What is Barbara's medical expense deduction for 2020? If required, round your computations to the nearest dollar. 2,050 X

What is Barbara's medical expense deduction for 2020? If required, round your computations to the nearest dollar. 2,050 X

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 15CE

Related questions

Question

please help me, correct my mistake .

Transcribed Image Text:Exercise 10-15 (Algorithmic) (LO. 2)

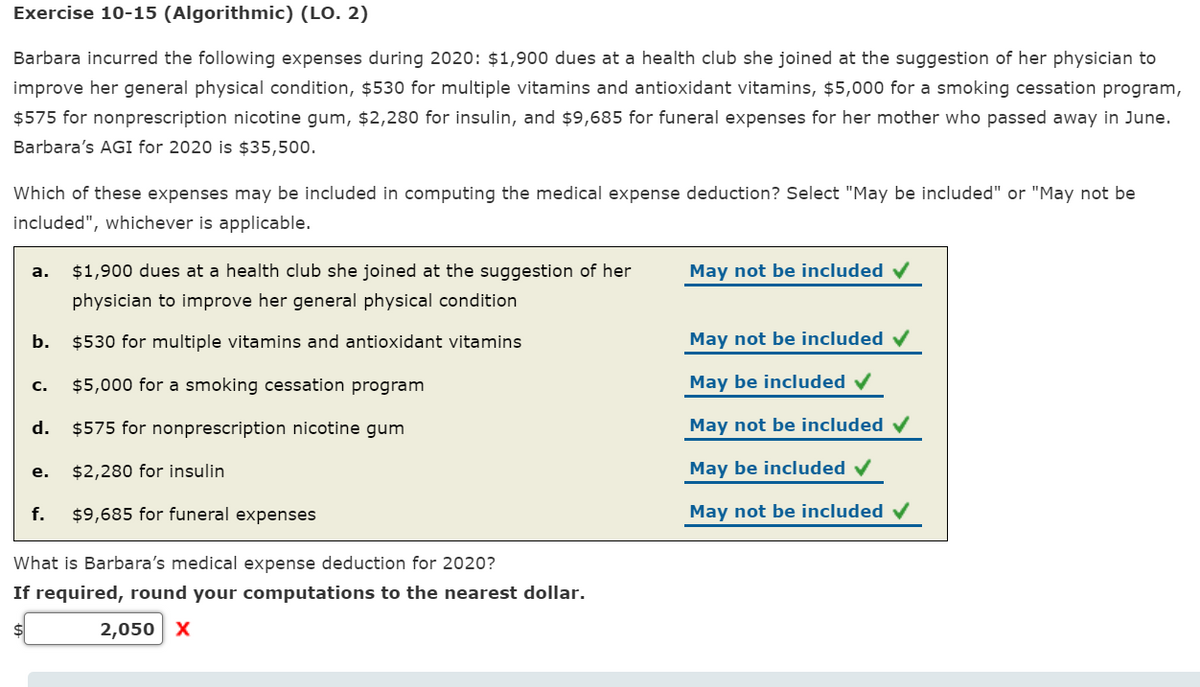

Barbara incurred the following expenses during 2020: $1,900 dues at a health club she joined at the suggestion of her physician to

improve her general physical condition, $530 for multiple vitamins and antioxidant vitamins, $5,000 for a smoking cessation program,

$575 for nonprescription nicotine gum, $2,280 for insulin, and $9,685 for funeral expenses for her mother who passed away in June.

Barbara's AGI for 2020 is $35,500.

Which of these expenses may be included in computing the medical expense deduction? Select "May be included" or "May not be

included", whichever is applicable.

$1,900 dues at a health club she joined at the suggestion of her

May not be included v

а.

physician to improve her general physical condition

b.

$530 for multiple vitamins and antioxidant vitamins

May not be included v

C.

$5,000 for a smoking cessation program

May be included v

d.

$575 for nonprescription nicotine gum

May not be included V

$2,280 for insulin

May be included v

е.

f.

$9,685 for funeral expenses

May not be included v

What is Barbara's medical expense deduction for 2020?

If required, round your computations to the nearest dollar.

2,050 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning