What is the bond price at 12 percent? b. What is the bond price at 8 percent? c. What would be your percentage return on investment if you bought when rates were 12 percent and sold when rates were 8 percent?

What is the bond price at 12 percent? b. What is the bond price at 8 percent? c. What would be your percentage return on investment if you bought when rates were 12 percent and sold when rates were 8 percent?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 9FPE: Which of these two bonds offers the highest current yield? Which one has the highest yield to...

Related questions

Question

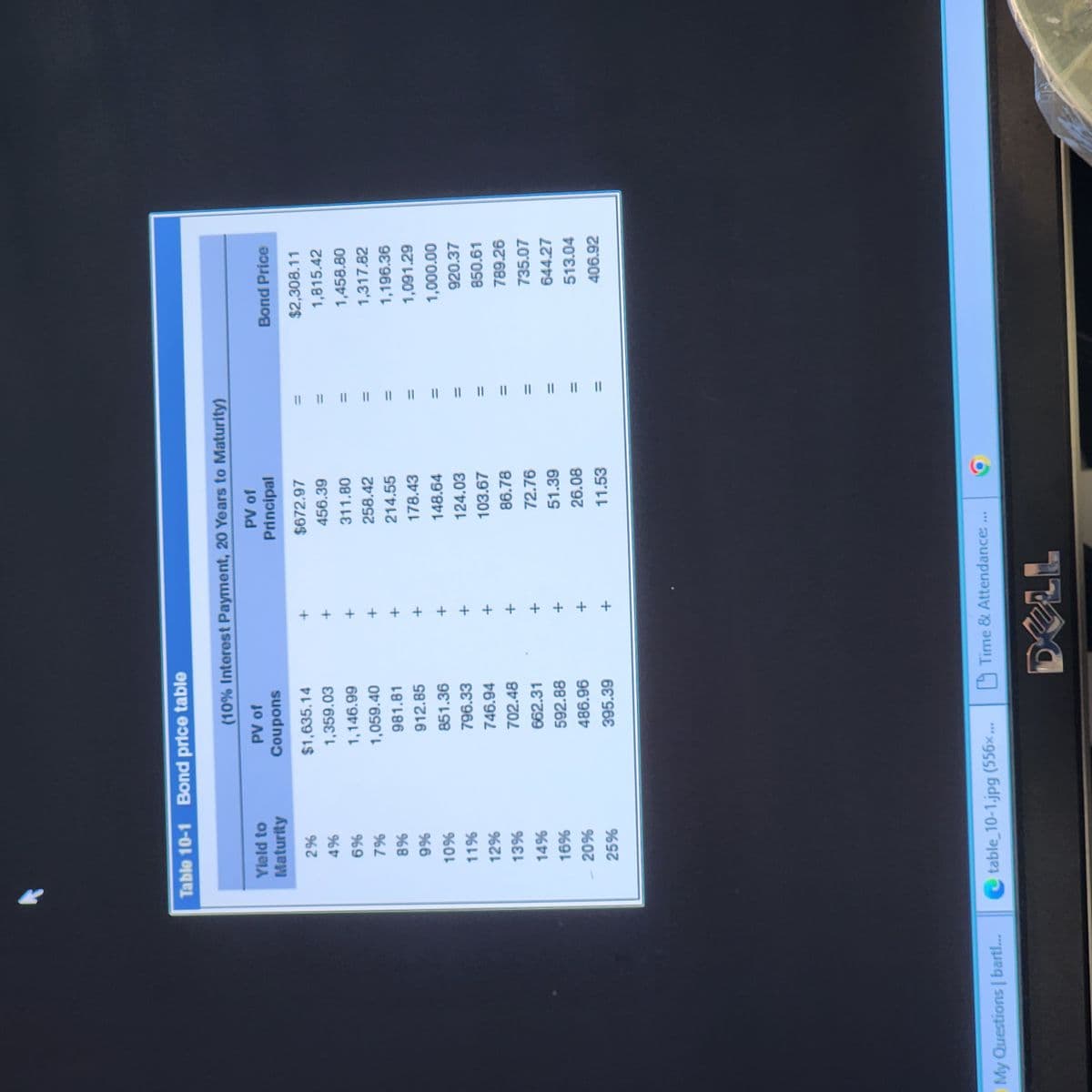

Refer to Table 10-1, which is based on bonds paying 10 percent interest for 20 years. Assume interest rates in the market (yield to maturity) decline from 12 percent to 8 percent.

a. What is the

b. What is the bond price at 8 percent?

c. What would be your percentage return on investment if you bought when rates were 12 percent and sold when rates were 8 percent? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

Transcribed Image Text:My Questions | bart!...

Table 10-1 Bond price table

Yield to

Maturity

296

496

6%

7%

8%

9%

10%

11%

12%

13%

14%

16%

- 20%

25%

(10% Interest Payment, 20 Years to Maturity)

PV of

PV of

Coupons

Principal

$1,635.14

1,359.03

1,146.99

1,059.40

981.81

912.85

851.36

796.33

746.94

702.48

662.31

592.88

486.96

395.39

table_10-1.jpg (556x...

+

+

fi

+

+

+

+

+

$672.97

456.39

Time & Attendance:

311.80

258.42

214.55

178.43

148.64

124.03

103.67

86.78

72.76

51.39

26.08

11.53

666

|| || || || || || || || || || || || || ||

Bond Price

$2,308.11

1,815.42

1,458.80

1,317.82

1,196.36

1,091.29

1,000.00

920.37

850.61

789.26

735.07

644.27

513.04

406.92

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning