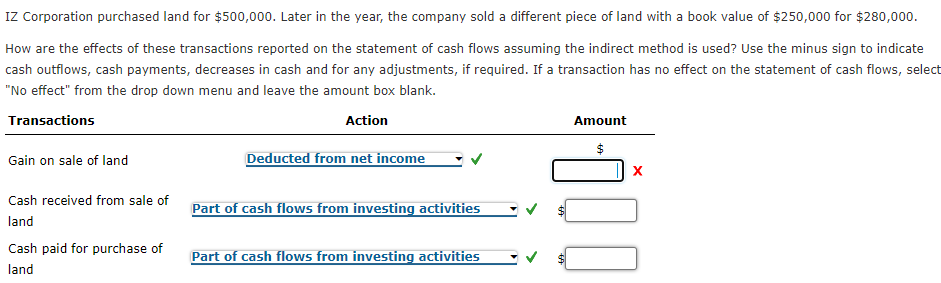

IZ Corporation purchased land for $500,000. Later in the year, the company sold a different piece of land with a book value of $250,000 for $280,000. How are the effects of these transactions reported on the statement of cash flows assuming the indirect method is used? Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, seled "No effect" from the drop down menu and leave the amount box blank. Transactions Action Amount $ Gain on sale of land Deducted from net income Cash received from sale of Part of cash flows from investing activities land Cash paid for purchase of Part of cash flows from investing activities land

IZ Corporation purchased land for $500,000. Later in the year, the company sold a different piece of land with a book value of $250,000 for $280,000. How are the effects of these transactions reported on the statement of cash flows assuming the indirect method is used? Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, seled "No effect" from the drop down menu and leave the amount box blank. Transactions Action Amount $ Gain on sale of land Deducted from net income Cash received from sale of Part of cash flows from investing activities land Cash paid for purchase of Part of cash flows from investing activities land

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 9DQ

Related questions

Question

I know that to find the cahs flows from investing activities its like this:

Cash flows from investing activities $xxx

cash used for investing activities $xxx=

Net Cash Flow from investing activities $xxx

But each time I compute this problem it keeps saying incorrect. I am so confused. I tried multiple different times.

Transcribed Image Text:IZ Corporation purchased land for $500,000. Later in the year, the company sold a different piece of land with a book value of $250,000 for $280,000.

How are the effects of these transactions reported on the statement of cash flows assuming the indirect method is used? Use the minus sign to indicate

cash outflows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, select

"No effect" from the drop down menu and leave the amount box blank.

Transactions

Action

Amount

$

Gain on sale of land

Deducted from net income

Cash received from sale of

Part of cash flows from investing activities

land

Cash paid for purchase of

Part of cash flows from investing activities

land

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,