What is the amount of loan extended to MAPCD Co

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Question

What is the amount of loan extended to MAPCD Co.

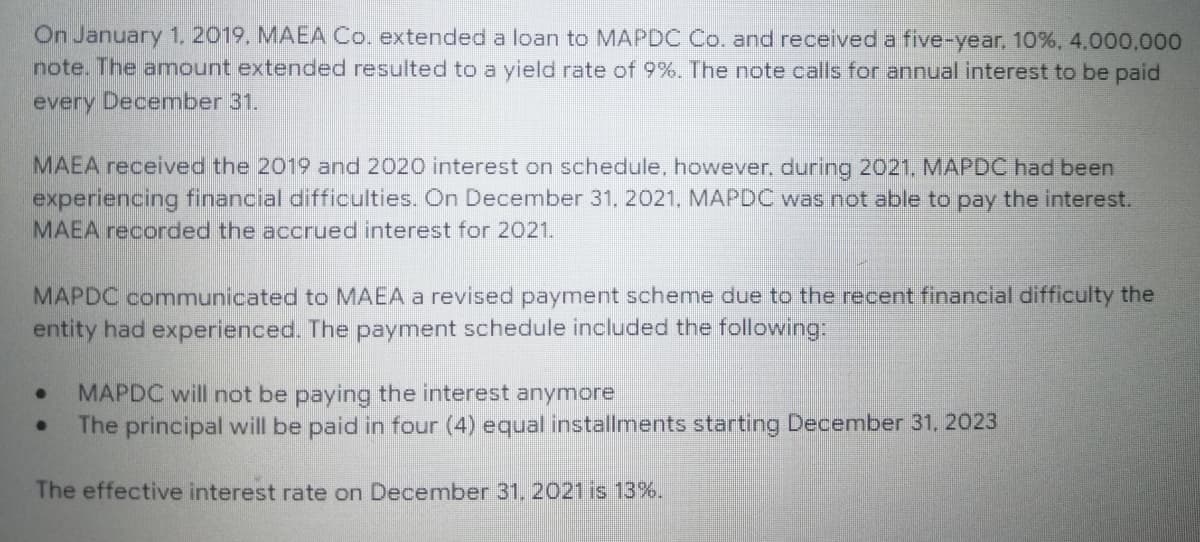

Transcribed Image Text:On January 1, 2019. MAEA Co. extended a loan to MAPDC Co. and received a five-year, 10%, 4,000,000

note. The amount extended resulted to a yield rate of 9%. The note calls for annual interest to be paid

every December 31.

MAEA received the 2019 and 2020 interest on schedule, however, during 2021, MAPDC had been

experiencing financial difficulties. On December 31, 2021. MAPDC was not able to pay the interest.

MAEA recorded the accrued interest for 2021.

MAPDC communicated to MAEA a revised payment scheme due to the recent financial difficulty the

entity had experienced. The payment schedule included the following:

MAPDC will not be paying the interest anymore

●

The principal will be paid in four (4) equal installments starting December 31, 2023

The effective interest rate on December 31, 2021 is 13%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College