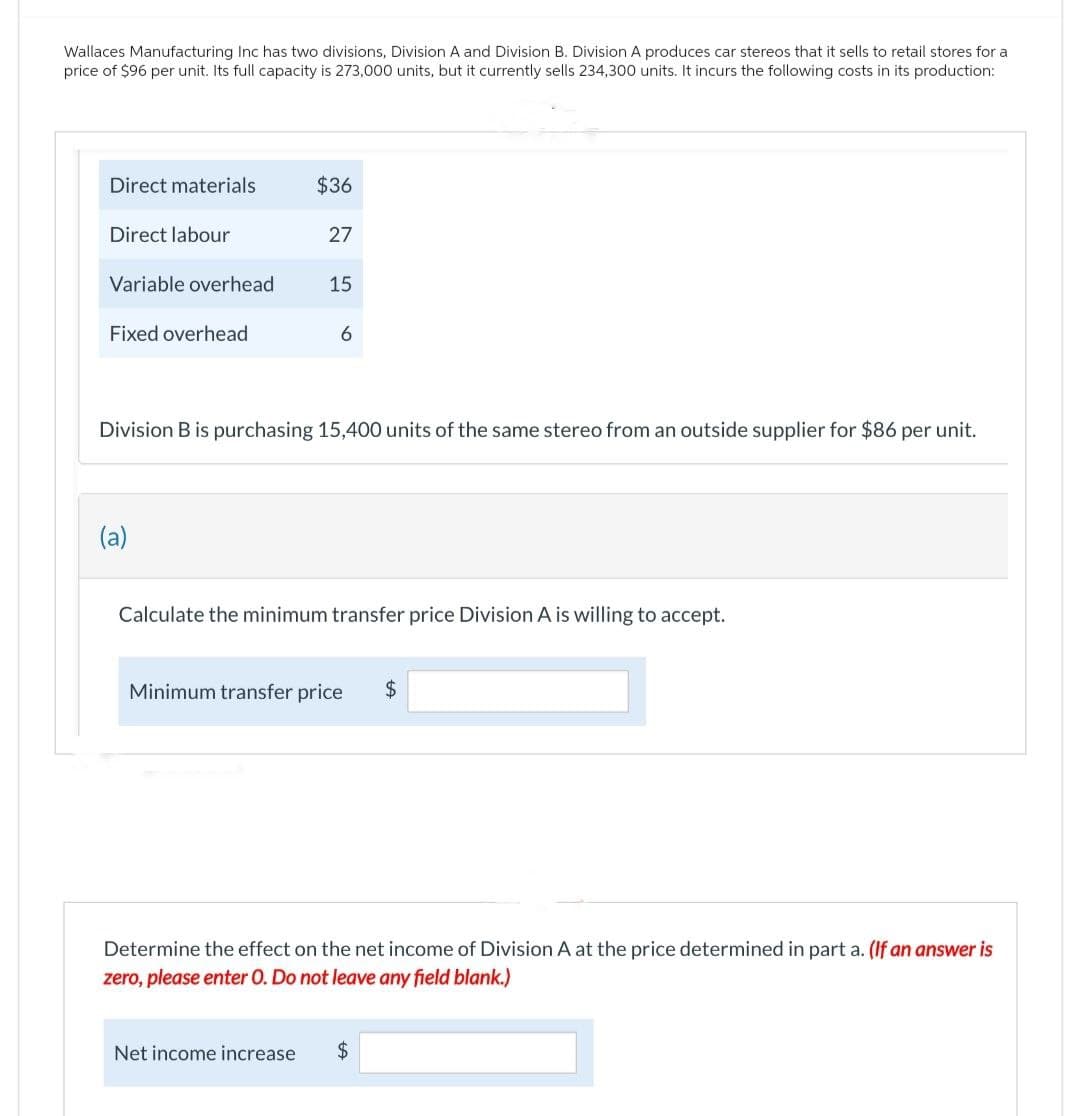

Wallaces Manufacturing Inc has two divisions, Division A and Division B. Division A produces car stereos that it sells to retail stores for a price of $96 per unit. Its full capacity is 273,000 units, but it currently sells 234,300 units. It incurs the following costs in its production: Direct materials $36

Wallaces Manufacturing Inc has two divisions, Division A and Division B. Division A produces car stereos that it sells to retail stores for a price of $96 per unit. Its full capacity is 273,000 units, but it currently sells 234,300 units. It incurs the following costs in its production: Direct materials $36

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter10: Standard Costing And Variance Analysis

Section: Chapter Questions

Problem 73P: The Lubbock plant of Morrils Small Motor Division produces a major subassembly for a 6.0 horsepower...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Wallaces Manufacturing Inc has two divisions, Division A and Division B. Division A produces car stereos that it sells to retail stores for a

price of $96 per unit. Its full capacity is 273,000 units, but it currently sells 234,300 units. It incurs the following costs in its production:

Direct materials

Direct labour

Variable overhead

Fixed overhead

(a)

$36

27

15

Division B is purchasing 15,400 units of the same stereo from an outside supplier for $86 per unit.

6

Net income increase

Calculate the minimum transfer price Division A is willing to accept.

Minimum transfer price

Determine the effect on the net income of Division A at the price determined in part a. (If an answer is

zero, please enter O. Do not leave any field blank.)

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub