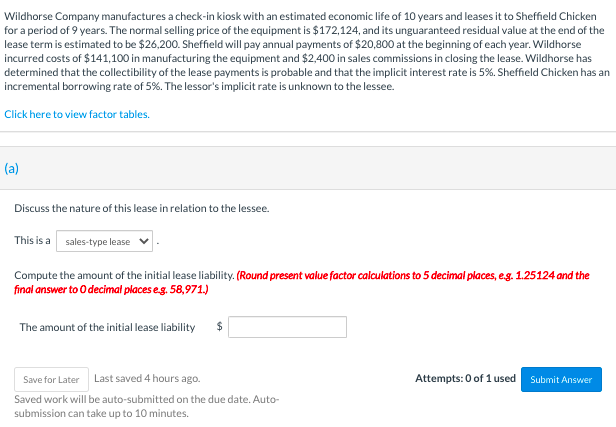

Wildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has ar incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee. Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessee. This is a sales-type lease Compute the amount of the initial lease liability. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to O decimal places eg. 58,971.) The amount of the initial lease liability Save for Later Last saved 4 hours ago. Attempts: 0 of 1 used Submit Answer Saved work will he auto-suhmitted on the due date Auto-

Wildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has ar incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee. Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessee. This is a sales-type lease Compute the amount of the initial lease liability. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to O decimal places eg. 58,971.) The amount of the initial lease liability Save for Later Last saved 4 hours ago. Attempts: 0 of 1 used Submit Answer Saved work will he auto-suhmitted on the due date Auto-

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6...

Related questions

Question

Transcribed Image Text:Wildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken

for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the

lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse

incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has

determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has an

incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee.

Click here to view factor tables.

(a)

Discuss the nature of this lease in relation to the lessee.

This is a sales-type lease

Compute the amount of the initial lease liability. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the

final answer to 0 decimal places eg. 58,971.)

The amount of the initial lease liability

24

Save for Later

Last saved 4 hours ago.

Attempts: 0 of 1 used

Submit Answer

Saved work will be auto-submitted on the due date. Auto-

submission can take up to 10 minutes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College