What is the 95% for a portfolio consisting of both investments A and B? (Hint: write out the probabilities of all possible portfolio outcomes.) Is the summation of the 95% VaRs of the individual investments greater or smaller than the 95% VaR of the portfolio? If we measure the risk of an investment or portfolio using VaR, does this suggest that diversification must decrease risk? (Intuitively, putting A and B in a portfolio is a form of diversification.)

What is the 95% for a portfolio consisting of both investments A and B? (Hint: write out the probabilities of all possible portfolio outcomes.) Is the summation of the 95% VaRs of the individual investments greater or smaller than the 95% VaR of the portfolio? If we measure the risk of an investment or portfolio using VaR, does this suggest that diversification must decrease risk? (Intuitively, putting A and B in a portfolio is a form of diversification.)

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 20P

Related questions

Question

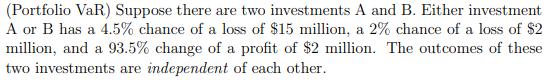

Transcribed Image Text:(Portfolio VaR) Suppose there are two investments A and B. Either investment

A or B has a 4.5% chance of a loss of $15 million, a 2% chance of a loss of $2

million, and a 93.5% change of a profit of $2 million. The outcomes of these

two investments are independent of each other.

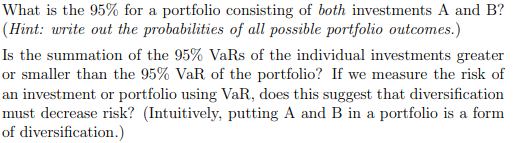

Transcribed Image Text:What is the 95% for a portfolio consisting of both investments A and B?

(Hint: write out the probabilities of all possible portfolio outcomes.)

Is the summation of the 95% VaRs of the individual investments greater

or smaller than the 95% VaR of the portfolio? If we measure the risk of

an investment or portfolio using VaR, does this suggest that diversification

must decrease risk? (Intuitively, putting A and B in a portfolio is a form

of diversification.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning