What does the firm need to do to raise its ROE? Calculate the profit margin ratio of the company and comment on the profitability performance of the o

What does the firm need to do to raise its ROE? Calculate the profit margin ratio of the company and comment on the profitability performance of the o

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 11P

Related questions

Question

100%

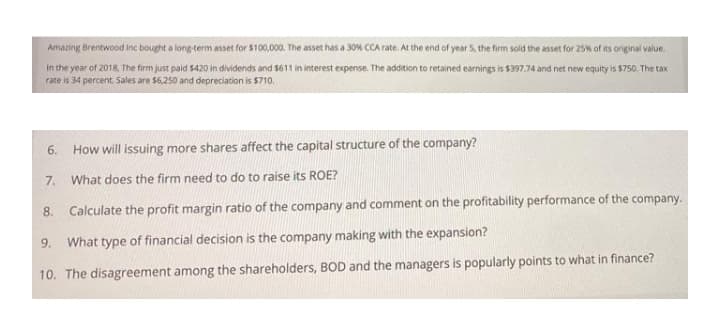

Transcribed Image Text:Amazing Brentwood inc bought a long-term asset for $100,000. The asset has a 30% CCA rate. At the end of year 5, the firm sold the asset for 25% of its original value.

In the year of 2018, The firm just paid 5420 in dividends and $611 in interest expense. The addition to retained earnings is $397.74 and net new equity is $750. The tax

rate is 34 percent. Sales are $6,250 and depreciation is $710.

6. How will issuing more shares affect the capital structure of the company?

7.

What does the firm need to do to raise its ROE?

8.

Calculate the profit margin ratio of the company and comment on the profitability performance of the company.

9.

What type of financial decision is the company making with the expansion?

10. The disagreement among the shareholders, BOD and the managers is popularly points to what in finance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning