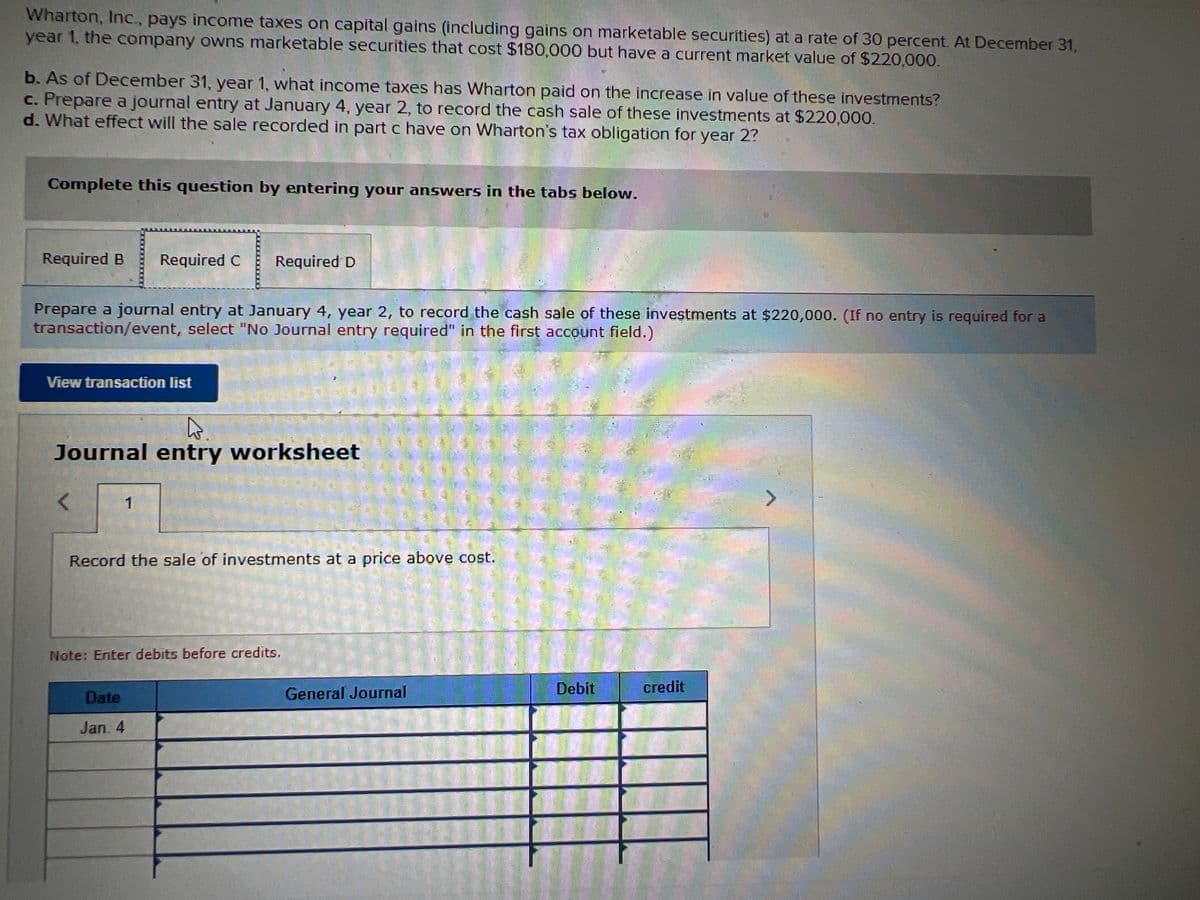

Wharton, Inc., pays income taxes on capital gains (Including gains on marketable securities) at a rate of 30 percent. At December 31, year 1, the company owns marketable securities that cost $180,000 but have a current market value of $220,000. b. As of December 31, year 1, what income taxes has Wharton paid on the increase in value of these investments? c. Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000. d. What effect will the sale recorded in part c have on Wharton's tax obligation for year 2? Complete this question by entering your answers in the tabs below. Required B Required C Required D Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale of investments at a price above cost. Note: Enter debits before credits. Date General Journal Debit credit Jan. 4

Wharton, Inc., pays income taxes on capital gains (Including gains on marketable securities) at a rate of 30 percent. At December 31, year 1, the company owns marketable securities that cost $180,000 but have a current market value of $220,000. b. As of December 31, year 1, what income taxes has Wharton paid on the increase in value of these investments? c. Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000. d. What effect will the sale recorded in part c have on Wharton's tax obligation for year 2? Complete this question by entering your answers in the tabs below. Required B Required C Required D Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale of investments at a price above cost. Note: Enter debits before credits. Date General Journal Debit credit Jan. 4

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

ACCT 102 - Please Do All Three Subparts, Thank You.

Transcribed Image Text:Wharton, Inc., pays income taxes on capital gains (including gains on marketable securities) at a rate of 30 percent. At December 31,

year 1, the company owns marketable securities that cost $180,000 but have a current market value of $220,000.

b. As of December 31, year 1, what income taxes has Wharton paid on the increase in value of these investments?

c. Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000.

d. What effect will the sale recorded in part c have on Wharton's tax obligation for year 2?

Complete this question by entering your answers in the tabs below.

Required B

Required C

Required D

Prepare a journal entry at January 4, year 2, to record the cash sale of these investments at $220,000. (If no entry is required for a

transaction/event, select "No Journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

<>

Record the sale of investments at a price above cost.

Note: Enter debits before credits.

General Journal

Debit

credit

Date

Jan. 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning