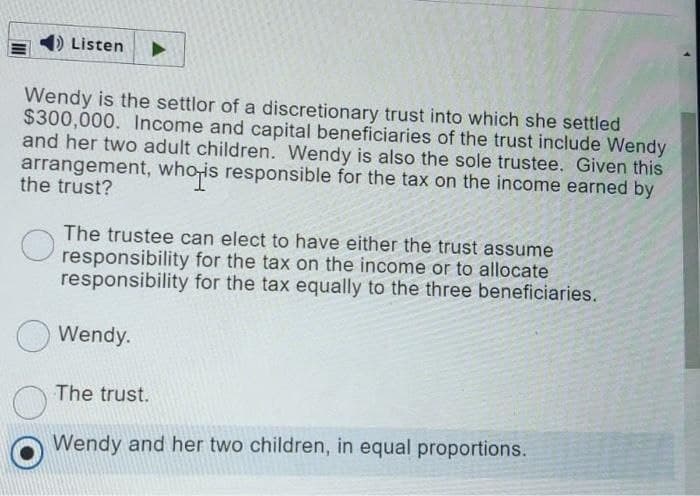

Wendy is the settlor of a discretionary trust into which she settled $300,000. Income and capital beneficiaries of the trust include Wendy and her two adult children. Wendy is also the sole trustee. Given this arrangement, who-is responsible for the tax on the income earned by the trust? The trustee can elect to have either the trust assume responsibility for the tax on the income or to allocate responsibility for the tax equally to the three beneficiaries. Wendy. The trust. Wendy and her two children, in equal proportions.

Wendy is the settlor of a discretionary trust into which she settled $300,000. Income and capital beneficiaries of the trust include Wendy and her two adult children. Wendy is also the sole trustee. Given this arrangement, who-is responsible for the tax on the income earned by the trust? The trustee can elect to have either the trust assume responsibility for the tax on the income or to allocate responsibility for the tax equally to the three beneficiaries. Wendy. The trust. Wendy and her two children, in equal proportions.

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 15CE

Related questions

Question

Transcribed Image Text:DListen

Wendy is the settlor of a discretionary trust into which she settled

$300,000. Income and capital beneficiaries of the trust include Wendy

and her two adult children. Wendy is also the sole trustee. Given this

arrangement, who-is responsible for the tax on the income earned by

the trust?

hois

The trustee can elect to have either the trust assume

U responsibility for the tax on the income or to allocate

responsibility for the tax equally to the three beneficiaries.

Wendy.

The trust.

Wendy and her two children, in equal proportions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you