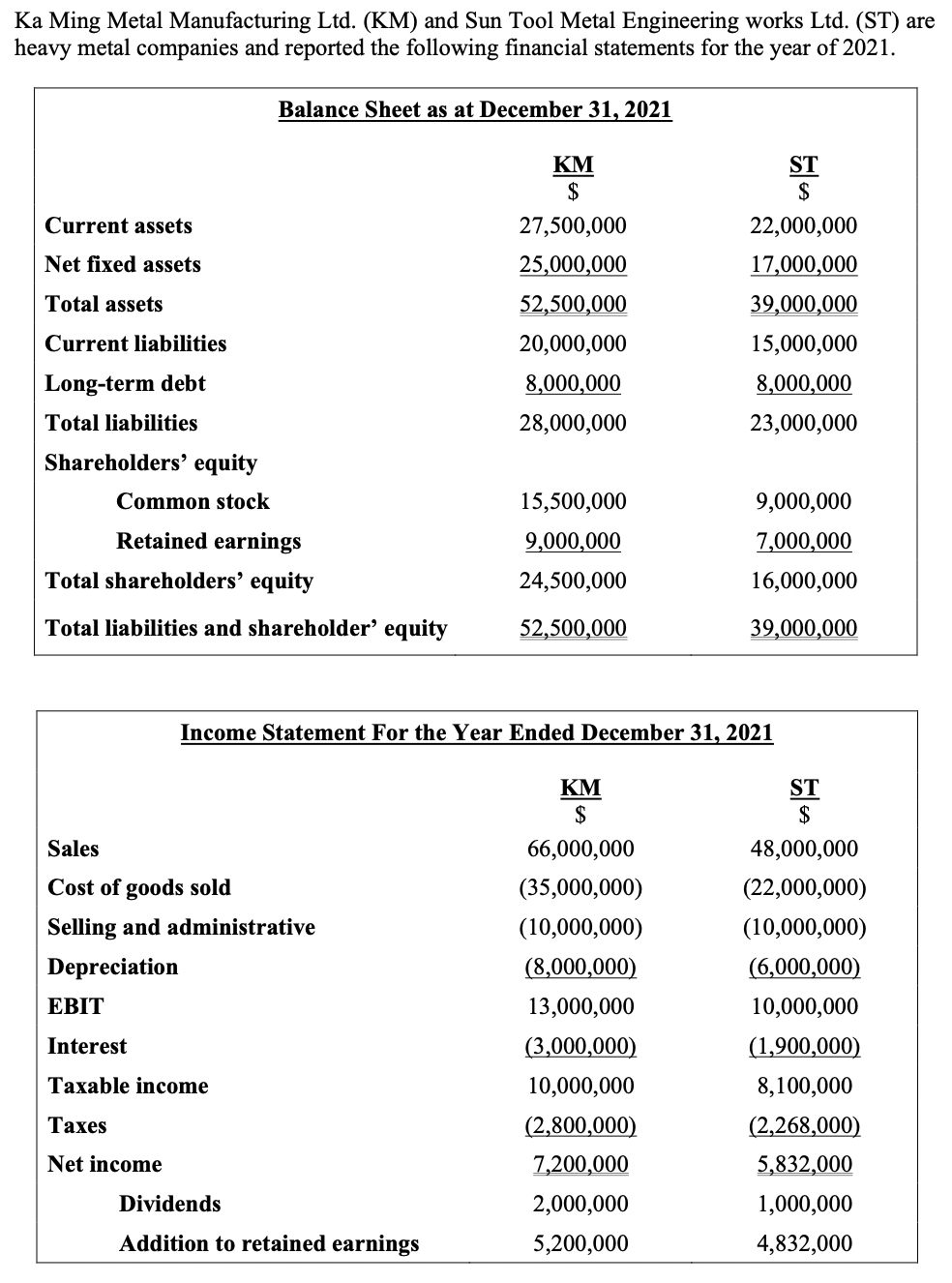

Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) are heavy metal companies and reported the following financial statements for the year of 2021. Balance Sheet as at December 31, 2021 KM $ ST $ Current assets 27,500,000 22,000,000 Net fixed assets 25,000,000 17,000,000 Total assets 52,500,000 39,000,000 Current liabilities 20,000,000 15,000,000 Long-term debt 8,000,000 8,000,000 Total liabilities 28,000,000 23,000,000 Shareholders’ equity Common stock 15,500,000 9,000,000 Retained earnings 9,000,000 7,000,000 Total shareholders’ equity 24,500,000 16,000,000 Total liabilities and shareholder' equity 52,500,000 39,000,000 Income Statement For the Year Ended December 31, 2021 KM $ ST $ Sales 66,000,000 48,000,000 Cost of goods sold (35,000,000) (22,000,000) Selling and administrative (10,000,000) (10,000,000) Depreciation (8,000,000) (6,000,000) ЕBIT 13,000,000 10,000,000 Interest (3,000,000) (1,900,000) Taxable income 10,000,000 8,100,000 Тахes (2,800,000) (2,268,000) Net income 7,200,000 5,832,000 Dividends 2,000,000 1,000,000 Addition to retained earnings 5,200,000 4,832,000

Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) are heavy metal companies and reported the following financial statements for the year of 2021. Balance Sheet as at December 31, 2021 KM $ ST $ Current assets 27,500,000 22,000,000 Net fixed assets 25,000,000 17,000,000 Total assets 52,500,000 39,000,000 Current liabilities 20,000,000 15,000,000 Long-term debt 8,000,000 8,000,000 Total liabilities 28,000,000 23,000,000 Shareholders’ equity Common stock 15,500,000 9,000,000 Retained earnings 9,000,000 7,000,000 Total shareholders’ equity 24,500,000 16,000,000 Total liabilities and shareholder' equity 52,500,000 39,000,000 Income Statement For the Year Ended December 31, 2021 KM $ ST $ Sales 66,000,000 48,000,000 Cost of goods sold (35,000,000) (22,000,000) Selling and administrative (10,000,000) (10,000,000) Depreciation (8,000,000) (6,000,000) ЕBIT 13,000,000 10,000,000 Interest (3,000,000) (1,900,000) Taxable income 10,000,000 8,100,000 Тахes (2,800,000) (2,268,000) Net income 7,200,000 5,832,000 Dividends 2,000,000 1,000,000 Addition to retained earnings 5,200,000 4,832,000

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 17P: Athenian Venues Inc. just reported the following selected portion of its financial statements for...

Related questions

Question

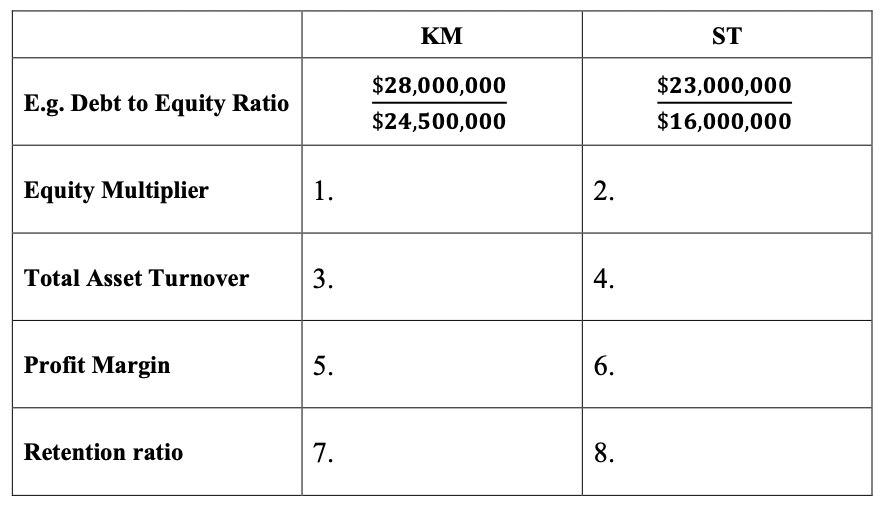

(a) Show the workings for the following financial ratios for Ka Ming Metal Manufacturing Ltd.

(KM) and Sun Tool Metal Engineering works Ltd. (ST) during the year of 2021. (Shown in the photo below)

(round final answer to 2 decimal places, thanks)

Transcribed Image Text:Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) are

heavy metal companies and reported the following financial statements for the year of 2021.

Balance Sheet as at December 31, 2021

KM

$

ST

$

Current assets

27,500,000

22,000,000

Net fixed assets

25,000,000

17,000,000

Total assets

52,500,000

39,000,000

Current liabilities

20,000,000

15,000,000

Long-term debt

8,000,000

8,000,000

Total liabilities

28,000,000

23,000,000

Shareholders’ equity

Common stock

15,500,000

9,000,000

Retained earnings

9,000,000

7,000,000

Total shareholders' equity

24,500,000

16,000,000

Total liabilities and shareholder’ equity

52,500,000

39,000,000

Income Statement For the Year Ended December 31, 2021

KM

$

ST

$

Sales

66,000,000

48,000,000

Cost of goods sold

(35,000,000)

(22,000,000)

Selling and administrative

(10,000,000)

(10,000,000)

Depreciation

(8,000,000)

(6,000,000)

ЕBIT

13,000,000

10,000,000

Interest

(3,000,000)

(1,900,000)

Taxable income

10,000,000

8,100,000

Тахes

(2,800,000)

(2,268,000)

Net income

7,200,000

5,832,000

Dividends

2,000,000

1,000,000

Addition to retained earnings

5,200,000

4,832,000

Transcribed Image Text:KM

ST

$28,000,000

$23,000,000

E.g. Debt to Equity Ratio

$24,500,000

$16,000,000

Equity Multiplier

1.

Total Asset Turnover

3.

4.

Profit Margin

5.

6.

Retention ratio

7.

8.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

can u help me finish the other sub parts from 4-8

thanks a lot!

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning