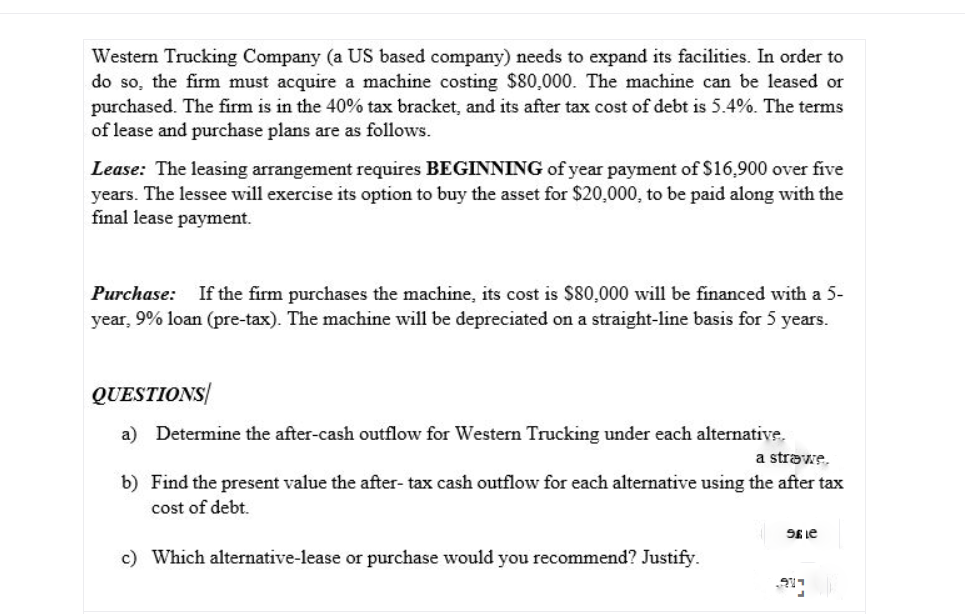

Western Trucking Company (a US based company) needs to expand its facilities. In order to do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 40% tax bracket, and its after tax cost of debt is 5.4%. The terms of lease and purchase plans are as follows. Lease: The leasing arrangement requires BEGINNING of year payment of $16,900 over five years. The lessee will exercise its option to buy the asset for $20,000, to be paid along with the final lease payment. Purchase: If the firm purchases the machine, its cost is $80,000 will be financed with a 5- year, 9% loan (pre-tax). The machine will be depreciated on a straight-line basis for 5 years. QUESTIONS a) Determine the after-cash outflow for Western Trucking under each alternative. a strawe. b) Find the present value the after- tax cash outflow for each alternative using the after tax cost of debt. SE Le c) Which alternative-lease or purchase would you recommend? Justify.

Western Trucking Company (a US based company) needs to expand its facilities. In order to do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 40% tax bracket, and its after tax cost of debt is 5.4%. The terms of lease and purchase plans are as follows. Lease: The leasing arrangement requires BEGINNING of year payment of $16,900 over five years. The lessee will exercise its option to buy the asset for $20,000, to be paid along with the final lease payment. Purchase: If the firm purchases the machine, its cost is $80,000 will be financed with a 5- year, 9% loan (pre-tax). The machine will be depreciated on a straight-line basis for 5 years. QUESTIONS a) Determine the after-cash outflow for Western Trucking under each alternative. a strawe. b) Find the present value the after- tax cash outflow for each alternative using the after tax cost of debt. SE Le c) Which alternative-lease or purchase would you recommend? Justify.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Western Trucking Company (a US based company) needs to expand its facilities. In order to

do so, the firm must acquire a machine costing $80,000. The machine can be leased or

purchased. The firm is in the 40% tax bracket, and its after tax cost of debt is 5.4%. The terms

of lease and purchase plans are as follows.

Lease: The leasing arrangement requires BEGINNING of year payment of $16,900 over five

years. The lessee will exercise its option to buy the asset for $20,000, to be paid along with the

final lease payment.

Purchase: If the firm purchases the machine, its cost is $80,000 will be financed with a 5-

year, 9% loan (pre-tax). The machine will be depreciated on a straight-line basis for 5 years.

QUESTIONS

a) Determine the after-cash outflow for Western Trucking under each alternative.

a strawe.

b) Find the present value the after- tax cash outflow for each alternative using the after tax

cost of debt.

SE Le

c) Which alternative-lease or purchase would you recommend? Justify.

Expert Solution

Step 1

PV is the present worth of cash flows that are expected to occur in the future.

Step 2

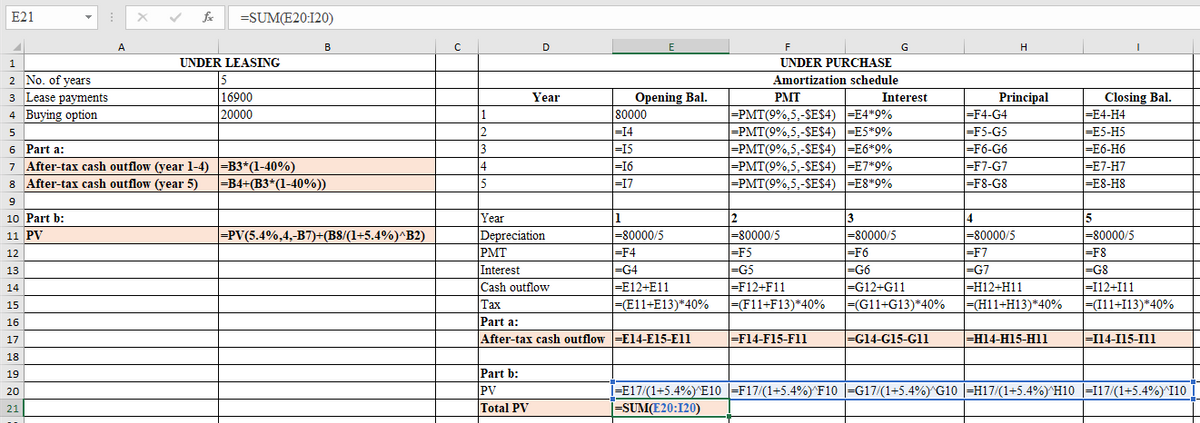

Formulation of part a & b:

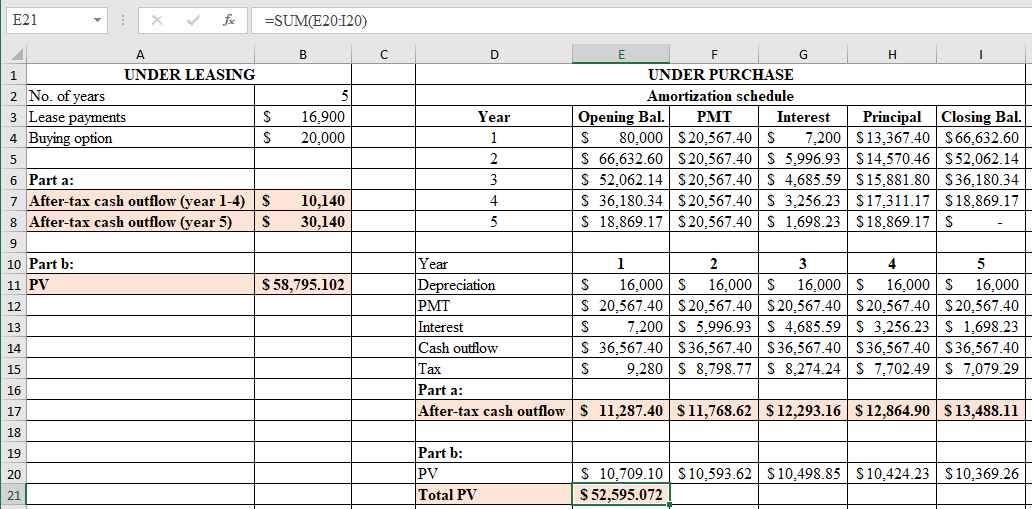

Computation of part a & b:

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning