What incentives might a manager have to dispose of assets?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

Can someone please tell me if I'm on the right track, and complete the missing cells by completing the forumulas? Thank you.

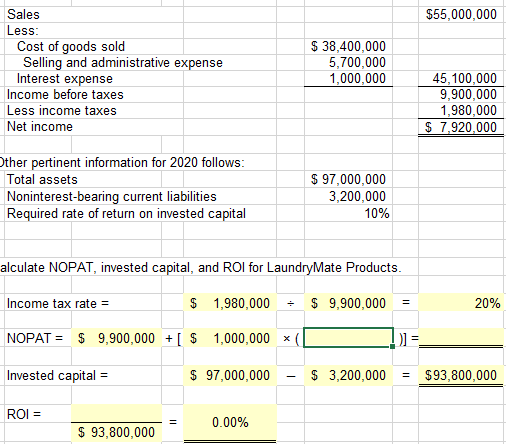

Transcribed Image Text:Sales

$55,000,000

Less:

$ 38,400,000

5,700,000

Cost of goods sold

Selling and administrative expense

Interest expense

Income before taxes

1,000,000

45,100,000

9,900,000

1,980,000

$ 7,920,000

Less income taxes

Net income

Other pertinent information for 2020 follows:

Total assets

$ 97,000,000

3,200,000

Noninterest-bearing current liabilities

Required rate of return on invested capital

10%

alculate NOPAT, invested capital, and ROI for LaundryMate Products.

Income tax rate =

$ 1,980,000

: $ 9,900,000

20%

NOPAT = $ 9,900,000 +[ $ 1,000,000 x

Invested capital =

$ 97,000,000

$ 3,200,000

= $93,800,000

ROI =

0.00%

$ 93,800,000

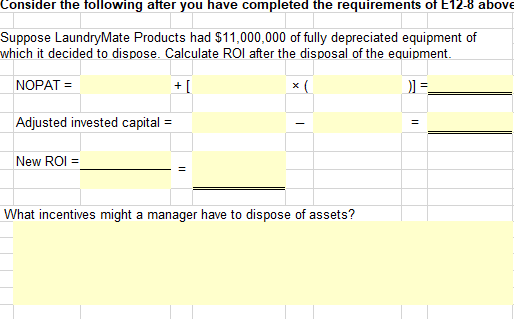

Transcribed Image Text:Consider the following after you have completed the requirements of E12-8 above

Suppose LaundryMate Products had $11,000,000 of fully depreciated equipment of

which it decided to dispose. Calculate ROl after the disposal of the equipment.

NOPAT =

+ [

x (

Adjusted invested capital =

New ROI =

What incentives might a manager have to dispose of assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning