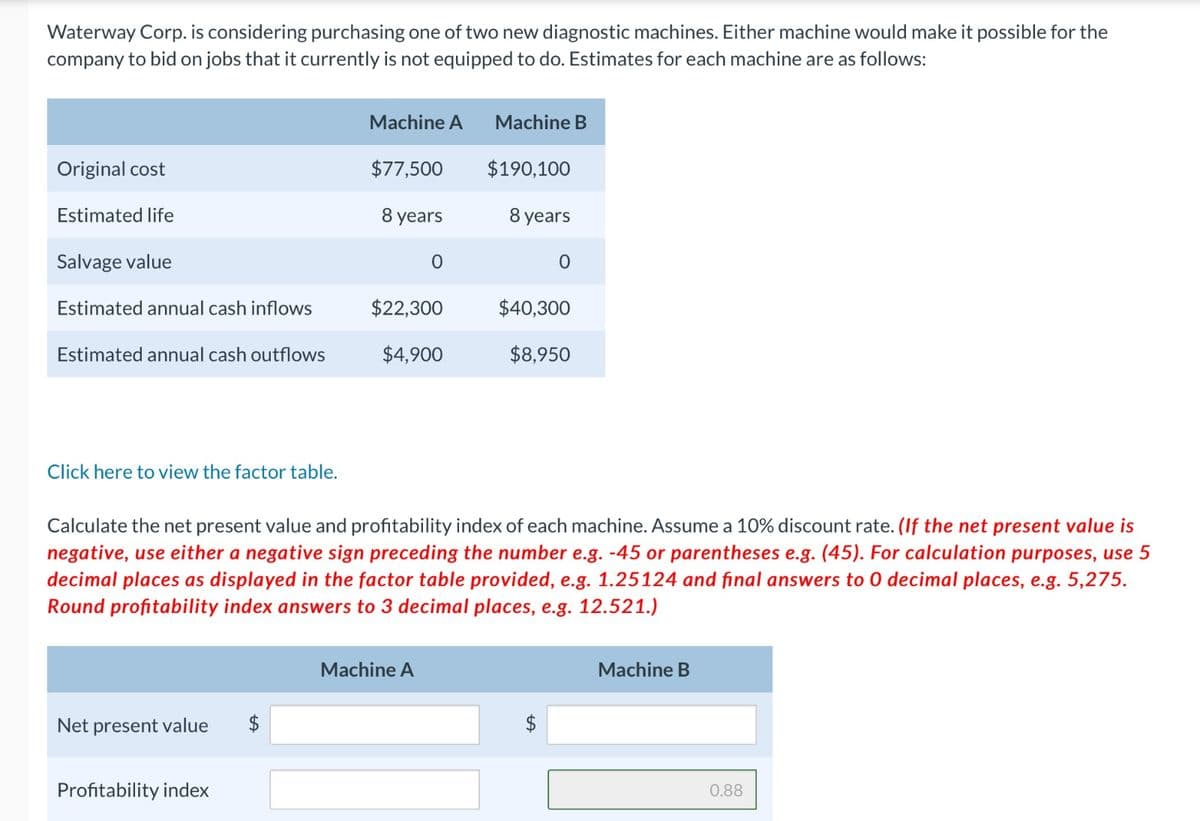

Waterway Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently is not equipped to do. Estimates for each machine are as follows: Original cost Estimated life Salvage value Estimated annual cash inflows Machine A $77,500 8 years 0 $22,300 Machine B $190,100 8 years 0 $40,300

Waterway Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently is not equipped to do. Estimates for each machine are as follows: Original cost Estimated life Salvage value Estimated annual cash inflows Machine A $77,500 8 years 0 $22,300 Machine B $190,100 8 years 0 $40,300

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 12P

Related questions

Question

Gadubhai

Transcribed Image Text:Waterway Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the

company to bid on jobs that it currently is not equipped to do. Estimates for each machine are as follows:

Original cost

Estimated life

Salvage value

Estimated annual cash inflows

Estimated annual cash outflows

Click here to view the factor table.

Net present value $

Machine A Machine B

Profitability index

$77,500

8 years

0

$22,300

$4,900

Machine A

$190,100

8 years

Calculate the net present value and profitability index of each machine. Assume a 10% discount rate. (If the net present value is

negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5

decimal places as displayed in the factor table provided, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.

Round profitability index answers to 3 decimal places, e.g. 12.521.)

0

$40,300

$8,950

Machine B

0.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning