What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.)

What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.)

Chapter22: S Corporations

Section: Chapter Questions

Problem 36P

Related questions

Question

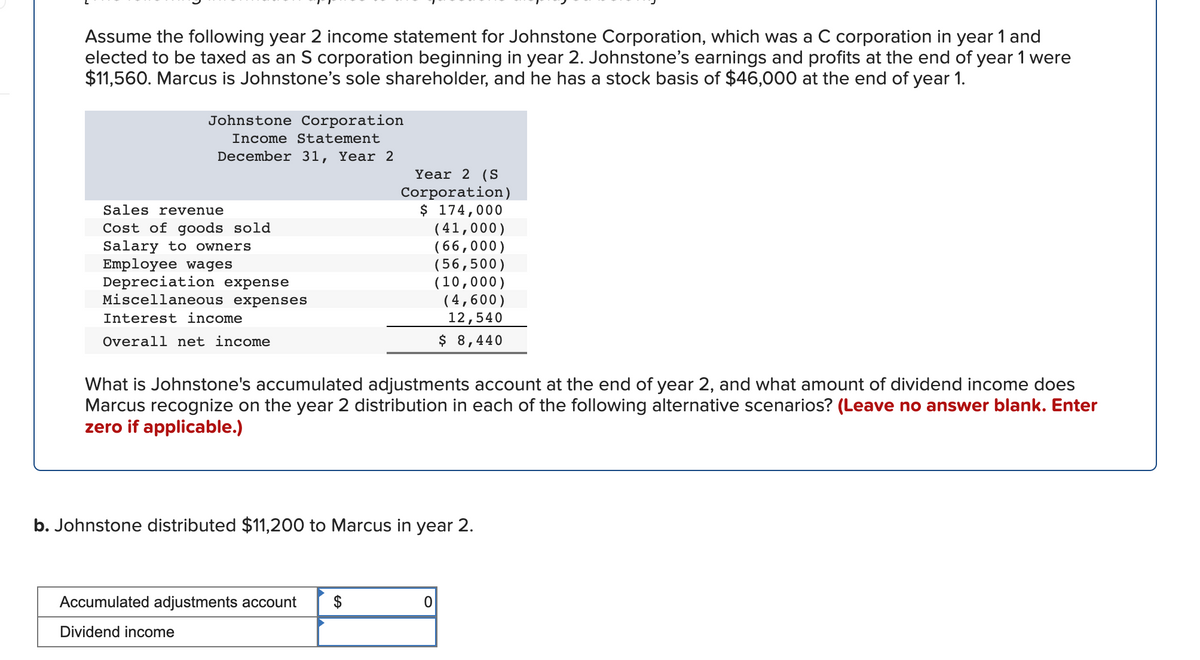

Transcribed Image Text:Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and

elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were

$11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1.

Johnstone Corporation

Income Statement

December 31, Year 2

Year 2 (S

Corporation)

$ 174,000

( 41,000)

( 66,000)

( 56,500)

(10,000)

( 4,600)

12,540

$ 8,440

Sales r evenue

Cost of goods sold

Salary to owners

Employee wages

Depreciation expense

Miscellaneous expenses

Interest income

Overall net income

What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does

Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter

zero if applicable.)

b. Johnstone distributed $11,200 to Marcus in year 2.

Accumulated adjustments account

$

Dividend income

Expert Solution

Step 1

Dividend income is the income which a stakeholder who is also known as the shareholder receives from the company on the investment made by him or her into the corporation. It is a return or income to the shareholder.

Given in the question:

Johnstone Corporation has Earnings and profits at the end of year 1 = $11,560

Marcus is the sole shareholder and he has a stock basis of $46,000 at the end of year 1

Overall Net Income at the end of year 2 = $8,440

Interest Income for the year 2 = $12,540

Johnstone distributed $11,200 to Marcus in year 2

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you