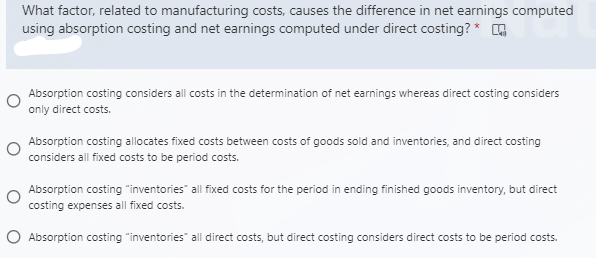

What factor, related to manufacturing costs, causes the difference in net earnings computed using absorption costing and net earnings computed under direct costing? * , Absorption costing considers all costs in the determination of net earnings whereas direct costing considers only direct costs. Absorption costing allocates fixed costs between costs of goods sold and inventories, and direct costing considers all fixed costs to be period costs. Absorption costing "inventories" all fixed costs for the period in ending finished goods inventory, but direct costing expenses all fixed costs. O Absorption costing "inventories" all direct costs, but direct costing considers direct costs to be period costs.

What factor, related to manufacturing costs, causes the difference in net earnings computed using absorption costing and net earnings computed under direct costing? * , Absorption costing considers all costs in the determination of net earnings whereas direct costing considers only direct costs. Absorption costing allocates fixed costs between costs of goods sold and inventories, and direct costing considers all fixed costs to be period costs. Absorption costing "inventories" all fixed costs for the period in ending finished goods inventory, but direct costing expenses all fixed costs. O Absorption costing "inventories" all direct costs, but direct costing considers direct costs to be period costs.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter3: Cost Behavior And Cost Forecasting

Section: Chapter Questions

Problem 21BEA: Inventory Valuation under Absorption Costing Refer to the data for Judson Company above. Required:...

Related questions

Question

28

Transcribed Image Text:What factor, related to manufacturing costs, causes the difference in net earnings computed

using absorption costing and net earnings computed under direct costing? * ,

Absorption costing considers all costs in the determination of net earnings whereas direct costing considers

only direct costs.

Absorption costing allocates fixed costs between costs of goods sold and inventories, and direct costing

considers all fixed costs to be period costs.

Absorption costing "inventories" all fixed costs for the period in ending finished goods inventory, but direct

costing expenses all fixed costs.

O Absorption costing "inventories" all direct costs, but direct costing considers direct costs to be period costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning