I. Journal. Journalize the following transactions in balance sheet approach. On September 1, 2020. Raze Co started a delivery – pick up service by investing P500,000 cash. Date Transaction Rented a small office space amounting P50,000 with a monthly rent of P10,000 Paid tax and license amounting P12,000 for one year. Purchased Sofa, T.V and organizing cabinet amounting P50,000. The price of the furniture are 20%, 45% and 35% respectively with a useful life of 10 years each and salvage value of 5% each. Purchased 5 equipment-motorcycle on credit S.O.V.A. The amount is P75,000 each with an agreement of 10% down payment and an installment basis of P2,500 each at the end of each month starting October. Perform a service to Mr. Brimstone amounting P50,000. The agreement calls for 50% down payment and he promised to pay the balance on Sept. 30, 2020. Purchased utilities- gas and oil for the motorcycle amounting P5,000 Paid Electricity amounting P3,000 Received water bill amounting P1,500. The due date is sept 30, 2021. 1 3 3 4 7

I. Journal. Journalize the following transactions in balance sheet approach. On September 1, 2020. Raze Co started a delivery – pick up service by investing P500,000 cash. Date Transaction Rented a small office space amounting P50,000 with a monthly rent of P10,000 Paid tax and license amounting P12,000 for one year. Purchased Sofa, T.V and organizing cabinet amounting P50,000. The price of the furniture are 20%, 45% and 35% respectively with a useful life of 10 years each and salvage value of 5% each. Purchased 5 equipment-motorcycle on credit S.O.V.A. The amount is P75,000 each with an agreement of 10% down payment and an installment basis of P2,500 each at the end of each month starting October. Perform a service to Mr. Brimstone amounting P50,000. The agreement calls for 50% down payment and he promised to pay the balance on Sept. 30, 2020. Purchased utilities- gas and oil for the motorcycle amounting P5,000 Paid Electricity amounting P3,000 Received water bill amounting P1,500. The due date is sept 30, 2021. 1 3 3 4 7

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

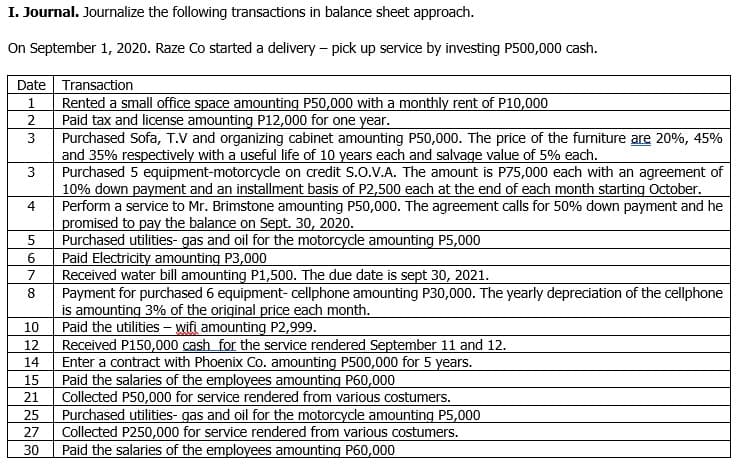

Transcribed Image Text:I. Journal. Journalize the following transactions in balance sheet approach.

On September 1, 2020. Raze Co started a delivery – pick up service by investing P500,000 cash.

Date Transaction

Rented a small office space amounting P50,000 with a monthly rent of P10,000

Paid tax and license amounting P12,000 for one year.

Purchased Sofa, T.V and organizing cabinet amounting P50,000. The price of the furniture are 20%, 45%

and 35% respectively with a useful life of 10 years each and salvage value of 5% each.

Purchased 5 equipment-motorcycle on credit S.O.V.A. The amount is P75,000 each with an agreement of

10% down payment and an installment basis of P2,500 each at the end of each month starting October.

Perform a service to Mr. Brimstone amounting P50,000. The agreement calls for 50% down payment and he

promised to pay the balance on Sept. 30, 2020.

Purchased utilities- gas and oil for the motorcycle amounting P5,000

Paid Electricity amounting P3,000

Received water bill amounting P1,500. The due date is sept 30, 2021.

Payment for purchased 6 equipment- cellphone amounting P30,000. The yearly depreciation of the cellphone

is amounting 3% of the original price each month.

Paid the utilities – wifi amounting P2,999.

Received P150,000 cash for the service rendered September 11 and 12.

Enter a contract with Phoenix Co. amounting P500,000 for 5 years.

Paid the salaries of the employees amounting P60,000

Collected P50,000 for service rendered from various costumers.

1

3

3

4

7

8.

10

12

14

15

21

25

Purchased utilities- gas and oil for the motorcycle amounting P5,000

Collected P250,000 for service rendered from various costumers.

Paid the salaries of the employees amounting P60,000

27

30

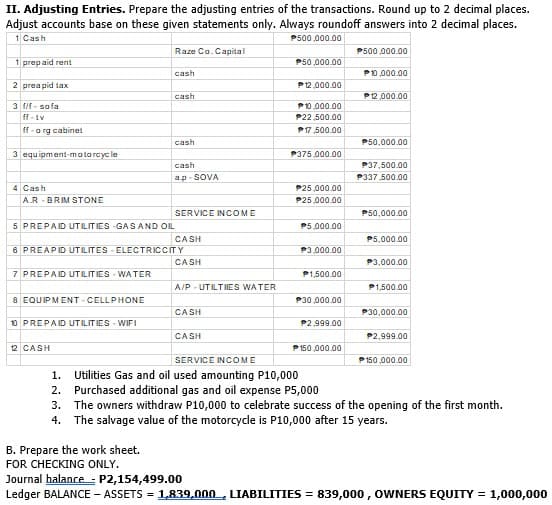

Transcribed Image Text:II. Adjusting Entries. Prepare the adjusting entries of the transactions. Round up to 2 decimal places.

Adjust accounts base on these given statements only. Always roundoff answers into 2 decimal places.

1 Cash

P500,000.00

Raze Co. Capital

P500,000.00

1 prepaid rent

P50,000.00

cash

P10,000.00

2 prea pid tax

P12,000.00

cash

P12,000.00

3 fif - sofa

ff-tv

P10,000.00

P22,500.00

ff -a rg cabinet

P17,500.00

cash

P50,000.00

3 equipment-matorcyc le

P375,000.00

cash

P37,500.00

ap- SOVA

P337,500.00

4 Cash

P25,000.00

A.R - BRIM STONE

P25,000.00

SERVICE INCOME

P50,000.00

5 PREPAID UTILITIES GAS AND OIL

P5,000.00

CASH

P5,000.00

6 PREAPID UTILITES - ELECTRICCITY

P3.000.00

CA SH

P3,000.00

7 PREPAID UTILITIES - WATER

P1,500.00

A/P - UTILTIES WATER

P1,500.00

a EQUIPMENT - CELLPHONE

P30,000.00

CA SH

P30,000.00

10 PREPAID UTILITIES - WIFI

P2,999.00

CASH

P2,999.00

12 CASH

P150.000.00

SERVICE INCOME

P150,000.00

1. Utilities Gas and oil used amounting P10,000

2. Purchased additional gas and oil expense P5,000

3. The owners withdraw P10,000 to celebrate success of the opening of the first month.

4. The salvage value of the motorcycle is P10,000 after 15 years.

B. Prepare the work sheet.

FOR CHECKING ONLY.

Journal halance - P2,154,499.00

Ledger BALANCE - ASSETS = 1,839,000, LIABILITIES = 839,000 , OWNERS EQUITY = 1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT