What defenses might the auditors use to rebut any charges made about their audit?

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter4: Professional Legal Liability

Section: Chapter Questions

Problem 18RQSC

Related questions

Question

2. What defenses might the auditors use to rebut any charges made about their audit?

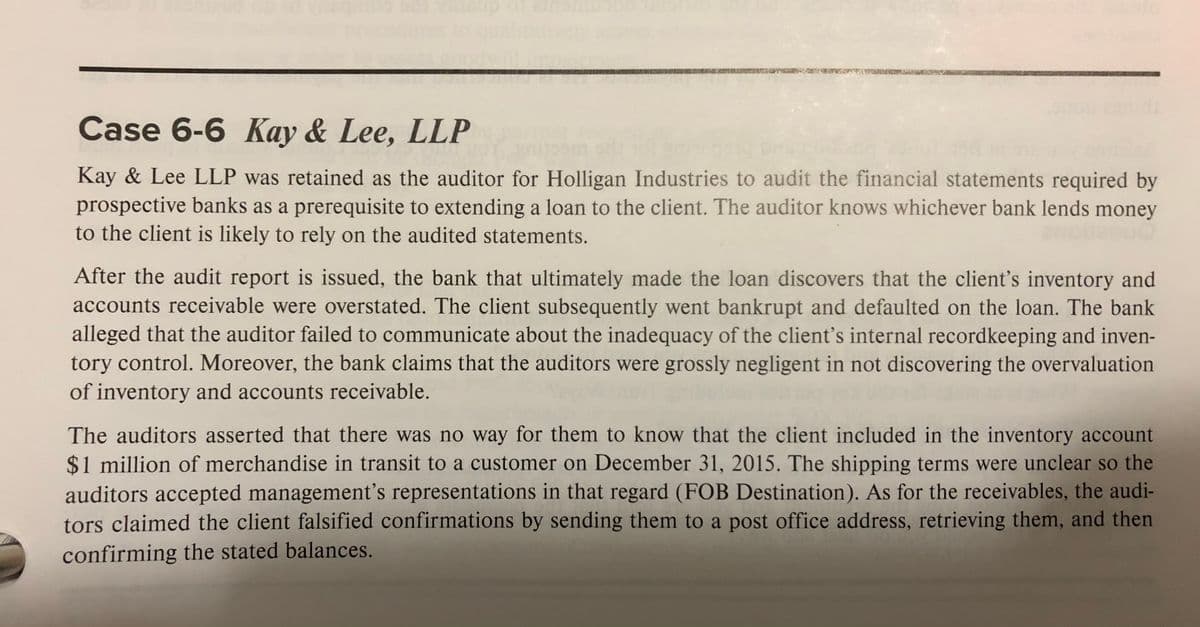

Transcribed Image Text:Case 6-6 Kay & Lee, LLP

Kay & Lee LLP was retained as the auditor for Holligan Industries to audit the financial statements required by

prospective banks as a prerequisite to extending a loan to the client. The auditor knows whichever bank lends money

to the client is likely to rely on the audited statements.

After the audit report is issued, the bank that ultimately made the loan discovers that the client's inventory and

accounts receivable were overstated. The client subsequently went bankrupt and defaulted on the loan. The bank

alleged that the auditor failed to communicate about the inadequacy of the client's internal recordkeeping and inven-

tory control. Moreover, the bank claims that the auditors were grossly negligent in not discovering the overvaluation

of inventory and accounts receivable.

The auditors asserted that there was no way for them to know that the client included in the inventory account

$1 million of merchandise in transit to a customer on December 31, 2015. The shipping terms were unclear so the

auditors accepted management's representations in that regard (FOB Destination). As for the receivables, the audi-

tors claimed the client falsified confirmations by sending them to a post office address, retrieving them, and then

confirming the stated balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning