and the requirements. equirement 1. Compute the collections from customers. Collections from customers are $ 24.444 Requirement 2. Compute payments for merchandise inventory. Payments for merchandise inventory are $ 18,560 Requirement 3. Compute payments of other operating expenses. Payments of other operating expenses are $ 4,324 Requirement 4. Compute acquisitions of property, plant, and equipment (no sales of property during 2024). Acquisitions of property, plant, and equipment are Data table Income Statement Net Sales Revenue Cost of Goods Sold Depreciation Expense Other Operating Expenses Income Tax Expense Net Income Balance Sheet Cash $ Accounts Receivable Merchandise Inventory Property, Plant, and Equipment, net Accounts Payable Accrued Liabilities Long-term Liabilities Common Stock, no par Retained Earnings Print S $ Done 2024 24,623 S 18,097 269 4,411 535 1,311 S 22 $ 795 3,487 4,341 1,546 935 483 676 5,005 2023 21,674 15,458 233 4,283 488 1,212 19 616 2,840 3,424 1,362 848 467 444 3,778

and the requirements. equirement 1. Compute the collections from customers. Collections from customers are $ 24.444 Requirement 2. Compute payments for merchandise inventory. Payments for merchandise inventory are $ 18,560 Requirement 3. Compute payments of other operating expenses. Payments of other operating expenses are $ 4,324 Requirement 4. Compute acquisitions of property, plant, and equipment (no sales of property during 2024). Acquisitions of property, plant, and equipment are Data table Income Statement Net Sales Revenue Cost of Goods Sold Depreciation Expense Other Operating Expenses Income Tax Expense Net Income Balance Sheet Cash $ Accounts Receivable Merchandise Inventory Property, Plant, and Equipment, net Accounts Payable Accrued Liabilities Long-term Liabilities Common Stock, no par Retained Earnings Print S $ Done 2024 24,623 S 18,097 269 4,411 535 1,311 S 22 $ 795 3,487 4,341 1,546 935 483 676 5,005 2023 21,674 15,458 233 4,283 488 1,212 19 616 2,840 3,424 1,362 848 467 444 3,778

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 4PB: The accounts and their balances in the ledger of Markeys Mountain Shop as of December 31, the end of...

Related questions

Question

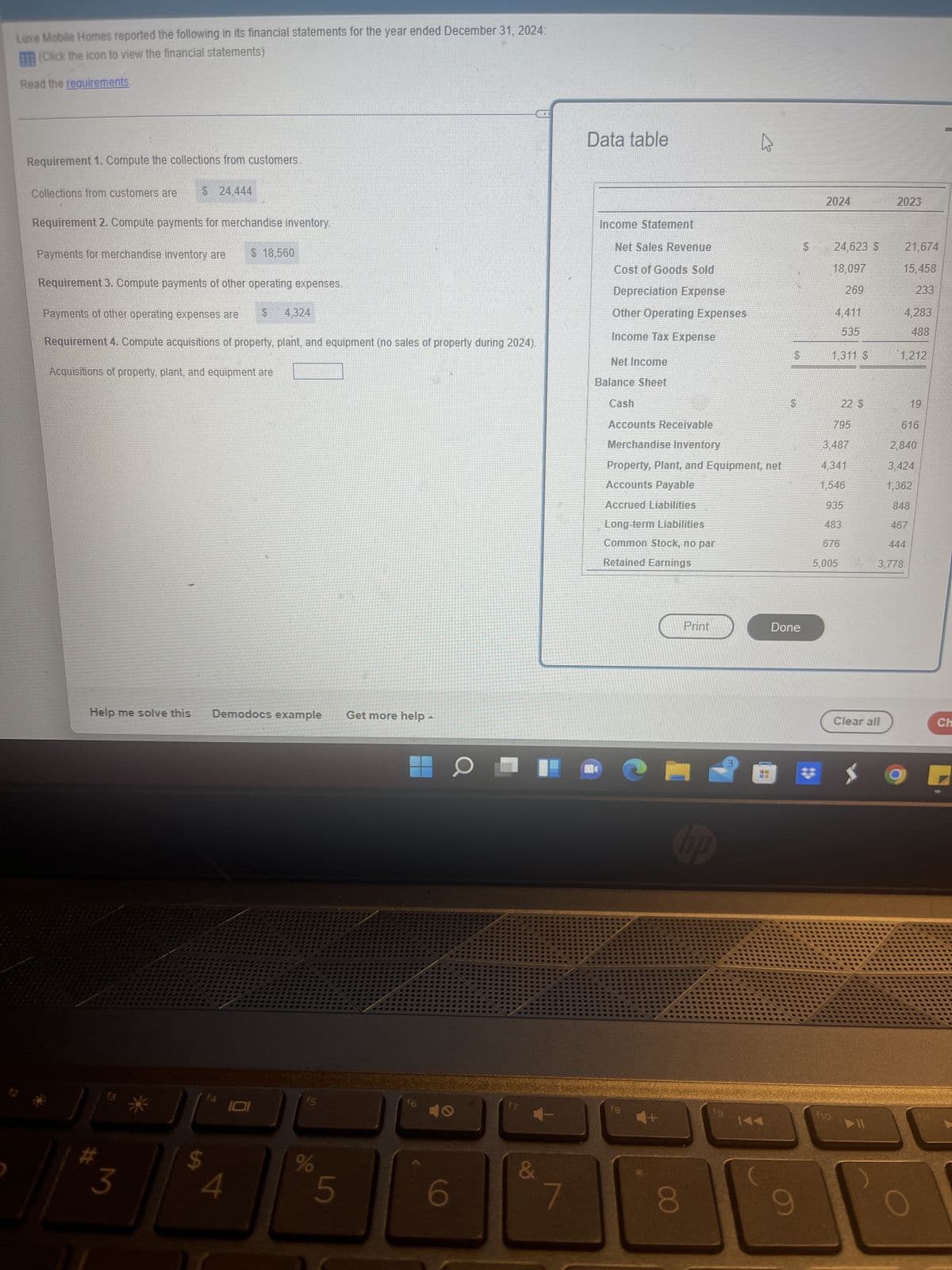

Transcribed Image Text:Luxe Mobile Homes reported the following in its financial statements for the year ended December 31, 2024:

(Click the icon to view the financial statements)

Read the requirements.

Requirement 1. Compute the collections from customers.

Collections from customers are $ 24.444

Requirement 2. Compute payments for merchandise inventory.

Payments for merchandise inventory are $ 18,560

Requirement 3. Compute payments of other operating expenses.

Payments of other operating expenses are S 4.324

Requirement 4. Compute acquisitions of property, plant, and equipment (no sales of property during 2024).

Acquisitions of property, plant, and equipment are

Help me solve this

Demodocs example Get more help -

f4

f5

#

+3

$

4

do

%

5

6

O

&

7

Data table

M

Income Statement

Net Sales Revenue

Cost of Goods Sold

Depreciation Expense

Other Operating Expenses

Income Tax Expense

Net Income

Balance Sheet

Cash

Accounts Receivable

Merchandise Inventory

Property, Plant, and Equipment, net

Accounts Payable

Accrued Liabilities

Long-term Liabilities

Common Stock, no par

Retained Earnings

fg

Print

hp

8

fg

144

Done

9

2024

24,623 $

18,097

269

4,411

535

1,311 S

22 $

795

3,487

4,341

1,546

935

f10

483

676

5,005

2023

Clear all

X

21,674

15,458

233

4,283

488

1,212

19

616

2,840

3,424

1,362

848

467

444

3,778

Ch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning