What is the amount of sales under cash basis? What is the amount of purchases under cash basis? What is the cost of goods sold under cash basis?

What is the amount of sales under cash basis? What is the amount of purchases under cash basis? What is the cost of goods sold under cash basis?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.17E

Related questions

Question

What is the amount of sales under cash basis?

What is the amount of purchases under cash basis?

What is the cost of goods sold under cash basis?

What is the amount of

What is the net income under cash basis?

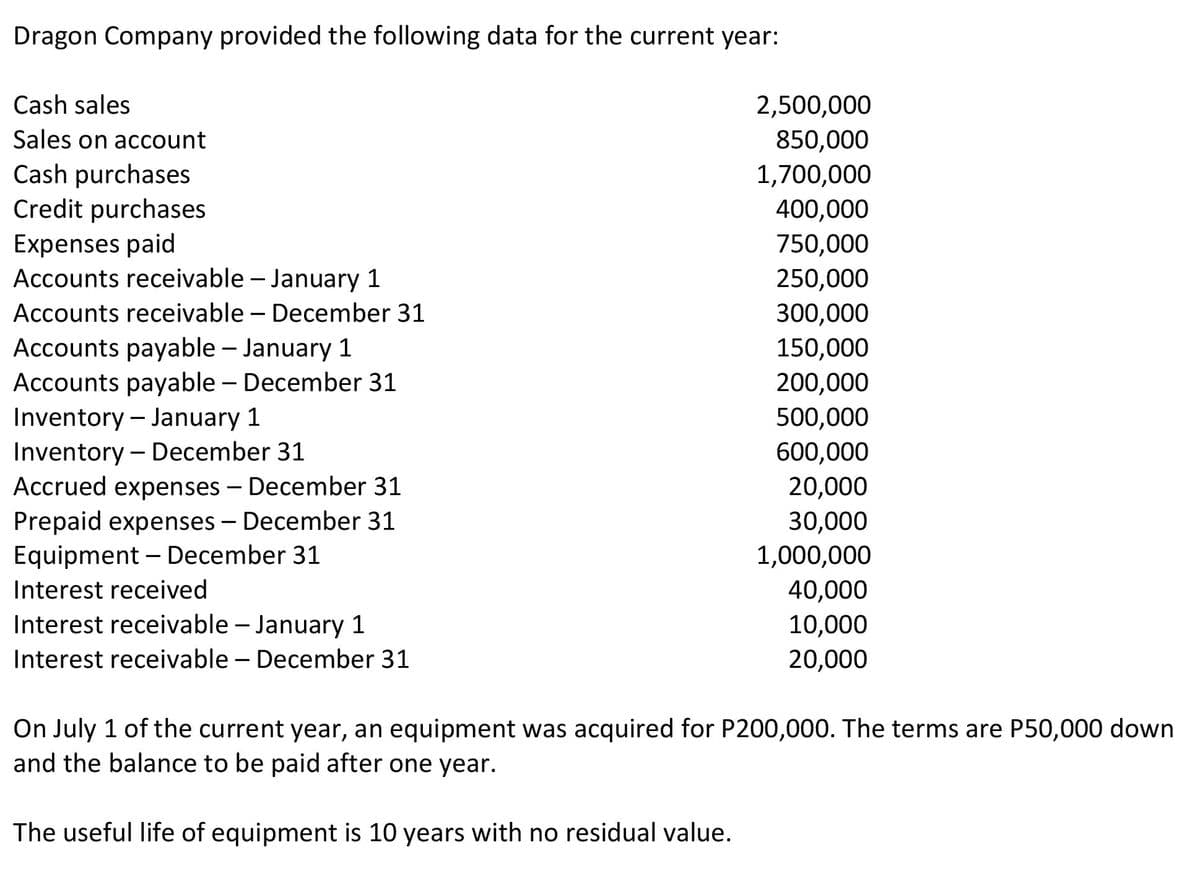

Transcribed Image Text:Dragon Company provided the following data for the current year:

Cash sales

2,500,000

Sales on account

850,000

Cash purchases

Credit purchases

1,700,000

400,000

750,000

Expenses paid

Accounts receivable - January 1

250,000

Accounts receivable – December 31

300,000

Accounts payable – January 1

150,000

Accounts payable – December 31

Inventory - January 1

Inventory - December 31

Accrued expenses – December 31

Prepaid expenses – December 31

Equipment – December 31

200,000

500,000

600,000

20,000

30,000

1,000,000

40,000

10,000

Interest received

Interest receivable – January 1

Interest receivable – December 31

20,000

On July 1 of the current year, an equipment was acquired for P200,000. The terms are P50,000 down

and the balance to be paid after one year.

The useful life of equipment is 10 years with no residual value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT