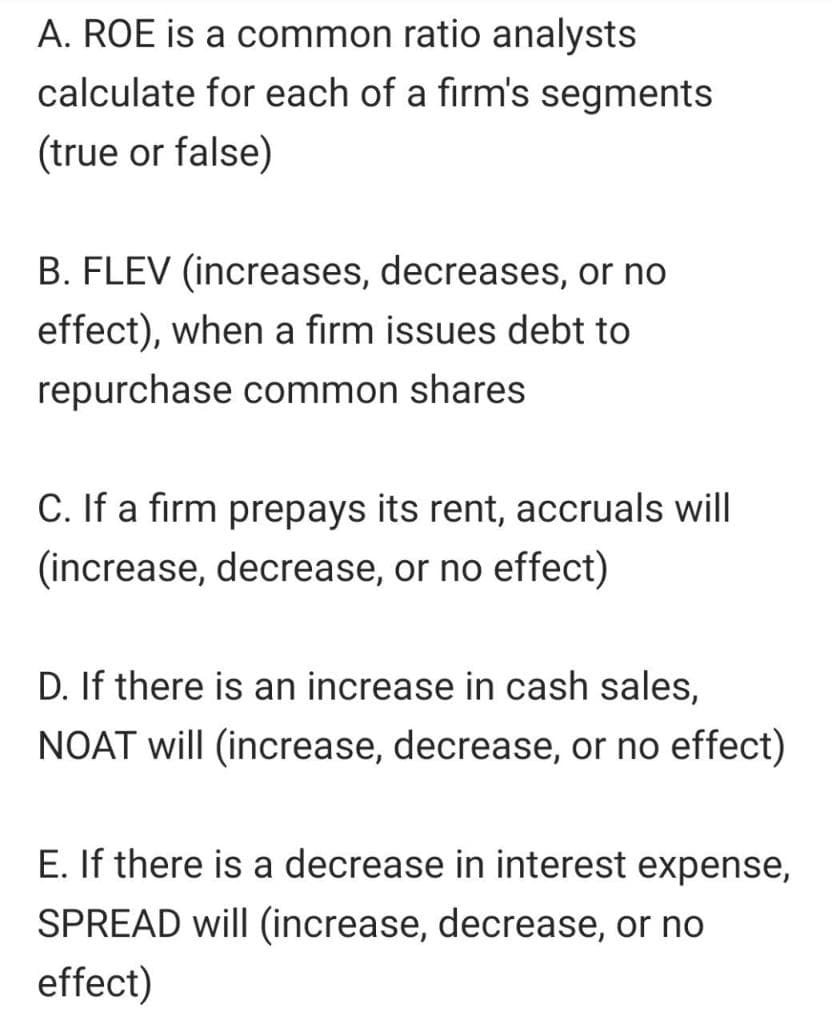

A. ROE is a common ratio analysts calculate for each of a firm's segments (true or false)

Q: Upper Limit on Misstatements Calculations: Monetary Unit Sampling. Clyde Billy isconducting the audi...

A: Disclaimer:- “Since you have posted a question with multiple sub-parts, we will solve first three su...

Q: b.) From the given figures relating to the following profitability ratios for the two years: Wick Co...

A: The ration analysis helps to analyze the financial statements of the business. The gross profit and ...

Q: b. Debits: Accounts Receivable, Cost of Goods Sold; credits: Sales options correctly expresses the a...

A: "Since you have asked multiple questions, we will solve first question for you. If you want any spec...

Q: Bill's deductible loss from the activity in Year 1 and Year 2?

A: Partners investing in partnership business have a limitation on the losses from the partnership that...

Q: following data relate to store equipment of BBB Company for 2021: · Store Equipment at cost, ...

A: Solution: For the depreciation expense on store equipment for 2021, first accumulated depreciation o...

Q: Prepare a schedule showing a vertical analysis for 2022 and 20 SWIFTY CORPORATION Condensed Income S...

A: The question is based on the concept of Cost Accounting.

Q: DEL GATO CLINIC Bank Reconciliation June 30 Bank statement balance Book balance Add: Add: Deduct: De...

A: Bank reconciliation statement is prepared where an entry which is found in one book (Cash book or ba...

Q: An entrepreneur is considering opening a coffee shop in downtown Pasadena. The building that he is c...

A: Introduction Cost-Volume-Profit analysis (CVP analysis) is a powerful tool for planning and decision...

Q: . In January 2021, ABC Inc. paid property taxes on its factory building for the calendar year 2021 i...

A: Solution: Property taxes are paid for whole year in Jan'21, however its benefits will be available f...

Q: nciples (GAAP) and are audited by CPA firms. Do investors need to worry about the validity of those ...

A: GAAP = generally accepted accounting principles When CPA firms are audited they take all types of me...

Q: a) Ace Company stockholder's equity at the end of 2015 is shown in the table below. Determine the nu...

A: Ordinary share capital means the shares having the voting rights in the entity.

Q: Elon Minig Ine is income back Into ne buzinend ond a neturn 01 its kurently suinuesting Soy net deli...

A: Introduction:- The price-to-earnings ratio (P/E ratio) compares a company's current share price to i...

Q: On January 1, 2022, Ivanhoe Corporation had the following stockholders’ equity accounts. Common Sto...

A: A shareholder, also referred to as a stockholder. He is a person or company, that owns at least one ...

Q: Popoy is a messenger of Basha Logistics. He receives a monthly salary of P25,000. At the end of the ...

A: computation of taxable income of Mr. Popoy for the year particulars Amount (PHP) Basic salar...

Q: What was the annual amount of depreciation for the Years 1-3 using the straight-line method of depre...

A: The question is based on the concept of Financial Accounting. Depreciation is the accounting term fo...

Q: Cash received from long-term notes payable Purchase of investments $ 44,000 11,100 Cash dividends pa...

A: Cash flow from financing activity includes transactions concerned with the funds available in the en...

Q: [The following information applies to the questions displayed below.] Felix & Company reports the fo...

A: The costs are classified as fixed and variable costs. The high low method is used to separate the fi...

Q: On June 30, 2021, Mill Corp. incurred a 100,000 net loss from disposal of a business segment. Also, ...

A: Here we will apply the accounting rule that for an interim report all revenues and gains have to be ...

Q: Presented below is selected information pertaining to the Cone Company: § Cash balance, January 1,...

A: Solution: As per basic accounting equation: Total Assets = Total liabilities + Capital Ending Capita...

Q: Use the following information to prepare, in good form, an income statement, a statement of changes ...

A: An income statement is a statement that shows the income and expenses of a company. It also shows w...

Q: Below is a portion of the December 31, 2024, adjusted trial balance for a company. Prepare an income...

A: Income Statement For the Year Ended December 31, 2024 Service Revenue $ 5,40,000 Less: E...

Q: 1. Company policy 2. Control account to be balanced 3. Personnel access controls

A: Since we answer up to 3 sub-parts, we'll answer the first 3. Please resubmit the question and specif...

Q: Wellco returned 43 barrels to its supplier. The supplier paid $34.50 in cash for each barrel.

A: The answer is stated below:

Q: ABC Company acquired a fire insurance on Nov. 1, 2021. The company paid P12,000 for the said annual ...

A: Annual insurance payment = P12,000 Period from Nov 1, 2021 to Dec 31, 2021 = 2 Months

Q: Determine whether each procedure described below is an internal control strength or weakness; then i...

A: Step2 in the solution.

Q: For the current year, Work-From-Home Company received a donation of 3,000 shares with a par value of...

A: As per PFRS Treasury stock and a gain or revenue account are increased by the market value of the st...

Q: Cola Company is preparing the interim financial statements for the quarter ended March 31, 2020. Sal...

A: Variable expenses = Sales x 20% Advertisement expense = Total advertisement expense for one year x 3...

Q: Presented below is selected information pertaining to the Cassie Inc: Cash balance, January 1, 2020...

A: Capital account balance, December 31, 2020 = Total asset, December 31, 2020 - Total liabilities, Dec...

Q: Lala Company reported the following information in 2021: · Sales revenue- P500,000 · C...

A: Answer) Total Comprehensive income before tax includes all Operating and non-operating incomes net o...

Q: ABC Company acquired a fire insurance on Nov. 1, 2021. The company paid P12,000 for the said annual ...

A: The prepaid expenses are the expenses paid but not due yet for payment. These are recorded as curren...

Q: elk Steel Company, which began operations in Year 1, had the following transactions and events in it...

A: Under the equity method of accounting, investment balance is decreased by dividends received from th...

Q: Unde commonly: a. charged or credited to Work-in-Process Inventory. b. charged or credited to Cost o...

A: “Since you have asked multiple question, we will solve the first question for you. If you want any s...

Q: Timmy Company provided the following information pertaining to revenue earned by operating segments ...

A: Reportable Segment: IFRS (International Financial Reporting Standards) accounting processes are refe...

Q: Yilmaz A.Ş. encounters the following situations: Identify the type of adjusting entry needed. Y...

A: Prepaid expense are expenses which are already paid ( in advance ) , the expenses are yet to be incu...

Q: In 2021, Allen company reported cash basis income of P 7,800,000. Tracing back its records, accounts...

A: The net income realized in these case is P17,225,000. We will add the income we had plus the account...

Q: Work in Process 20,000 Oct. 31 Goods finished 96,700 201,000 Oct. 1 Balance 31 Direct materials 31 D...

A: Factory overhead: A manufacturing business's factory overhead, sometimes referred to as manufacturin...

Q: Cost method consolidation entries (controlling investment in affiliate, fair value differs from book...

A: Common stock is a type of security that represents a company's ownership. The board of directors is ...

Q: Pat Company reported the following information on December 31, 2020. Determine the legal capital: P2...

A: Legal Capital: When it comes to companies, legal capital is the amount of stock that is not legally ...

Q: uit buying vendor coffee for one year $4,483.97 and decided to contribute $2,400 (you saved $200 per...

A: The value of the money at retirement is the future value of the savings.

Q: 13. Which of the following would most likely be a product cost? a. Salary of VP of sales. b. Adverti...

A: Solution 13: Product cost are the cost that is capitalized in inventory cost or that is incurred in ...

Q: n January 2021, Lite Inc. paid property taxes on its factory building for the calendar year 2021 in ...

A: Solution: Property taxes is for whole year, therefore same should be recognized equally in each quar...

Q: A trial balance will indicate the existence of an error if: a The purchase of ...

A: The existence of an error can only be seen in a trial balance in the cases where the trial balance d...

Q: Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and s...

A: Inventory valuation refers to the monetary amount or value associated with the goods in the inventor...

Q: A jeans maker is designing a new line of jeans called Slams. Slams will sell for $320 per unit and c...

A:

Q: Sunn Company manufactures a single product that sells for $170 per unit and whose variable costs are...

A: Formulas: Break even units = Fixed costs /Contribution margin per unit Contribution margin per unit...

Q: An investment of 500 will increase to 4000 at the end of 20 years. Find the sum of the present value...

A: solution working note calculation of interest rate PV * (1+interest) ^20 =FV 500 * (1+ in...

Q: On the first day of the fiscal year, a company issues a $3,500,000, 6%, five-year bond that pays sem...

A: Introduction: Journals: Recording of a business transactions in a chronological order. Firs step in ...

Q: Jimin Corp. is preparing the interim financial statements for the quarter ended March 31, 2022. Sale...

A: Variable expenses = Sales x 20% Advertisement expense = Total advertisement expense for one year x 3...

Q: 5. Question: Under the accrual basis, Professional Fees by Atty. Bruno for the year 2021 amounts to ...

A: Accrual system of accounting means where the cash received or paid is not important but the income a...

Q: LMN Corp has the following data showing for the current year: Interest on peso savings account, net ...

A: Solution Concept The interest deduction allowable is 20% of the interest income that is chargeable t...

Step by step

Solved in 2 steps

- A firm had the following values for the four debt ratios discussed in the chapter: Liabilities to Assets Ratio: less than 1.0 Liabilities to Shareholders Equity Ratio: equal to 1.0 Long-Term Debt to Long-Term Capital Ratio: less than 1.0 Long-Term Debt to Shareholders Equity Ratio: less than 1.0 a. Indicate whether each of the following independent transactions increases, decreases, or has no effect on each of the four debt ratios. (1) The firm issued long-term debt for cash. (2) The firm issued short-term debt and used the cash proceeds to redeem long-term debt (treat as a unified transaction). (3) The firm redeemed short-term debt with cash. (4) The firm issued long-term debt and used the cash proceeds to repurchase shares of its common stock (treat as a unified transaction). b. The text states that analysts need not compute all four debt ratios each year because the debt ratios are highly correlated. Does your analysis in Requirement a support this statement? Explain.Which of the following statements is false?(a) The quickest way to determine whether a firm has too much debt is to calculate the debt-to-equity ratio.(b) The best guideline to determine the firm's liquidity is to calculate the current ratio.(c) From the investor's point of view, the rate of return on common equity is a good indicator of whether the firm is generating an acceptable return to the investor.( d) We can determine the operating margin by expressing net income as a percentage of total sales.For a typical firm, which of the following sequences is CORRECT? All rates are after taxes, and assume that the firm operates at its target capital structure rs: Cost of equities new stock issuance re: Cost of equities retained earnings rd: Cost of debts WACC: Weigthed average costs of capital rs > re rd WACC re rs > WACC rd. WACC > re> rs >rd. rd >rers > WACC

- Which of the following statements are false? Select all that apply a. Liquidity ratios are used to measure the speed with which various accounts are converted into sales. b. When ratios of different years are being compared, inflation should be taken into consideration c. Return on total assets (ROA) is sometimes called return on investment d. Generally, inventory is concerned with the most liquid asset that a firm possesses. e. A P/E ratio of 20 indicates that investors are willing to pay $20 for each $1 of earnings.Which of the following statements is CORRECT? A. Net working capital is defined as current assets minus the difference between current liabilities and notes payable, and any increase in the current ratio automatically indicates that net working capital has increased B. If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt. C. Net working capital is defined as current assets minus the difference between current liabilities and notes payable, and any decrease in the current ratio automatically indicates that net working capital has decreased. D. Credit policy has an impact on working capital because it influences both sales and the time before receivables are collected.Which of the following statements is correct?(a) The quickest way to determine whether the firmhas too much debt is to calculate the Timesinterest-earned ratio.(b) The best rule of thumb for determining the firm’sliquidity is to calculate the current ratio.(c) From an investor’s point of view, the price-toearnings ratio is a good indicator of whether ornot a firm is generating an acceptable return tothe investor.(d) The operating margin is determined by subtracting all operating and non-operating expensesfrom the gross margin.

- If we know that a firm has a net profit margin of 4.3 %, total asset turnover of 0.77, and a financial leverage multiplier of 1.36, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity?The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Raymond Co. has $1.4 million of debt, $3 million of preferred stock, and $1.2 million of common equity. What would be its weight on debt? 0.59 0.25 0.49 0.21Some of the financial ratios of V, W, X, Y, and Z companies are calculated and presented in the following table. Ratio V W X Y Z Quick Ratio 4.1 times 2.4 times 3.9 times 2.8 times 3.2 times Return on sales 12% 8% 10% 16% 14% Inventory Turnover Ratio 9.7 times 12.6 times 10.4 times 11.5 times 7.8 times Debt-to- equity Ratio 0.45 0.64 0.21 0.36 0.81 You are an individual investor assessing the publicly traded companies V, W, X, Y, and Z based on their profitability. If you are to choose one of the companies to invest your money, which one would you choose? Explain your reason You are the loans manager of a bank assessing the applications of companies V, W, X, Y, and Z for long-term debt. If you are to choose one of the companies to lend money, which one would you choose? Explain your reason You are the loans manager of a bank assessing the applications of companies V, W, X, Y, and Z for short-term debt. If you…

- Which of the following statements is false? a. A firm’s return on equity exceeds its return on investment under conditions of favorable leverage. b. A common-size balance sheet states each asset, liability and shareholder’s equity account as a percentage of total assets. c. Common-size statements are used to evaluate trends and to make industry comparisons. d. Creditors tend to favor a firm with high financial leverage.Which of the following statements is correct? A. The optimal dividend policy is the one that satisfies management, not shareholders. B. The use of debt financing has no effect on earnings per share (EPS) or stock price. C. Stock price is dependent on the projected EPS and the use of debt, but not on the timing of the earnings stream. D. The riskiness of projected EPS can impact the firm's value. E. Dlvidend policy is one aspect of the firm's financial policy that is determined solely by the shareholders. Reset SelectionA profitability measure of ROE is affected by the level of a firm’s debt. Thus,an investor must consider the debt-equity ratio to evaluate the firm’sprofitability. The debt-equity ratio determines a firm’s financial leverage whichindicates how much of assets the firm is able to deploy for each monetary unitof stockholders’ equity.1) Explain how the financial leverage effect can be defined as the differencebetween ROE and ROA. 2) Explain how the financial leverage effect is affected by the debt ratio and theinterest rate.