Western Communications has the following stockholders' equity on December 31, 2024: E (Click on the icon to view the stockholders' equity) Read the requirements. cumulative, compute the amount of dividends to preferred stockholders and common stockholders for 2024 and 2025 if total dividends are $10,880 in 2024 and $52,000 in 2025. Requirement 1. Assuming the preferred stock Assume no changes in preferred stock and common stock in 2025. (Assume all preferred dividends have been paid prior to 2024. Complete all input boxes. Enter a "0" for zero amounts. For the current year preferred dividend, be sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.) Western's 2024 dividend would be divided between preferred and common stockholders in this manner: Total Dividend-2024 Dividend to preferred stockholders: Data table Dividend in arrears Current year dividend Stockholders' Equity Total dividend to preferred stockholders Paid-In Capital: Preferred Stock-6%, $9 Par Value; 150,000 shares Dividend to common stockholders authorized, 22,000 shares issued and outstanding $ 198,000 Common Stock-$1 Par Value; 575,000 shares authorized, 390,000 shares issued and outstanding - X 390,000 Requirements 585,000 Paid-In Capital Excess of Par-Common Total Paid-In Capital 1,173,000 1. Assuming the preferred stock is cumulative, compute the amount of dividends 230,000 Retained Earnings

Western Communications has the following stockholders' equity on December 31, 2024: E (Click on the icon to view the stockholders' equity) Read the requirements. cumulative, compute the amount of dividends to preferred stockholders and common stockholders for 2024 and 2025 if total dividends are $10,880 in 2024 and $52,000 in 2025. Requirement 1. Assuming the preferred stock Assume no changes in preferred stock and common stock in 2025. (Assume all preferred dividends have been paid prior to 2024. Complete all input boxes. Enter a "0" for zero amounts. For the current year preferred dividend, be sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.) Western's 2024 dividend would be divided between preferred and common stockholders in this manner: Total Dividend-2024 Dividend to preferred stockholders: Data table Dividend in arrears Current year dividend Stockholders' Equity Total dividend to preferred stockholders Paid-In Capital: Preferred Stock-6%, $9 Par Value; 150,000 shares Dividend to common stockholders authorized, 22,000 shares issued and outstanding $ 198,000 Common Stock-$1 Par Value; 575,000 shares authorized, 390,000 shares issued and outstanding - X 390,000 Requirements 585,000 Paid-In Capital Excess of Par-Common Total Paid-In Capital 1,173,000 1. Assuming the preferred stock is cumulative, compute the amount of dividends 230,000 Retained Earnings

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 36CE: Preferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value,...

Related questions

Question

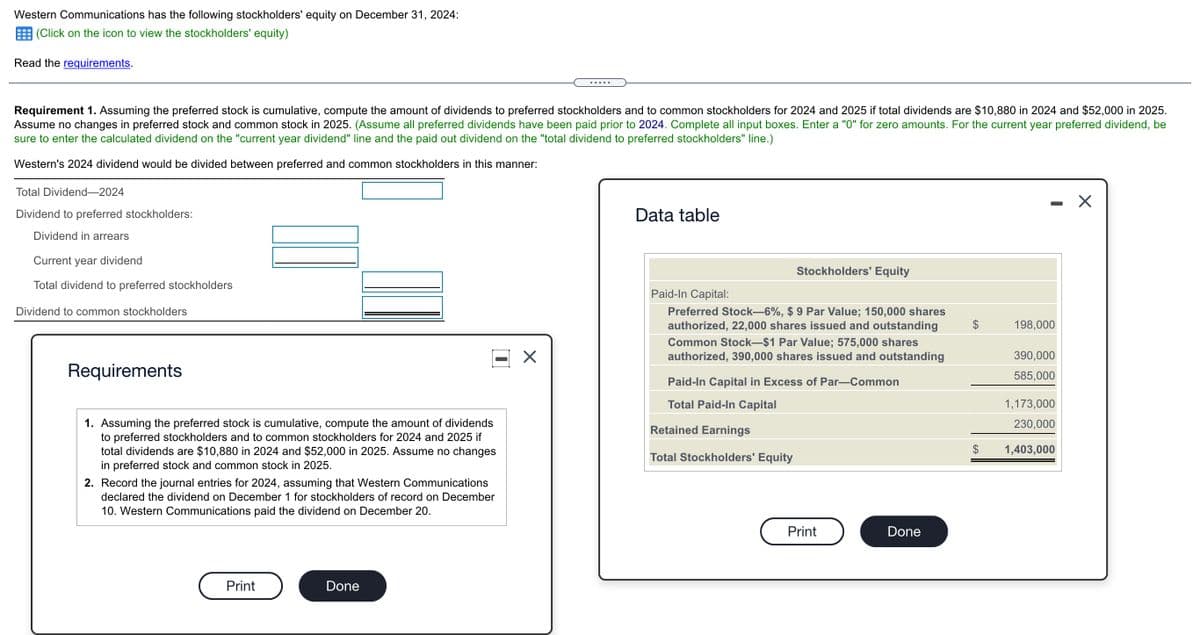

Transcribed Image Text:Western Communications has the following stockholders' equity on December 31, 2024:

(Click on the icon to view the stockholders' equity)

Read the requirements.

.....

Requirement 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for 2024 and 2025 if total dividends are $10,880 in 2024 and $52,000 in 2025.

Assume no changes in preferred stock and common stock in 2025. (Assume all preferred dividends have been paid prior to 2024. Complete all input boxes. Enter a "0" for zero amounts. For the current year preferred dividend, be

sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.)

Western's 2024 dividend would be divided between preferred and common stockholders in this manner:

Total Dividend-2024

Dividend to preferred stockholders:

Data table

Dividend in arrears

Current year dividend

Stockholders' Equity

Total dividend to preferred stockholders

Paid-In Capital:

Preferred Stock-6%, $ 9 Par Value; 150,000 shares

authorized, 22,000 shares issued and outstanding

Dividend to common stockholders

$

198,000

Common Stock–$1 Par Value; 575,000 shares

authorized, 390,000 shares issued and outstanding

390,000

Requirements

585,000

Paid-In Capital in Excess of Par-Common

Total Paid-In Capital

1,173,000

1. Assuming the preferred stock is cumulative, compute the amount of dividends

to preferred stockholders and to common stockholders for 2024 and 2025 if

total dividends are $10,880 in 2024 and $52,000 in 2025. Assume no changes

in preferred stock and common stock in 2025.

230,000

Retained Earnings

$

1,403,000

Total Stockholders' Equity

2. Record the journal entries for 2024, assuming that Western Communications

declared the dividend on December 1 for stockholders of record on December

10. Western Communications paid the dividend on December 20.

Print

Done

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning