What are the primary benefits that Angelini's will gain from preparing and using a budget?

What are the primary benefits that Angelini's will gain from preparing and using a budget?

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter21: Cash Budgeting (cashbud)

Section: Chapter Questions

Problem 1R: On January 1, Sweet Pleasures, Inc., begins business. The company has 14,000 cash on hand and is...

Related questions

Question

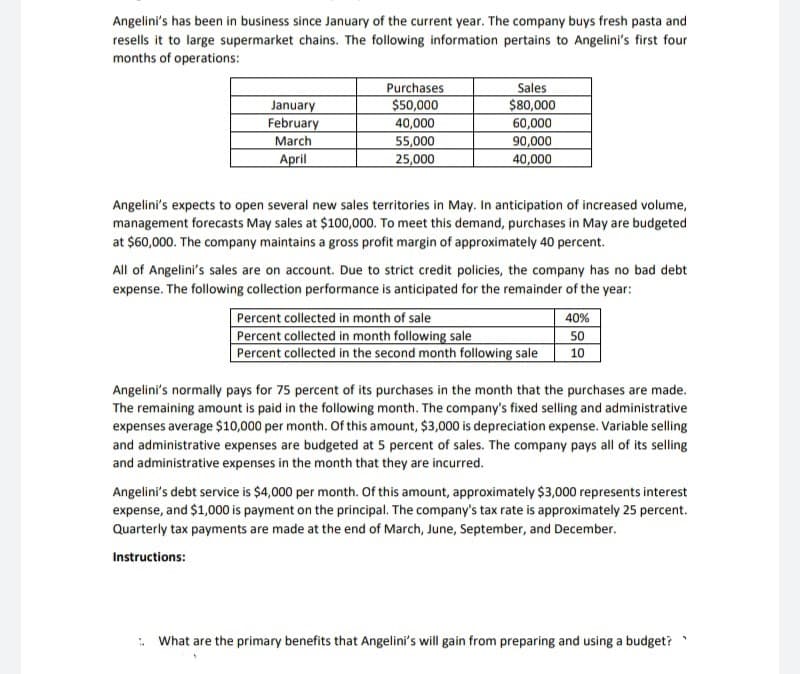

Transcribed Image Text:Angelini's has been in business since January of the current year. The company buys fresh pasta and

resells it to large supermarket chains. The following information pertains to Angelini's first four

months of operations:

Purchases

$50,000

January

February

March

April

40,000

55,000

25,000

Sales

$80,000

60,000

90,000

40,000

Angelini's expects to open several new sales territories in May. In anticipation of increased volume,

management forecasts May sales at $100,000. To meet this demand, purchases in May are budgeted

at $60,000. The company maintains a gross profit margin of approximately 40 percent.

All of Angelini's sales are on account. Due to strict credit policies, the company has no bad debt

expense. The following collection performance is anticipated for the remainder of the year:

Percent collected in month of sale

Percent collected in month following sale

Percent collected in the second month following sale

40%

50

10

Angelini's normally pays for 75 percent of its purchases in the month that the purchases are made.

The remaining amount is paid in the following month. The company's fixed selling and administrative

expenses average $10,000 per month. Of this amount, $3,000 is depreciation expense. Variable selling

and administrative expenses are budgeted at 5 percent of sales. The company pays all of its selling

and administrative expenses in the month that they are incurred.

Angelini's debt service is $4,000 per month. Of this amount, approximately $3,000 represents interest

expense, and $1,000 is payment on the principal. The company's tax rate is approximately 25 percent.

Quarterly tax payments are made at the end of March, June, September, and December.

Instructions:

: What are the primary benefits that Angelini's will gain from preparing and using a budget?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning