Warm-Up 10-1 (similar to) D Assigned Media E Question Help Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of $34,000. Using the expected cash inflows given for each project in the following table, , calculate each projects payback period. Which project meets Elysian's standards? The payback period of project Hydrogen isyears. (Round to two decimal places.) Data Table (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Expected cash inflows Hydrogen Year Helium 1 $6,500 $8,000 $8,000 $7,000 $4,500 $5,000 $5,000 $8,500 $3,000 $3,500 $2,500 $4,000 Print Done

Warm-Up 10-1 (similar to) D Assigned Media E Question Help Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of $34,000. Using the expected cash inflows given for each project in the following table, , calculate each projects payback period. Which project meets Elysian's standards? The payback period of project Hydrogen isyears. (Round to two decimal places.) Data Table (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Expected cash inflows Hydrogen Year Helium 1 $6,500 $8,000 $8,000 $7,000 $4,500 $5,000 $5,000 $8,500 $3,000 $3,500 $2,500 $4,000 Print Done

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 11P: CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S costs 17,000, and its expected...

Related questions

Question

Transcribed Image Text:Warm-Up 10-1 (similar to)

D Assigned Media

E Question Help

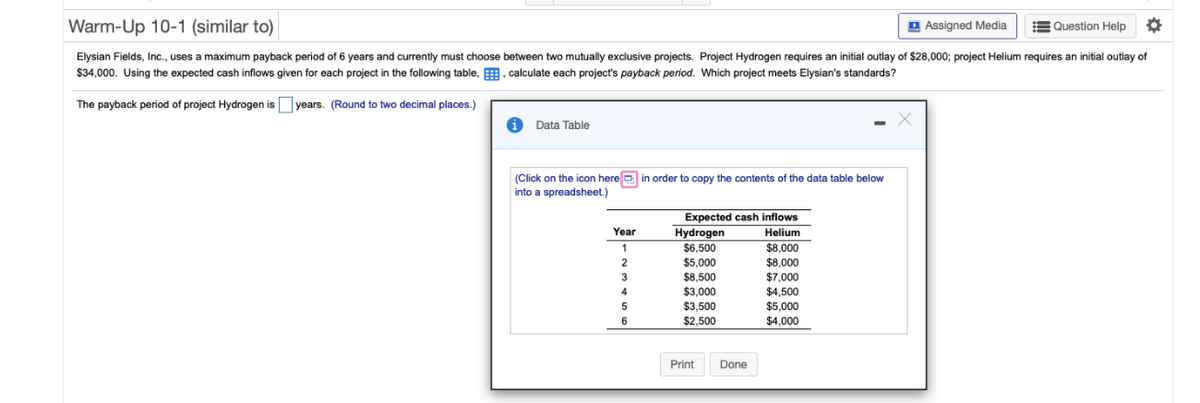

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of

$34,000. Using the expected cash inflows given for each project in the following table, , calculate each projects payback period. Which project meets Elysian's standards?

The payback period of project Hydrogen isyears. (Round to two decimal places.)

Data Table

(Click on the icon here e in order to copy the contents of the data table below

into a spreadsheet.)

Expected cash inflows

Hydrogen

Year

Helium

1

$6,500

$8,000

$8,000

$7,000

$4,500

$5,000

$5,000

$8,500

$3,000

$3,500

$2,500

$4,000

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning