What internal controls might have prevented a former Smucker employee from stealing $4.1 million over 16 years? In October 2019, a former Smucker employee, Mark Kershey, was charged with defrauding the J.M. Smucker Company of more than $4.1 million over a 16 year period. Kershey was the chief airplane mechanic at the company's hangar at the Akron-Canton Airport inOhio from 1990 until he was discharged by Smucker in 2018. From 1997 until he left Smucker,Kershey invoiced Smucker for more than $8.1 million by using a fictitious entity he created. Hebilled Smucker for nonexistent parts and/or work that he himself actually performed as part ofhis duties as a salaried employee. Most of these invoices were for less than $10,000, which Kershey himself was authorized to approve. A supervisor to Kershey approved the few invoices that were for more than $10,000 based on his trust in Kershey. To carry out his false billing scheme, Kershey set up a post office box in Lake Township in Ohio using the fictitious entity name of Aircraft Parts Services Co (APS). He (as APS) woul then invoice Smucker using non-sequential invoice numbers, so it looked like APS was invoicing other companies too. Kershey used the proceeds to purchase and maintain two planes, several automobiles, and to make payments on his house. Kershey was eventually caught in late 2012 when three checks written by Smucker to APS totalingS44,000 were not cashed. When a Smucker employee questioned Kershey about the APS un-cashed checks, Kershey indicated that APS had been sold to another Smucker vendor. The false billing scheme pegan to unravel and Kershey was fired by Smucker. The Special Assistant United States Attorney has charged Kershey with mail fraud following an investigation by the Federal Bureau of Investigation, Canton, Ohio. Charges were filed in October 2019 and the case is pending. Questions: 1. What internal controls could have been used to prevent Kershey from carrying out the false billing scheme? 2. What factors might have contributed to the weak internal control environment that allowed this scheme to exist for 21 years?

What internal controls might have prevented a former Smucker employee from stealing $4.1 million over 16 years? In October 2019, a former Smucker employee, Mark Kershey, was charged with defrauding the J.M. Smucker Company of more than $4.1 million over a 16 year period. Kershey was the chief airplane mechanic at the company's hangar at the Akron-Canton Airport inOhio from 1990 until he was discharged by Smucker in 2018. From 1997 until he left Smucker,Kershey invoiced Smucker for more than $8.1 million by using a fictitious entity he created. Hebilled Smucker for nonexistent parts and/or work that he himself actually performed as part ofhis duties as a salaried employee. Most of these invoices were for less than $10,000, which Kershey himself was authorized to approve. A supervisor to Kershey approved the few invoices that were for more than $10,000 based on his trust in Kershey. To carry out his false billing scheme, Kershey set up a post office box in Lake Township in Ohio using the fictitious entity name of Aircraft Parts Services Co (APS). He (as APS) woul then invoice Smucker using non-sequential invoice numbers, so it looked like APS was invoicing other companies too. Kershey used the proceeds to purchase and maintain two planes, several automobiles, and to make payments on his house. Kershey was eventually caught in late 2012 when three checks written by Smucker to APS totalingS44,000 were not cashed. When a Smucker employee questioned Kershey about the APS un-cashed checks, Kershey indicated that APS had been sold to another Smucker vendor. The false billing scheme pegan to unravel and Kershey was fired by Smucker. The Special Assistant United States Attorney has charged Kershey with mail fraud following an investigation by the Federal Bureau of Investigation, Canton, Ohio. Charges were filed in October 2019 and the case is pending. Questions: 1. What internal controls could have been used to prevent Kershey from carrying out the false billing scheme? 2. What factors might have contributed to the weak internal control environment that allowed this scheme to exist for 21 years?

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 22CE

Related questions

Question

Answer question 1 and 2

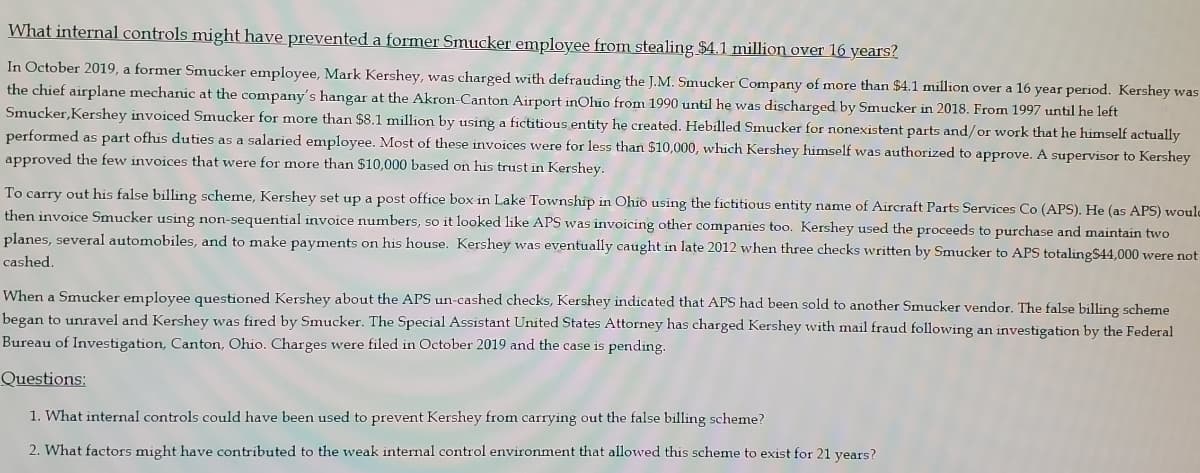

Transcribed Image Text:What internal controls might have prevented a former Smucker employee from stealing $4.1 million over 16 years?

In October 2019, a former Smucker employee, Mark Kershey, was charged with defrauding the J.M. Smucker Company of more than $4.1 million over a 16 year period. Kershey was

the chief airplane mechanic at the company's hangar at the Akron-Canton Airport inOhio from 1990 until he was discharged by Smucker in 2018. From 1997 until he left

Smucker,Kershey invoiced Smucker for more than $8.1 million by using a fictitious entity he created. Hebilled Smucker for nonexistent parts and/or work that he himself actually

performed as part ofhis duties as a salaried employee. Most of these invoices were for less than $10,000, which Kershey himself was authorized to approve. A supervisor to Kershey

approved the few invoices that were for more than $10,000 based on his trust in Kershey.

To carry out his false billing scheme, Kershey set up a post office box in Lake Township in Ohio using the fictitious entity name of Aircraft Parts Services Co (APS). He (as APS) woule

then invoice Smucker using non-sequential invoice numbers, so it looked like APS was invoicing other companies too. Kershey used the proceeds to purchase and maintain two

planes, several automobiles, and to make payments on his house. Kershey was eventually caught in late 2012 when three checks written by Smucker to APS totalingS44,000 were not

cashed.

When a Smucker employee questioned Kershey about the APS un-cashed checks, Kershey indicated that APS had been sold to another Smucker vendor. The false billing scheme

began to unravel and Kershey was fired by Smucker. The Special Assistant United States Attorney has charged Kershey with mail fraud following an investigation by the Federal

Bureau of Investigation, Canton, Ohio. Charges were filed in October 2019 and the case is pending.

Questions:

1. What internal controls could have been used to prevent Kershey from carrying out the false billing scheme?

2. What factors might have contributed to the weak internal control environment that allowed this scheme to exist for 21 years?

Expert Solution

Step 1

Internal control system indicates the decisions regarding the rules and regulations of operations taken by the corporation for getting ensure the smooth flow of operations without error or fraud.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage