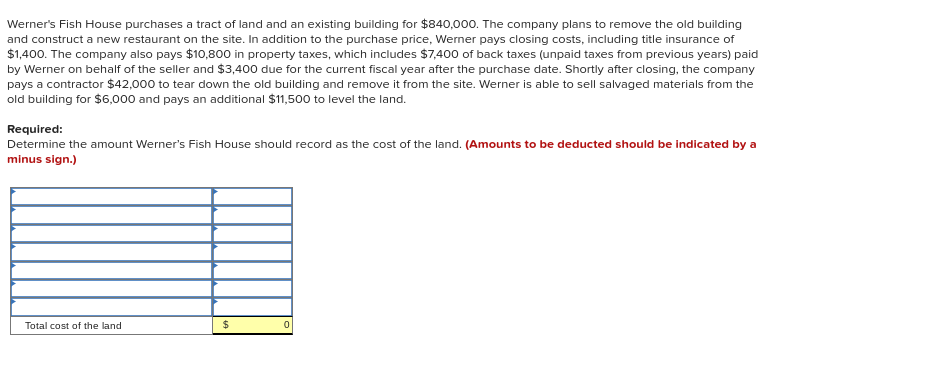

Werner's Fish House purchases a tract of land and an existing building for $840,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, Werner pays closing costs, including title insurance of $1,400. The company also pays $10,800 in property taxes, which includes $7,400 of back taxes (unpaid taxes from previous years) paid by Werner on behalf of the seller and $3,400 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $42,000 to tear down the old building and remove it from the site. Werner is able to sell salvaged materials from the old building for $6,000 and pays an additional $11,500 to level the land. Required: Determine the amount Werner's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land

Werner's Fish House purchases a tract of land and an existing building for $840,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, Werner pays closing costs, including title insurance of $1,400. The company also pays $10,800 in property taxes, which includes $7,400 of back taxes (unpaid taxes from previous years) paid by Werner on behalf of the seller and $3,400 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $42,000 to tear down the old building and remove it from the site. Werner is able to sell salvaged materials from the old building for $6,000 and pays an additional $11,500 to level the land. Required: Determine the amount Werner's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Please read and answer the question carefully.

Transcribed Image Text:Werner's Fish House purchases a tract of land and an existing building for $840,000. The company plans to remove the old building

and construct a new restaurant on the site. In addition to the purchase price, Werner pays closing costs, including title insurance of

$1,400. The company also pays $10,800 in property taxes, which includes $7,400 of back taxes (unpaid taxes from previous years) paid

by Werner on behalf of the seller and $3,400 due for the current fiscal year after the purchase date. Shortly after closing, the company

pays a contractor $42,000 to tear down the old building and remove it from the site. Werner is able to sell salvaged materials from the

old building for $6,000 and pays an additional $11,500 to level the land.

Required:

Determine the amount Werner's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a

minus sign.)

Total cost of the land

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT