what is adjusting journal entries? what is AJEs? T1 Feb 1 You invest $10,000 into your brand new company, Just for Kicks. T2 Feb 1 You obtain a bank loan of $20,000 at a rate of 8% per year. T3 Feb 2 You purchase 50 pairs of shoes from Sloan's Shoes. Total cost is $2,500 terms 2/10, net 30. T4 Feb 3 Go to Staples to buy a desk, chair, and filing cabinet etc for a total of $1,100. T5 Feb 3 When at Staples you also purchase $500 worth of packing and office supplies. T6 Feb 4 You pay $400 for the first month of Shopify's Advanced Features. T7 Feb 6 With the website set up, you make your first sales - 10 pairs of shoes at an average price of $120 each. T8 Feb 6 You go to the post office and ship the 10 pairs of shoes for a cost of $11 per pair. You pay with a business cheque. T9 Feb 8 A friend comes to your place and buys shoes directly from you. He says he'll pay you the $100 next week. T10 Feb 13 In the last week, you sold 38 pairs of shoes at an average price of $120 each. T11 Feb 14 You're low on inventory and buy another 80 pairs from Sloan's Shoes. You pay with a business cheque. T12 Feb 14 While you're there, you pay Sloan's shoes the full amount owing from Feb 2. T13 Feb 14 On the way back from Sloan's Shoes, you buy yourself a $15 lunch using cash from the business. T14 Feb 20 One of your customers emails to say they want to return the shoes - he was able to buy them elsewhere for less. You decide to allow the return but he must cover the cost of shipping them back to you. You receive the shoes the next day and process the full refund of $120. T15 Feb 25 You learn that Shopify's service allows you to sell gift certificates. You do some promotion and within a few hours have sold $500 worth of gift cards. T16 Feb 26 In the last few weeks you've sold 60 pairs of shoes for the average price of $120. Gift cards totalling $150 were used. T17 Feb 28 With so much cash on hand, you decide to make a $15,000 payment on the principal of your bank loan.

what is adjusting journal entries? what is AJEs? T1 Feb 1 You invest $10,000 into your brand new company, Just for Kicks. T2 Feb 1 You obtain a bank loan of $20,000 at a rate of 8% per year. T3 Feb 2 You purchase 50 pairs of shoes from Sloan's Shoes. Total cost is $2,500 terms 2/10, net 30. T4 Feb 3 Go to Staples to buy a desk, chair, and filing cabinet etc for a total of $1,100. T5 Feb 3 When at Staples you also purchase $500 worth of packing and office supplies. T6 Feb 4 You pay $400 for the first month of Shopify's Advanced Features. T7 Feb 6 With the website set up, you make your first sales - 10 pairs of shoes at an average price of $120 each. T8 Feb 6 You go to the post office and ship the 10 pairs of shoes for a cost of $11 per pair. You pay with a business cheque. T9 Feb 8 A friend comes to your place and buys shoes directly from you. He says he'll pay you the $100 next week. T10 Feb 13 In the last week, you sold 38 pairs of shoes at an average price of $120 each. T11 Feb 14 You're low on inventory and buy another 80 pairs from Sloan's Shoes. You pay with a business cheque. T12 Feb 14 While you're there, you pay Sloan's shoes the full amount owing from Feb 2. T13 Feb 14 On the way back from Sloan's Shoes, you buy yourself a $15 lunch using cash from the business. T14 Feb 20 One of your customers emails to say they want to return the shoes - he was able to buy them elsewhere for less. You decide to allow the return but he must cover the cost of shipping them back to you. You receive the shoes the next day and process the full refund of $120. T15 Feb 25 You learn that Shopify's service allows you to sell gift certificates. You do some promotion and within a few hours have sold $500 worth of gift cards. T16 Feb 26 In the last few weeks you've sold 60 pairs of shoes for the average price of $120. Gift cards totalling $150 were used. T17 Feb 28 With so much cash on hand, you decide to make a $15,000 payment on the principal of your bank loan.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter2: Financial Reporting: Its Conceptual Framework

Section: Chapter Questions

Problem 4C

Related questions

Topic Video

Question

what is

what is AJEs?

| T1 | Feb 1 |

You invest $10,000 into your brand new company, Just for Kicks.

|

|||||||||||

| T2 | Feb 1 |

You obtain a bank loan of $20,000 at a rate of 8% per year.

|

|||||||||||

| T3 | Feb 2 |

You purchase 50 pairs of shoes from Sloan's Shoes. Total cost is $2,500 terms 2/10, net 30.

|

|||||||||||

| T4 | Feb 3 |

Go to Staples to buy a desk, chair, and filing cabinet etc for a total of $1,100.

|

|||||||||||

| T5 | Feb 3 |

When at Staples you also purchase $500 worth of packing and office supplies.

|

|||||||||||

| T6 | Feb 4 |

You pay $400 for the first month of Shopify's Advanced Features.

|

|||||||||||

| T7 | Feb 6 |

With the website set up, you make your first sales - 10 pairs of shoes at an average price of $120 each.

|

|||||||||||

| T8 | Feb 6 |

You go to the post office and ship the 10 pairs of shoes for a cost of $11 per pair. You pay with a business cheque.

|

|||||||||||

| T9 | Feb 8 |

A friend comes to your place and buys shoes directly from you. He says he'll pay you the $100 next week.

|

|||||||||||

| T10 |

Feb 13

|

In the last week, you sold 38 pairs of shoes at an average price of $120 each.

|

|||||||||||

| T11 |

Feb 14

|

You're low on inventory and buy another 80 pairs from Sloan's Shoes. You pay with a business cheque.

|

|||||||||||

| T12 |

Feb 14

|

While you're there, you pay Sloan's shoes the full amount owing from Feb 2.

|

|||||||||||

| T13 |

Feb 14

|

On the way back from Sloan's Shoes, you buy yourself a $15 lunch using cash from the business.

|

|||||||||||

| T14 |

Feb 20

|

One of your customers emails to say they want to return the shoes - he was able to buy them elsewhere for less.

|

|||||||||||

|

You decide to allow the return but he must cover the cost of shipping them back to you. You receive

|

|||||||||||||

|

the shoes the next day and process the full refund of $120.

|

|||||||||||||

| T15 |

Feb 25

|

You learn that Shopify's service allows you to sell gift certificates. You do some promotion

|

|||||||||||

|

and within a few hours have sold $500 worth of gift cards.

|

|||||||||||||

| T16 |

Feb 26

|

In the last few weeks you've sold 60 pairs of shoes for the average price of $120. Gift cards totalling $150 were used.

|

|||||||||||

| T17 |

Feb 28

|

With so much cash on hand, you decide to make a $15,000 payment on the principal of your bank loan.

|

|||||||||||

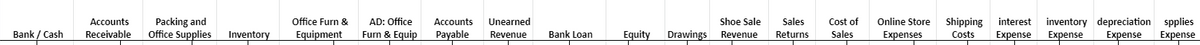

Transcribed Image Text:Cost of

Unearned

Revenue

Accounts

Packing and

Office Supplies

Office Furn &

AD: Office

Accounts

Shoe Sale

Sales

Online Store

Shipping

Costs

interest

inventory depreciation spplies

Bank / Cash

Receivable

Inventory

Equipment

Furn & Equip

Payable

Bank Loan

Equity

Drawings

Revenue

Returns

Sales

Expenses

Expense

Expense

Expense

Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning