What does it mean if a company ratio's are below or above industry average? Please see attached scans depicting company data and industry averages

What does it mean if a company ratio's are below or above industry average? Please see attached scans depicting company data and industry averages

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 3MC

Related questions

Question

What does it mean if a company ratio's are below or above industry average?

Please see attached scans depicting company data and industry averages.

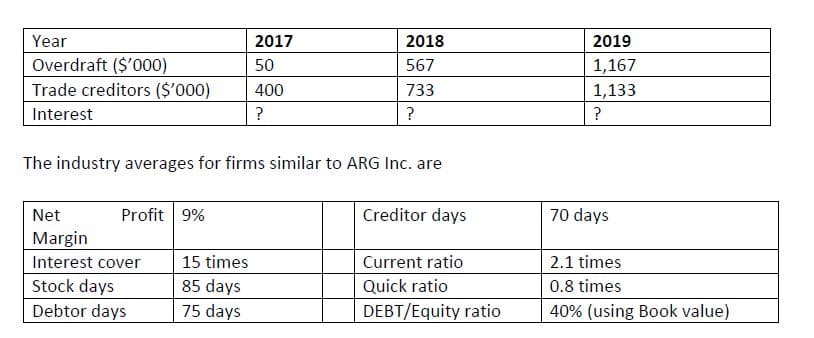

Transcribed Image Text:Year

2017

2018

2019

Overdraft ($'000)

50

567

1,167

Trade creditors ($'000)

400

733

1,133

Interest

?

?

The industry averages for firms similar to ARG Inc. are

Net

Profit 9%

Creditor days

70 days

Margin

Interest cover

15 times

Current ratio

2.1 times

Stock days

85 days

75 days

Quick ratio

0.8 times

Debtor days

DEBT/Equity ratio

40% (using Book value)

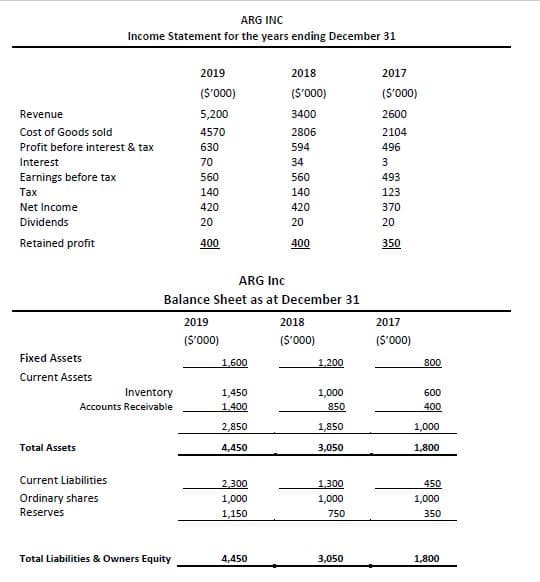

Transcribed Image Text:ARG INC

Income Statement for the years ending December 31

2019

2018

2017

(S'000)

(S'000)

(S'000)

Revenue

5,200

3400

2600

Cost of Goods sold

4570

2806

2104

Profit before interest & tax

630

594

496

Interest

70

34

3

Earnings before tax

Tax

560

140

560

493

140

123

Net Income

420

420

370

Dividends

20

20

20

Retained profit

400

400

350

ARG Inc

Balance Sheet as at December 31

2019

2018

2017

(S'000)

(S'000)

(S'000)

Fixed Assets

1.600

1,200

800

Current Assets

Inventory

Accounts Receivable

1,450

1,000

600

1.400

850

400

2,850

1,850

1,000

Total Assets

4,450

3,050

1,800

Current Liabilities

2.300

1,300

450

Ordinary shares

1,000

1,000

1,000

Reserves

1,150

750

350

Total Liabilities & Owners Equity

4,450

3,050

1,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning