What is causing the volatility for this company? Is anything in this statement unusual or concerning and why?

What is causing the volatility for this company? Is anything in this statement unusual or concerning and why?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 87PSB

Related questions

Question

What is causing the volatility for this company? Is anything in this statement unusual or concerning and why?

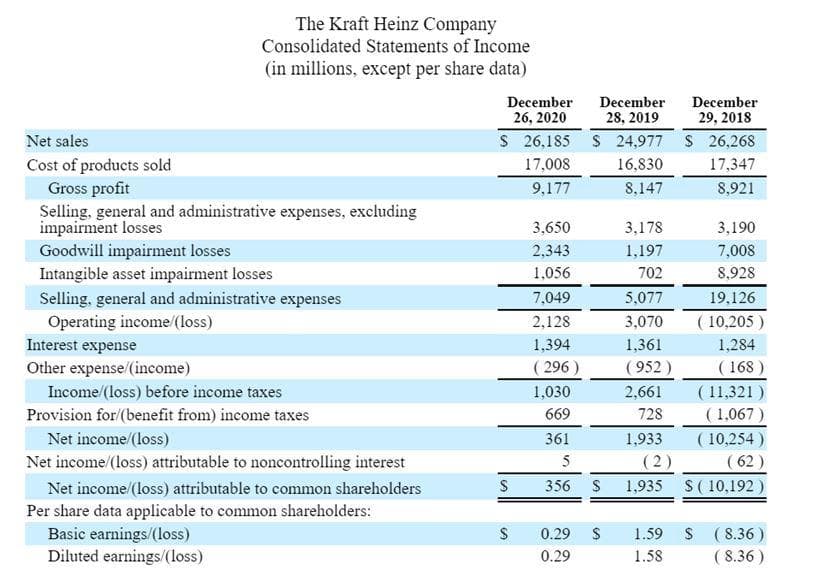

Transcribed Image Text:Net sales

Cost of products sold

Gross profit

The Kraft Heinz Company

Consolidated Statements of Income

(in millions, except per share data)

Selling, general and administrative expenses, excluding

impairment losses

Goodwill impairment losses

Intangible asset impairment losses

Selling, general and administrative expenses

Operating income/(loss)

Interest expense

Other expense/(income)

Income/(loss) before income taxes

Provision for/(benefit from) income taxes

Net income/(loss)

Net income/(loss) attributable to noncontrolling interest

Net income/(loss) attributable to common shareholders

Per share data applicable to common shareholders:

Basic earnings/(loss)

Diluted earnings/(loss)

December

26, 2020

S 26,185

17,008

9,177

S

S

3,650

2,343

1,056

December

28, 2019

0.29

0.29

$ 24,977

16,830

8,147

7,049

2,128

1,394

(296)

1,030

669

361

5

(2)

356 S 1,935

3,178

1,197

702

$

5,077

3,070

1,361

(952)

2,661

728

1,933

1.59

1.58

December

29, 2018

S

26,268

17,347

8,921

S

3,190

7,008

8,928

19,126

(10,205)

1,284

(168)

(11,321)

(1,067)

(10,254)

(62)

$(10,192)

(8.36)

(8.36)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning