west Company reported the following balances at December 31, 2016 ordinary share $500,000, share premium-ordinary $100,000, and retained earnings $250,000. During 2017, the following transactions affected shareholders 'equity 1. Issued preference shares with a par value of $125,000 for $200,000. 2. Purchased treasury shares (ordinary ) for $40,000. 3. Earned net income of $180,000. 4. Declared and paid cash dividends of $56,000. Instruction -prepare journal entries & closing entries for above transaction -Prepare the shareholders' equity section of west Company's December 31, 2017, balance sheet

west Company reported the following balances at December 31, 2016 ordinary share $500,000, share premium-ordinary $100,000, and retained earnings $250,000. During 2017, the following transactions affected shareholders 'equity 1. Issued preference shares with a par value of $125,000 for $200,000. 2. Purchased treasury shares (ordinary ) for $40,000. 3. Earned net income of $180,000. 4. Declared and paid cash dividends of $56,000. Instruction -prepare journal entries & closing entries for above transaction -Prepare the shareholders' equity section of west Company's December 31, 2017, balance sheet

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

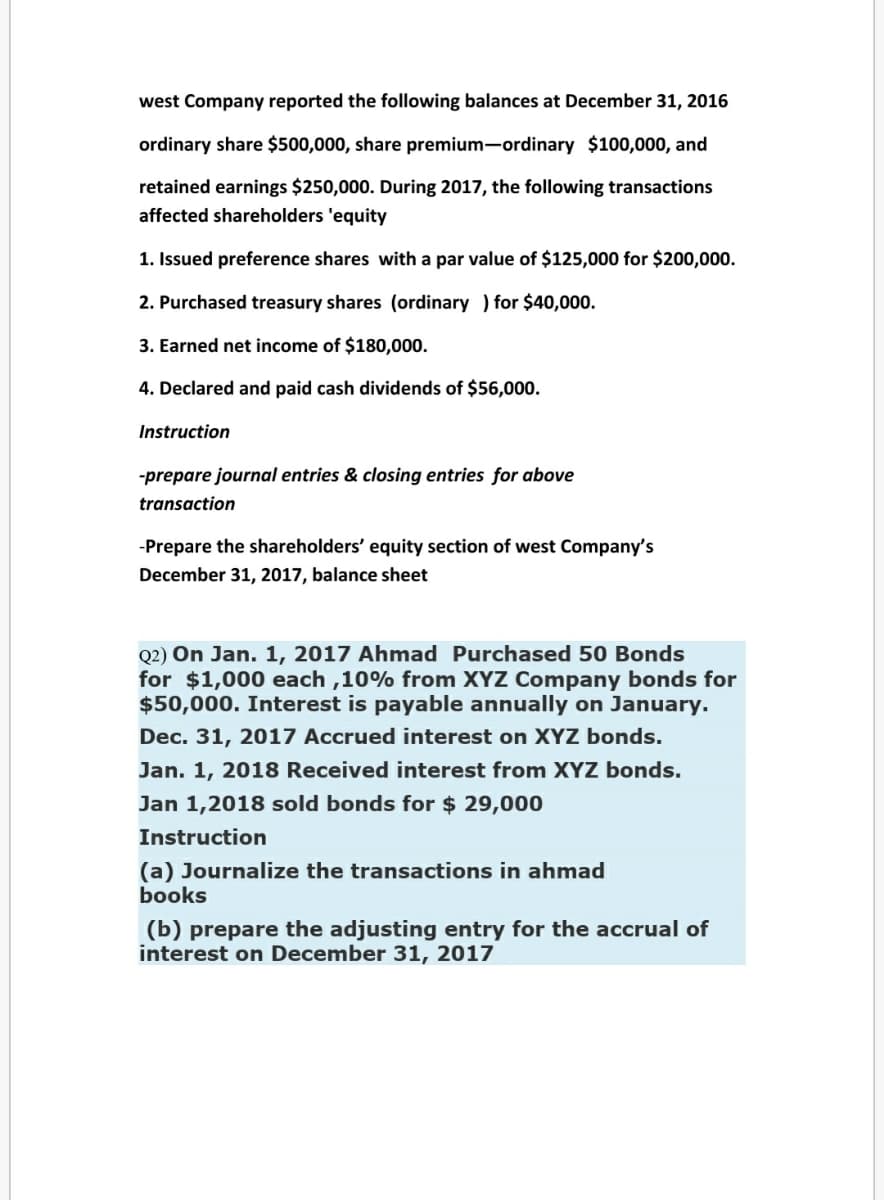

Transcribed Image Text:west Company reported the following balances at December 31, 2016

ordinary share $500,000, share premium-ordinary $100,000, and

retained earnings $250,000. During 2017, the following transactions

affected shareholders 'equity

1. Issued preference shares with a par value of $125,000 for $200,000.

2. Purchased treasury shares (ordinary ) for $40,000.

3. Earned net income of $180,000.

4. Declared and paid cash dividends of $56,000.

Instruction

-prepare journal entries & closing entries for above

transaction

-Prepare the shareholders' equity section of west Company's

December 31, 2017, balance sheet

Q2) On Jan. 1, 2017 Ahmad Purchased 50 Bonds

for $1,000 each ,10% from XYZ Company bonds for

$50,000. Interest is payable annually on January.

Dec. 31, 2017 Accrued interest on XYZ bonds.

Jan. 1, 2018 Received interest from XYZ bonds.

Jan 1,2018 sold bonds for $ 29,000

Instruction

(a) Journalize the transactions in ahmad

books

(b) prepare the adjusting entry for the accrual of

interest on December 31, 2017

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning