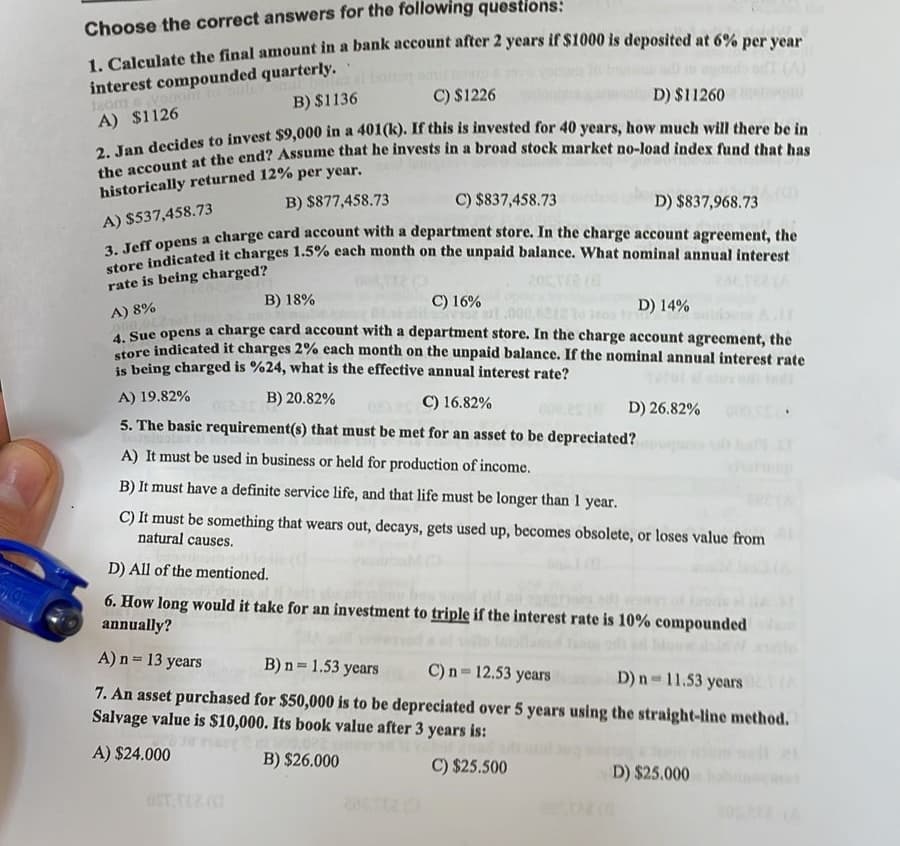

Choose the 1. Calculate the final amount in a bank account after 2 years if $1000 is deposited at 6% per year interest compounded quarterly. 120mV A) $1126 B) $1136 C) $1226 D) $11260 2. Jan decides to invest $9,000 in a 401(k). If this is invested for 40 years, how much will there be in the account at the end? Assume that he invests in a broad stock market no-load index fund that has historically returned 12% per year. B) $877,458.73 A) $537,458.73 C) $837,458.73 D) $837,968.73 3. Jeff opens a charge card account with a department store. In the charge account agreement, the store indicated it charges 1.5% each month on the unpaid balance. What nominal annual interest rate is being charged? C) 16% 339 B) 18% A) 8% D) 14% 4. Sue opens a charge card account with a department store. In the charge account agreement, the store indicated it charges 2% each month on the unpaid balance. If the nominal annual interest rate is being charged is %24, what is the effective annual interest rate? B) 20.82% D) 26.82% 000 A) 19.82% 0 C) 16.82% 5. The basic requirement(s) that must be met for an asset to be depreciated? A) It must be used in business or held for production of income. B) It must have a definite service life, and that life must be longer than 1 year. C) It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes. D) All of the mentioned. 6. How long would it take for an investment to triple if the interest rate is 10% compounded annually? A) n = 13 years B) n = 1.53 years C) n = 12.53 years D) n=11.53 years 7. An asset purchased for $50,000 is to be depreciated over 5 years using the straight-line method. Salvage value is $10,000. Its book value after 3 years is: A) $24.000 B) $26.000 C) $25.500 D) $25.000

Choose the 1. Calculate the final amount in a bank account after 2 years if $1000 is deposited at 6% per year interest compounded quarterly. 120mV A) $1126 B) $1136 C) $1226 D) $11260 2. Jan decides to invest $9,000 in a 401(k). If this is invested for 40 years, how much will there be in the account at the end? Assume that he invests in a broad stock market no-load index fund that has historically returned 12% per year. B) $877,458.73 A) $537,458.73 C) $837,458.73 D) $837,968.73 3. Jeff opens a charge card account with a department store. In the charge account agreement, the store indicated it charges 1.5% each month on the unpaid balance. What nominal annual interest rate is being charged? C) 16% 339 B) 18% A) 8% D) 14% 4. Sue opens a charge card account with a department store. In the charge account agreement, the store indicated it charges 2% each month on the unpaid balance. If the nominal annual interest rate is being charged is %24, what is the effective annual interest rate? B) 20.82% D) 26.82% 000 A) 19.82% 0 C) 16.82% 5. The basic requirement(s) that must be met for an asset to be depreciated? A) It must be used in business or held for production of income. B) It must have a definite service life, and that life must be longer than 1 year. C) It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes. D) All of the mentioned. 6. How long would it take for an investment to triple if the interest rate is 10% compounded annually? A) n = 13 years B) n = 1.53 years C) n = 12.53 years D) n=11.53 years 7. An asset purchased for $50,000 is to be depreciated over 5 years using the straight-line method. Salvage value is $10,000. Its book value after 3 years is: A) $24.000 B) $26.000 C) $25.500 D) $25.000

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Q 5 please

Transcribed Image Text:Choose the correct answers for the following questions:

1. Calculate the final amount in a bank account after 2 years if $1000 is deposited at 6% per year

interest compounded quarterly.

500

120mvong

B) $1136

A) $1126

C) $1226

D) $11260

2. Jan decides to invest $9,000 in a 401(k). If this is invested for 40 years, how much will there be in

the account at the end? Assume that he invests in a broad stock market no-load index fund that has

historically returned 12% per year.

B) $877,458.73

A) $537,458.73

C) $837,458.73

D) $837,968.73

3. Jeff opens a charge card account with a department store. In the charge account agreement, the

store indicated it charges 1.5% each month on the unpaid balance. What nominal annual interest

rate is being charged?

B) 18%

A) 8%

C) 16%

D) 14%

4. Sue opens a charge card account with a department store. In the charge account agreement, the

store indicated it charges 2% each month on the unpaid balance. If the nominal annual interest rate

is being charged is %24, what is the effective annual interest rate?

B) 20.82%

A) 19.82%

C) 16.82%

5. The basic requirement(s) that must be met for an asset to be depreciated?

A) It must be used in business or held for production of income.

B) It must have a definite service life, and that life must be longer than 1 year.

C) It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from

natural causes.

D) 26.82%

D) All of the mentioned.

6. How long would it take for an investment to triple if the interest rate is 10% compounded

annually?

A) n = 13 years

B) n = 1.53 years

C) n = 12.53 years

D) n=11.53 years

7. An asset purchased for $50,000 is to be depreciated over 5 years using the straight-line method.

Salvage value is $10,000. Its book value after 3 years is:

nasy?

Y

A) $24.000

B) $26.000

C) $25.500

D) $25.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning