Extreme Company reported the following information about its stock on its December 31, 2016, balance sheet: Preferred stock, $2 par value, 5% cumulative, 300,000 shares authorized, 120,000 shares issued $240,000 and outstanding Common stock, $1 par value, 500,000 shares authorized, 240,000 shares issued and outstanding 240,000 The following amounts were taken from Extreme's income statement: Income from continuing operations before income taxes $680,000 Income tax expense (204,000) Income from continuing operations $476,000 Loss from discontinued operations, net of $13,000 tax benefit (36,000) Net income $440,000 The only stock issued during 2016 was 80,000 shares of common stock issued on June 30, 2016. No dividends were declared during 2016. Required: 1. Calculate all earnings per share amounts for 2016. If required, round your answer to two decimals. per share 2. If the preferred stock is cumulative, the dividend for the current period taken into account while calculating earning per share. If the preferred stock is not cumulative, the dividend taken into account only if it has been declared.

Extreme Company reported the following information about its stock on its December 31, 2016, balance sheet: Preferred stock, $2 par value, 5% cumulative, 300,000 shares authorized, 120,000 shares issued $240,000 and outstanding Common stock, $1 par value, 500,000 shares authorized, 240,000 shares issued and outstanding 240,000 The following amounts were taken from Extreme's income statement: Income from continuing operations before income taxes $680,000 Income tax expense (204,000) Income from continuing operations $476,000 Loss from discontinued operations, net of $13,000 tax benefit (36,000) Net income $440,000 The only stock issued during 2016 was 80,000 shares of common stock issued on June 30, 2016. No dividends were declared during 2016. Required: 1. Calculate all earnings per share amounts for 2016. If required, round your answer to two decimals. per share 2. If the preferred stock is cumulative, the dividend for the current period taken into account while calculating earning per share. If the preferred stock is not cumulative, the dividend taken into account only if it has been declared.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 15E

Related questions

Question

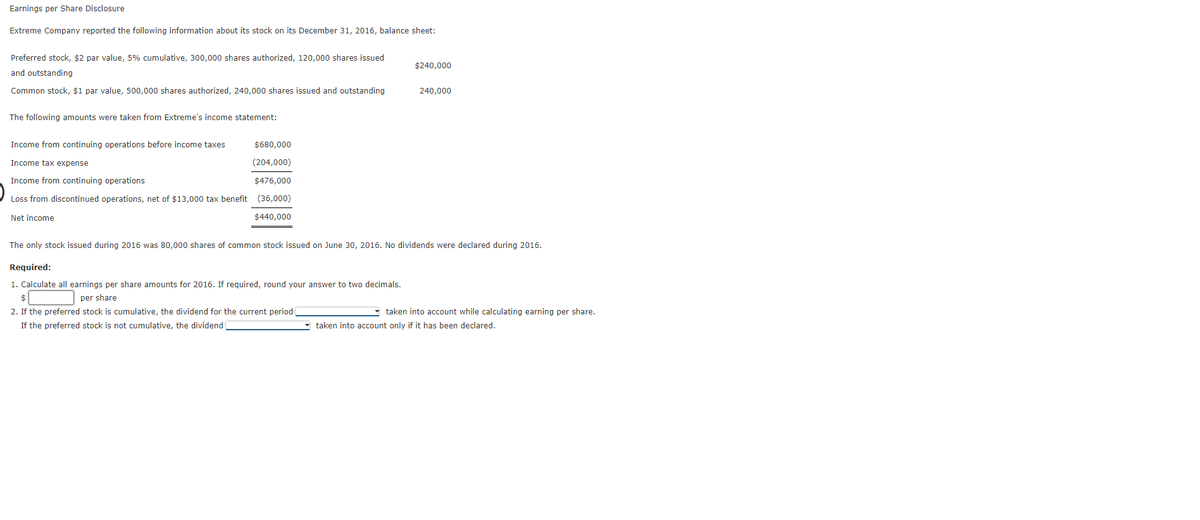

Transcribed Image Text:Earnings per Share Disclosure

Extreme Company reported the following information about its stock on its December 31, 2016, balance sheet:

Preferred stock, $2 par value, 5% cumulative, 300,000 shares authorized, 120,000 shares issued

$240,000

and outstanding

Common stock, $1 par value, 500,000 shares authorized, 240,000 shares issued and outstanding

240.000

The following amounts were taken from Extreme's income statement:

Income from continuing operations before income taxes

$680,000

Income tax expense

(204,000)

Income from continuing operations

$476,000

Loss from discontinued operations, net of $13,000 tax benefit (36,000)

Net income

$440,000

The only stock issued during 2016 was 80,000 shares of common stock issued on June 30, 2016. No dividends were declared during 2016.

Required:

1. Calculate all earnings per share amounts for 2016. If required, round your answer to two decimals.

$

per share

2. If the preferred stock is cumulative, the dividend for the current period

taken into account while calculating earning per share.

If the preferred stock is not cumulative, the dividend

taken into account only if it has been declared.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,