Chapter11: Long-term Assets

Section: Chapter Questions

Problem 1TP: You are an accounting student at your local university. Your brother has recently managed to save...

Related questions

Question

What advantages/disadvantages do the mutual funds offer compared to company stock for your retirement investing?

Transcribed Image Text:A Job at S&S Air

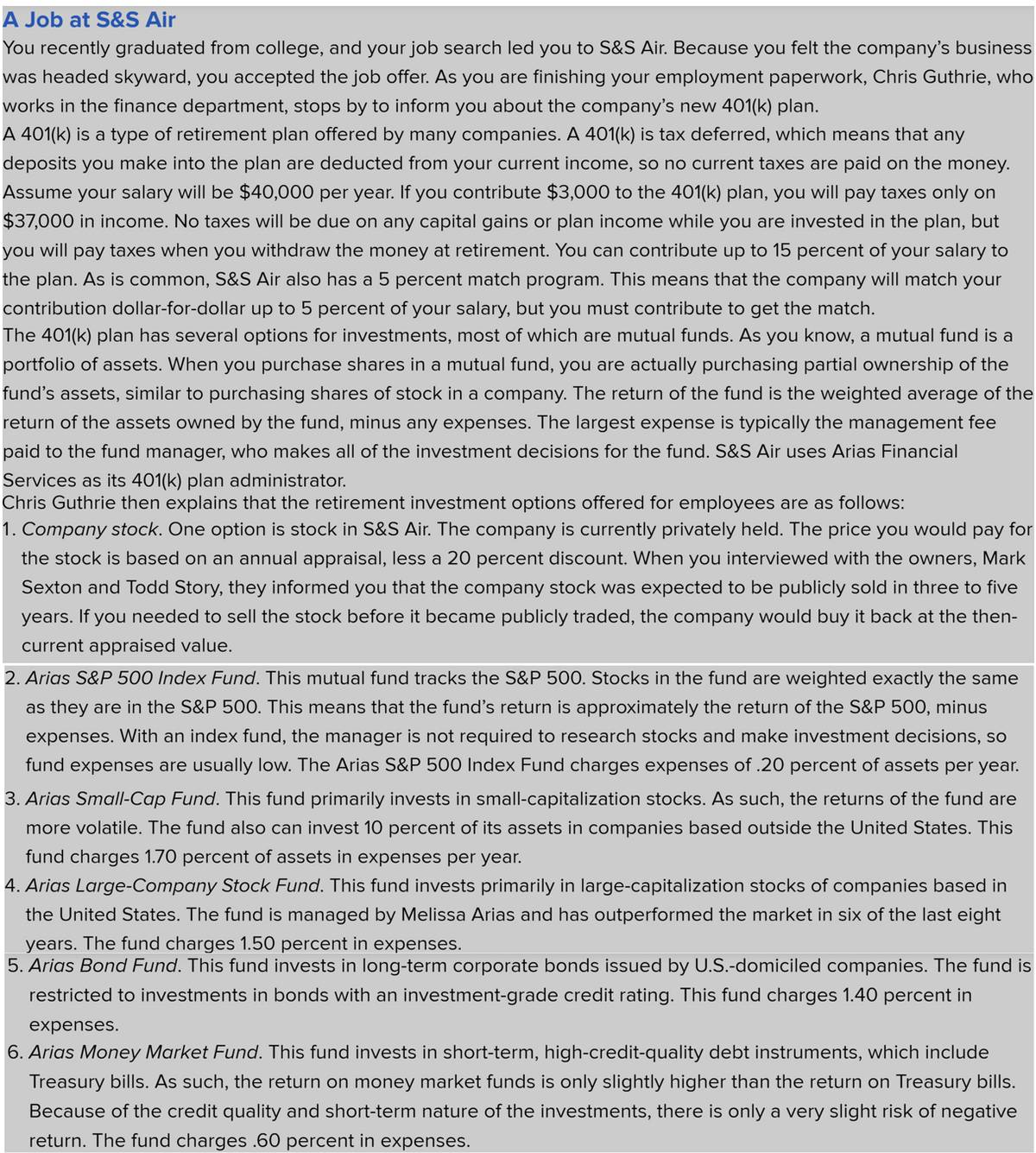

You recently graduated from college, and your job search led you to S&S Air. Because you felt the company's business

was headed skyward, you accepted the job offer. As you are finishing your employment paperwork, Chris Guthrie, who

works in the finance department, stops by to inform you about the company's new 401(k) plan.

A 401(k) is a type of retirement plan offered by many companies. A 401(k) is tax deferred, which means that any

deposits you make into the plan are deducted from your current income, so no current taxes are paid on the money.

Assume your salary will be $40,000 per year. If you contribute $3,000 to the 401(k) plan, you will pay taxes only on

$37,000 in income. No taxes will be due on any capital gains or plan income while you are invested in the plan, but

you will pay taxes when you withdraw the money at retirement. You can contribute up to 15 percent of your salary to

the plan. As is common, S&S Air also has a 5 percent match program. This means that the company will match your

contribution dollar-for-dollar up to 5 percent of your salary, but you must contribute to get the match.

The 401(k) plan has several options for investments, most of which are mutual funds. As you know, a mutual fund is a

portfolio of assets. When you purchase shares in a mutual fund, you are actually purchasing partial ownership of the

fund's assets, similar to purchasing shares of stock in a company. The return of the fund is the weighted average of the

return of the assets owned by the fund, minus any expenses. The largest expense is typically the management fee

paid to the fund manager, who makes all of the investment decisions for the fund. S&S Air uses Arias Financial

Services as its 401(k) plan administrator.

Chris Guthrie then explains that the retirement investment options offered for employees are as follows:

1. Company stock. One option is stock in S&S Air. The company is currently privately held. The price you would pay for

the stock is based on an annual appraisal, less a 20 percent discount. When you interviewed with the owners, Mark

Sexton and Todd Story, they informed you that the company stock was expected to be publicly sold in three to five

years. If you needed to sell the stock before it became publicly traded, the company would buy it back at the then-

current appraised value.

2. Arias S&P 500 Index Fund. This mutual fund tracks the S&P 500. Stocks in the fund are weighted exactly the same

as they are in the S&P 500. This means that the fund's return is approximately the return of the S&P 500, minus

expenses. With an index fund, the manager is not required to research stocks and make investment decisions, so

fund expenses are usually low. The Arias S&P 500 Index Fund charges expenses of .20 percent of assets per year.

3. Arias Small-Cap Fund. This fund primarily invests in small-capitalization stocks. As such, the returns of the fund are

more volatile. The fund also can invest 10 percent of its assets in companies based outside the United States. This

fund charges 1.70 percent of assets in expenses per year.

4. Arias Large-Company Stock Fund. This fund invests primarily in large-capitalization stocks of companies based in

the United States. The fund is managed by Melissa Arias and has outperformed the market in six of the last eight

years. The fund charges 1.50 percent in expenses.

5. Arias Bond Fund. This fund invests in long-term corporate bonds issued by U.S.-domiciled companies. The fund is

restricted to investments in bonds with an investment-grade credit rating. This fund charges 1.40 percent in

expenses.

6. Arias Money Market Fund. This fund invests in short-term, high-credit-quality debt instruments, which include

Treasury bills. As such, the return on money market funds is only slightly higher than the return on Treasury bills.

Because of the credit quality and short-term nature of the investments, there is only a very slight risk of negative

return. The fund charges .60 percent in expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning