what amount should RED initially record its investment in Orange Company? 2. At what amount should RED initially record its investment in Yellow Corporation? 3. How much gain or (loss) should be recognized on the sale of Yellow bon

what amount should RED initially record its investment in Orange Company? 2. At what amount should RED initially record its investment in Yellow Corporation? 3. How much gain or (loss) should be recognized on the sale of Yellow bon

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.1EX

Related questions

Question

1. At what amount should RED initially record its investment in Orange Company?

2. At what amount should RED initially record its investment in Yellow Corporation?

3. How much gain or (loss) should be recognized on the sale of Yellow bonds?

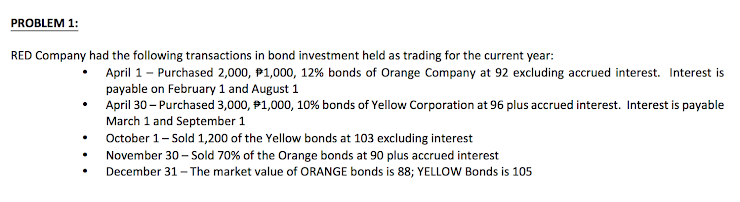

Transcribed Image Text:PROBLEM 1:

RED Company had the following transactions in bond investment held as trading for the current year:

April 1- Purchased 2,000, P1,000, 12% bonds of Orange Company at 92 excluding accrued interest. Interest is

payable on February 1 and August 1

April 30 – Purchased 3,000, #1,000, 10% bonds of Yellow Corporation at 96 plus accrued interest. Interest is payable

March 1 and September 1

October 1- Sold 1,200 of the Yellow bonds at 103 excluding interest

November 30 - Sold 70% of the Orange bonds at 90 plus accrued interest

December 31 - The market value of ORANGE bonds is 88; YELLOW Bonds is 105

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub