What is the adjusted net income/loss in 2021? For net loss please put minus sign before the amount of net loss. ( Example -100,000 )*

What is the adjusted net income/loss in 2021? For net loss please put minus sign before the amount of net loss. ( Example -100,000 )*

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10P: At the beginning of 2020, Tanham Company discovered the following errors made in the preceding 2...

Related questions

Question

2. What is the adjusted net income/loss in 2021? For net loss please put minus sign before the amount of net loss. ( Example -100,000 )*

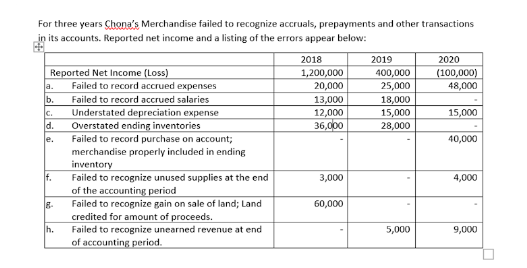

Transcribed Image Text:For three years Chona's Merchandise failed to recognize accruals, prepayments and other transactions

in its accounts. Reported net income and a listing of the errors appear below:

2018

2019

2020

(100,000)

Reported Net Income (Loss)

1,200,000

400,000

a.

Failed to record accrued expenses

20,000

25,000

48,000

b.

Failed to record accrued salaries

13,000

18,000

C.

12,000

15,000

15,000

Understated depreciation expense

Overstated ending inventories

d.

36,000

28,000

e.

Failed to record purchase on account;

40,000

merchandise properly included in ending

inventory

f.

3,000

4,000

Failed to recognize unused supplies at the end

of the accounting period

8-

60,000

Failed to recognize gain on sale of land; Land

credited for amount of proceeds.

h.

5,000

9,000

Failed to recognize unearned revenue at end

of accounting period.

П

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,