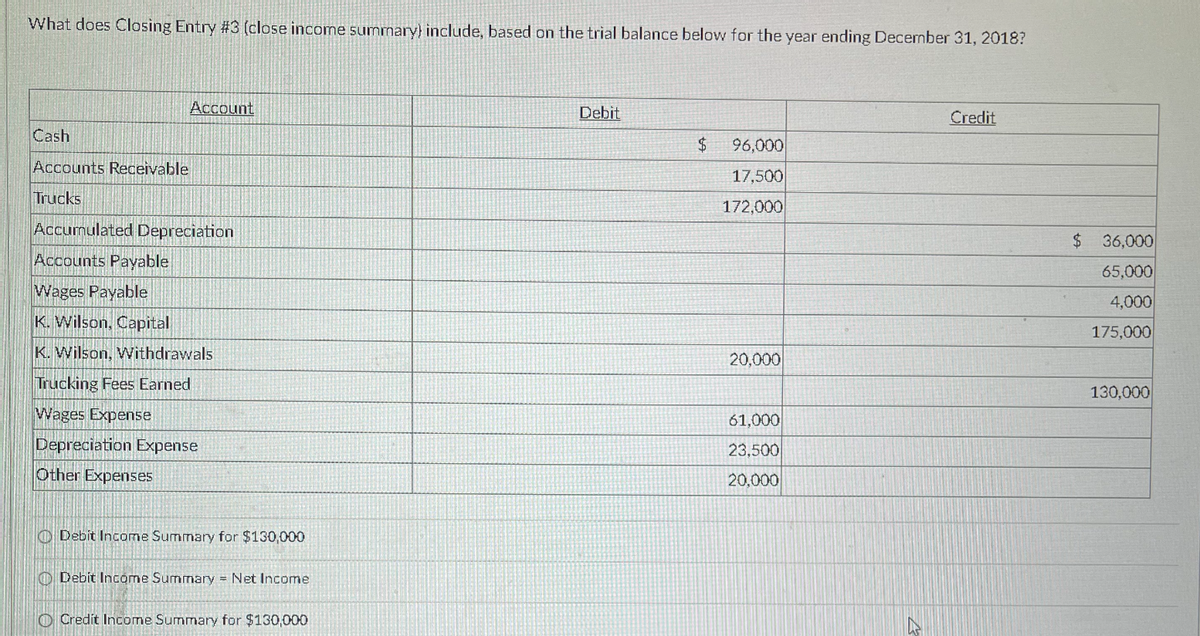

What does Closing Entry #3 (close income summary) include, based on the trial balance below for the year ending December 31, 2018? Cash Accounts Receivable Trucks Account Accumulated Depreciation Accounts Payable Wages Payable K. Wilson, Capital K. Wilson, Withdrawals Trucking Fees Earned Wages Expense Depreciation Expense Other Expenses Debit Income Summary for $130,000 Debit Income Summary = Net Income Credit Income Summary for $130,000 Debit $ 96,000 17,500 172,000 Credit $ 36,000 65,000 4,000 175,000 20,000 130,000 61,000 23,500 20,000

What does Closing Entry #3 (close income summary) include, based on the trial balance below for the year ending December 31, 2018? Cash Accounts Receivable Trucks Account Accumulated Depreciation Accounts Payable Wages Payable K. Wilson, Capital K. Wilson, Withdrawals Trucking Fees Earned Wages Expense Depreciation Expense Other Expenses Debit Income Summary for $130,000 Debit Income Summary = Net Income Credit Income Summary for $130,000 Debit $ 96,000 17,500 172,000 Credit $ 36,000 65,000 4,000 175,000 20,000 130,000 61,000 23,500 20,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 35E: Jarem Company showed 189,000 in prepaid rent on December 31, 20X1. On December 31, 20X2, the balance...

Related questions

Question

Transcribed Image Text:What does Closing Entry #3 (close income summary) include, based on the trial balance below for the year ending December 31, 2018?

Cash

Accounts Receivable

Trucks

Account

Accumulated Depreciation

Accounts Payable

Wages Payable

K. Wilson, Capital

K. Wilson, Withdrawals

Trucking Fees Earned

Wages Expense

Depreciation Expense

Other Expenses

Debit Income Summary for $130,000

Debit Income Summary = Net Income

Credit Income Summary for $130,000

Debit

$

96,000

17,500

172,000

Credit

$ 36,000

65,000

4,000

175,000

20,000

130,000

61,000

23,500

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning